Agric-Economic Production Factors - Agricultural Sciences Grade 12 Study Guides and Notes

Share via Whatsapp Join our WhatsApp Group Join our Telegram Group- Overview

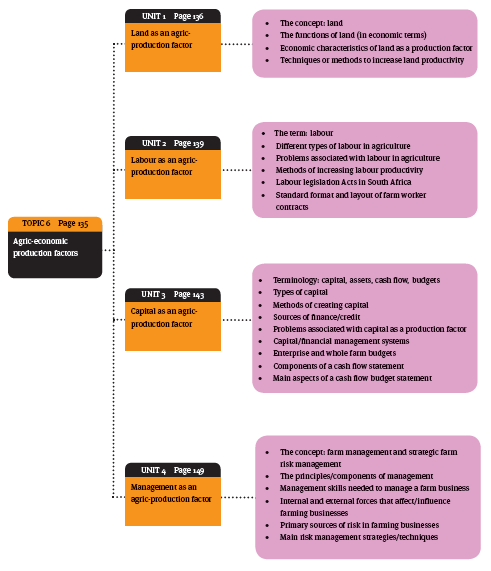

- Land as an agric-production factor

- Labour as an agric-production factor

- Capital as an agric-production factor

- Management as an agric-production factor

- Topic questions

Overview

Land as an agric-production factor

1. Land and its functions

Land is the part of the Earth's surface that is not covered by water, as opposed to the sea or the air. In agriculture, the focus is on soil. Soil is the upper layer of Earth in which plants grow, a black or dark brown material typically consisting of a mixture of organic remains, clay, and rock particles.

The functions of land (in economic terms)

Land provides space for economic activities

- Land provides a platform for various production processes and economic farming activities to take place. Soil is the medium in which crops grow.

Land provides food for plants, animals and human beings

- Crops obtain most of the water, nutrients and air that they need from soil. The soil also provides a suitable temperature and enough air for the supply of food. The chemical reactions that take place in the soil ensure that good quality crops are produced. Livestock also obtain food from the soil in the form of grass. The food that we eat comes from the soil, namely fruits, vegetables and herbs.

Land provides raw materials

- Raw materials are resources that are used to produce or manufacture other products. Plants obtain raw materials from the soil such as water, carbon dioxide and nutrients. These are used by the soil to manufacture carbohydrates through photosynthesis. The soil also provides plants, such as trees, that can be used as raw materials to make furniture.

Land provides minerals

- Land provides different minerals that serve different purposes. They can be classified into three categories:

- minerals of monetary value, e.g. gold, silver and diamonds

- minerals used as raw materials in industries, e.g. coal, copper, iron and platinum

- minerals used as nutrients by plants and animals, e.g. calcium, phosphorus and zinc.

2. Economic characteristics of land as a production factor

Land is durable

- Development processes in the soil ensure that the soil is able to renew itself. This makes it a useful and viable commodity.

Soils have different production potentials

- Soils have characteristics such as texture, structural type and the environment in which they are found. This means that soils have different production potentials.

Availability of agricultural land is limited

- Only 25% of the Earth is covered by land and only half of this land can be ploughed. Only a small percentage of soil can be used for agricultural production.

The nature of soil restricts agricultural activities

- Crops often only grow in certain types of soil. The nature of the soil restricts the agricultural activities, the crops that can be planted and diversification.

Soil is found in a specific environment

- Particular soils are located in particular environments and this determines their potential and value.

Soil is subject to the law of diminishing returns

- Soil has a maximum yield, where after its yield decreases.

The physical condition of soil cannot be changed

- Soil inherits its characteristics from the mother rock from which it is broken down. Therefore soil texture cannot be changed.

Analysis might show that a soil needs a particular fertiliser to achieve maximum crop production. The fertiliser application will increase the production of the crop, but the effect will probably decrease after further additions of the same fertiliser. This is known as the law of diminishing returns.

3. Techniques or methods to increase land productivity

Techniques or methods to increase land productivity must be considered and implemented withing the context of environmental sustainability so that future generations have access to this natural resource.

Adapt production to scientific methods

- Scientific methods, such as precision farming, will ensure maximum sustainable production. A scientific approach to irrigation will also be more effective than traditional methods. In this way, using scientific methods will allow for both maximum productivity and environmental sustainability.

Consolidating uneconomical farm units

- Consolidation of similar farm units will reduce management and running costs because separate farm units are more expensive to manage than combined, smaller units.

Use of technology

- Technology can be used to complete tasks in less time and with lower production costs.

Water supply through irrigation

- Crops that are watered by irrigation systems show higher production levels than crops that obtain their water naturally from the water table. The quality of irrigated crops is also better.

Increase access by building roads

- Increase accessibility to land will allow machinery, tractors and labourers to be transported to the land as needed. Products can also be more easily transported for processing or to the market.

Choose a farming type that suits the nature of the soil

- A poor choice of farming type, one that does not suit soil (or climate) conditions will result in total failure of the farming enterprise.

Gather enough information on the land to be used

- Soil analysis should be carried out at least every four years to give an indication of major nutrient levels within the soil. Larger fields should be split into smaller areas for sampling purposes to make sure each sample is as representative as possible.

Diversify land

- Different soil types will suit different forms of production. The farm should be divided into units according to the soil type and different forms of farming practised on each one. This is called diversification and it can ensure a continuous source of income for the farmer.

Modify land

- Farm land that has proved to be uneconomical could be modified. For example, the land could be excavated and farm infrastructure could be built on it.

Improve the physical condition and productivity of the soil

- Problems with soil texture and slope can be solved in several ways.

- Textural problems can be overcome if you:

- add organic matter

- improve drainage

- avoid over cultivation

- do not cultivate the soil when too dry or too wet

- improve the pH value of the soil.

- A slope on land can be dealt with by the use of:

- contour ploughing

- contour banks

- stone banks

- terraces.

Labour as an agric-production factor

1. Types of labour in agriculture

Labour is the physical and mental effort performed in return for remuneration, which is in the form of wages. In agriculture, there ate two broad types of labour.

Permanent/fixed labour

- Refers to farm workers that are employed on the farm throughout the year. They usually live on the farm and have certain rights and privileges, such as housing and food rations. Most permanent labourers are skilled.

Part-time/temporary labourers

- Refers to farm workers that do not stay permanently on the farm and do not work throughout the year. There are two types of part-time labourers:

- seasonal labourers – they are employed during a particular season or at peak periods to perform a particular task such as harvesting, pruning or weeding

- casual labourers – they are employed to do a particular task such as fencing or building.

2. Problems associated with labour in agriculture

Lack of skills

- Most farm labourers are poorly educated and they lack training. Modern farming methods such as precision farming are sophisticated and require skilled labourers.

Poor labour management

- Farmers are not always trained as managers. A lack of management skills, such as supervision, can lead to less productive workers.

Negative effect of HIV/AIDS

- This disease and its opportunistic infections reduce the number of days that labourers are able to work. HIV/AIDS also impacts the effort that workers are able to put into their tasks for effective production.

Scarcity of labour

- Fewer people are prepared to work as farm labourers due to low salaries, the physically demanding nature of the work and the low status of the job.

Competition from other sectors

- Industries usually pay higher wages than farmers. This causes skilled farm workers to look for work in industries to attain better living conditions.

Exploitation of farm workers

- Farm workers may be exploited due to ignorance: not knowing their rights, basic conditions of service, or what the minimum wage is. Some farm owners / managers still have racist attitudes (legacy of apartheid) to farm workers.

Methods of increasing labour productivity

Improved conditions of service

- Appropriate wages and fair working conditions, stipulated in a contract can improve labour productivity.

Physical farm (infrastructure) planning

- The physical aspects of the farm need to be well planned so that farm workers do not waste time moving from production sector to another Living quarters should be separate but easily accessible.

Supervision

- Supervision, control and monitoring of performance against production targets help to increase labour productivity. Incentives can be built in for targets achieved.

Daily planning

- Daily activities must be planned and tasks should be delegated. This will ensure that workers know what is expected of them.

Training

- A skills development programme needs to be planned after a skills audit has been carried out. Skilled workers are more productive than unskilled ones.

Effective mechanisation

- Appropriate use of machinery can boost worker productivity by providing them tools to do their jobs effectively and efficiently.

Economic planning of the farming activity

- The budget for each aspect of the business must be planned to keep expenses low. Partnership deals between farm owners and workers in terms of targets and profit sharing will encourage workers.

Planning of the production processes

- Each step in the production process must be planned, and short-, medium- and long-term goals need to be set, communicated to workers and monitored.

This will help to boost productivity.

3. Labour legislation Acts in South Africa

Labour legislation is needed so that farmers and workers are protected as both parties will know what their respective rights and responsibilities are.

- Occupational Health and Safety Act

- Addresses the safety of workers in the workplace. It enforces training of workers who operate machinery and the wearing of protective gear while at work.

- Labour Relations Act

- Regulates the relationship between employers and employees. It addresses aspects like the right to strike, labour dispute procedures and how to deal with unfair labour practices.

Basic Conditions of Employment Act

- Ensures that workers are treated fairly.

- It addresses several aspects, e.g.

- payment method

- minimum wages

- working hours

- overtime

- leave

- termination of employment.

Compensation for Occupational Injuries and Diseases Act

- States that workers must be compensated if injured or get sick while on duty.

Skills Development Act

- This Act is managed by the Department of Labour.

- Depending on how many employees they have and the size of their turnover, employers contribute to the Skills Development Levy.

- Contributions are sent to two bodies to facilitate training, namely:

- the relevant sector’s Education and Training Authority

- Skills Development Fund.

- The Act aims to develop and improve workforce skills and employers receive a refund if they train their workers.

Employment Equity Act

- Ensures that there is no workplace discrimination based on:

- race

- religion

- gender

- sexual orientation

- disability, etc.

Broad Based Black Economic Act

- This Act is guided by the Broad Based Black Economic Strategy which was implemented by the Department of Trade and Industry.

- The Agri-BEE charter requires sectors to implement employment equity and to subject their black employees to transformational activities such as:

- skills development

- company ownership and management.

- Sectors that adopt the Agri-BEE charter are awarded codes for good practice and points that position them favourably for doing business with local, provincial and national government.

Standard format and layout of farm worker contracts

A good employment contract protects the interests of the labourer and employer. It should contain these details:

Particulars of the employer:

- The name and identity number of the farm owner, the business name and physical address, and the type of business.

Particulars of the employee:

- The name of the employee, their residential and postal address, contact phone numbers, next of kin, gender, identity number, academic and professional qualifications, work experience and disabilities (if any).

Employment details:

- These details will vary in different sectors but they include the place of work, date of employment, normal working hours, job title and job description, entitlement to holidays and holiday pay.

Payment details:

- This section outlines salary or wage rate, calculation of wages, frequency of payment, overtime rate and any other cash payments.

Leave details

- This aspect addresses any leave that the workers are entitled to and terms about absences due to sickness and injury.

Pension arrangement

- All matters that relate to pension and pension schemes are described.

Notice or contract period

- The type of contract will determine the contract period and the notice period required to terminate a contract.

Disciplinary procedures

- This section deals with disciplinary procedures to be taken under various conditions. It also deals with breaking the terms of the contract.

Health and safety obligations

- This part of the contract outlines the responsibilities and obligations of the employer as contained in the Occupational Health and Safety Act and the Compensation for Occupational Injuries and Disease Act.

Capital as an agric-production factor

Important terms

Capital

- The wealth, including goods, which is accumulated by saving. It is used in the production process to generate income.

Assets

- Items of financial value that the farmer owns and they often require large amounts of capital input. Assets include land, buildings and machinery and they can be classified as short-, medium- and long-term. On the other hand, liabilities are what the farmer still owes, such as loans and an overdraft. The net worth of a farm equals the assets minus the liabilities.

Cash flow

- Refers to the movement of money into or out of a business. It is usually measured during a specified, finite period of time.

Budgets

- A document that shows the income, expenditure and profits for a certain period.

1. Types of capital

Capital refers to sums of money or assets put to productive use. There are three types of capital that are relevant in agriculture.

Fixed capital: involves fixed assets.

- Examples are land, buildings, fences and boreholes.

Movable capital: capital goods that can be moved from one place to another.

- Examples are tractors, machinery, equipment and livestock.

Working capital: involves goods used in the production process.

- Examples are seeds, fertilisers, salaries and wages, and fuel.

2. Methods of creating capital

Individual’s own savings

- Capital can be created through savings and investments.

Production and local market sales

- The farmer can increase production to accelerate the accumulation of capital.

Related Items

Credit

- Allows farmers to get goods or services before they pay for them. Farmers can use credit to borrow money from financial institutions but they must pay interest on the borrowed money. They must usually provide collateral for the credit.

3. Sources of finance/credit

| Type of credit | Description |

| Long-term credit | Long-term credit takes a long time to repay, namely 10–35 years. It is used for big capital goods such as land, or for big projects such as the construction of buildings and dams. The source for long-term credit is the Land Bank. |

| Medium-term credit | Medium-term credit is used to buy movable capital. This usually takes about 2–10 years to repay. The sources of this finance are co-operative societies, NGOs and commercial banks. Umthombo is an NGO that provides loans to sugar cane producers |

| Short-term credit | Short-term credit is used as working capital to buy goods for the production process such as seeds, pesticides and fertilisers, salaries and wages, and fuel. Types of short-term credit include overdraft, credit cards and advance personal loans. The loans must be repaid within two years. Commercial banks are the source of this credit |

4. Problems associated with capital as a production factor

High-risk factor

- There are many factors that the farmer cannot control, such as weather patterns and diseases. These risks must be managed to avoid capital losses:

- Insure all aspects of the farming enterprise

- Diversify by running different farming enterprises on the same farm

- Hedging by maintaining pre-determined prices even if conditions change.

High interest rates

- Financial institutions charge interest on loans which decreases profit margins.

Loans must be carefully managed to avoid high interest charges.

Scarcity of capital

- Many financial institutions are reluctant to finance beginner farmers as they doubt their ability to repay the loan. They therefore require security before they grant a loan.

Overcapitalisation

- Overcapitalisation occurs when more money is put into the farm than can be earned from it. This means that the business runs at a loss. This occurs when land or equipment is bought or leased for more than it is worth, or when unnecessary assets are accumulated and money is not made out of the investment.

Undercapitalisation

- Undercapitalisation means that you invest less capital than is required to run the farm, which hinders productivity and leads to a loss in income. This may occur because of poor financial planning, failure to get an adequate loan or insure against risks, or simply because of unfavourable economic conditions.

5. Capital/financial management systems

Financial records

- A financial record shows all monies received and used in a farming enterprise. An income statement can be used to show the income and expenses for a financial year.

Farm asset records

- Items of financial value owned by the farmer are listed in an asset registry. Assets should always be worth more than liabilities as they improve the net worth of a farming business. The best document to use for this is a balance sheet.

Farm budgets

- A farm is a business which aims to make a profit. In order to make a profit, the farm owner needs a financial plan or budget that lists all planned expenses and revenue for a particular time period, usually a year. A budget helps to:

- predict expenses and revenues

- measure the actual financial operation of the farm against the predictions

- identify cost constraints (i.e. areas where the farmer may have to cut costs to make a profit).

6. Enterprise and whole farm budgets

An enterprise budget

- Refers to the budget of a single farming or production unit in the farming business.

- For example, a farm that has livestock as well as dairy, maize and broiler production units needs a separate budget for each unit or enterprise.

| An enterprise budget for a maize production unit | |||

| Estimated cost | Estimated returns | ||

| Item | [Amount (R)] | Item | [Amount (R)] |

| Water | 10 500 | Mealies | 350 000 |

| Fertiliser | 30 000 | Maize meal | 250 000 |

| Labour | 27 000 | Compost | 7 500 |

| Maize seeds | 3 000 | Maize feeds | 250 000 |

| Pesticides | 18 756 | Haylage | 20 000 |

| Silage | 20 000 | ||

| Total cost | 89 256 | Total return | 897 500 |

A whole farm budget

- Incorporates all of the budgets for the different farming enterprises or units.

- It is required to determine the financial needs (e.g. all expected variable and fixed costs) and performance (e.g. all anticipated income) of all the production units.

| A whole farm budget | |||

| Estimated cost | Estimated returns | ||

| Item | [Amount (R)] | Item | [Amount (R)] |

| Livestock | |||

| Bulls | 5 000 400 | Old bulls | 200 000 |

| Feeds | 520 000 | Old cows | 500 000 |

| Veterinary treatment | 100 000 | Beef | 600 000 |

| Wool shearing | 1 800 | Mutton | 200 000 |

| Transport | 12 600 | Sheep | 500 000 |

| Abattoirs | 15 000 | Goats | 350 800 |

| Goats milk | 5 800 | ||

| Manure | 20 600 | ||

| Hides/skins | 11 800 | ||

| Wool | 95 000 | ||

| Total cost: | 5 649 800 | Total return: | 2 484 000 |

| Dairy | |||

| Milking parlour maintenance repairs | 25 000 | Milk | 600 000 |

| Milking staff | 10 000 | Manure | 23 000 |

| Feeds | 10 000 | Sour milk | 350 000 |

| Transport | 40 000 | Yoghurt | 380 000 |

| Veterinary treatment | 10 000 | ||

| Packaging | 6 900 | ||

| Total cost: | 101 900 | Total return: | 1 353 000 |

| Maize production | |||

| Water (irrigation) | 10 200 | Mealies | 35 500 |

| Fertilizer | 33 000 | Maize meal | 65 000 |

| Maize seeds | 5 000 | Compost | 34 500 |

| Labour | 25 000 | Haylage | 32 200 |

| Pesticides | 20 500 | Silage | 56 700 |

| Agents | 15 000 | ||

| Transport | 19 500 | ||

| Total cost: | 128 200 | Total return: | 223 900 |

| Broiler production | |||

| Chicks | 2 500 | Broilers | 90 000 |

| Feeding equipment | 10 000 | Manure | 45 000 |

| Labour | 11 500 | ||

| Feeds (mash) | 12 000 | ||

| Water | 3 000 | ||

| Transport | 2 800 | ||

| Vaccines | 1 800 | ||

| Total cost: | 43 600 | Total return: | 135 000 |

| Whole farm total cost: | 5 923 500 | Whole farm total return: | 4 195 900 |

Differences between an enterprise and whole farm budget

Table 1 Comparison of an enterprise and a whole farm budget

| Enterprise budget | Whole farm budget |

| Concentrates on budget for each enterprise | Incorporates budgets of all enterprises on the farm |

| Allows farmer to control the income and expenses of each enterprise which spreads the risk | Allows farmer to have overall control of the whole farm business |

7. Components of a cash flow statement

Shows the movement of money through a business over time. It is based on a month-to-month record and can be referred to as the monthly budget. There are three components to a cash flow statement:

- the income component

- the expenditure component

- the cash flow summary component.

Income component

The farmer records the expected income for each aspect of production on a monthly basis. He or she specifies the amount of money expected and the month in which it is due. If there is no income to be received, this is indicated with a zero. There are three sources of income:

- cash flow from sales, e.g. money received from the sale of crops and livestock

- capital sales, e.g. from the sale of machinery and breeding stock

- non-farm income, for example wages for the farmer.

Expenditure component

The farmer indicates the expenditure to be incurred for each month to prepare for these expenses. If there are no expenses for a particular month, then this is indicated with a zero. There are two types of expenses:

- operating expenses, for example operating inputs such as seeds and fertilisers

- capital expenditure, for example assets such as tractors and machinery.

Cash flow summary component

A cash flow summary shows the opening balance, total income, total expenditure, profit and closing balance for each month.

Main aspects of a cash flow budget statement

Farmers can use a cash budget to monitor cash flow. It has two main aspects:

- Cash receipts or cash inflows: cash receipts – they record cash received; they indicate the date, the amount received and a description of the transaction.

- Cash disbursements or cash outflows : they record cash paid out; they indicate the date, the amount paid and a description of the transaction.

A typical cash flow statement of a farming business

| Month 1 | Month 2 | Month 3 | |

| Beginning cash balance | - R150 000 | - R26 600 | R222 000 |

| Cash inflows (income) | |||

| Livestock sales | R300 000 | R400 000 | R0 |

| Insurance received in product loss | R40 000 | R50 000 | R0 |

| Sale of crops | R150 000 | R200 000 | R300 000 |

| Other | R20 000 | R30 000 | R50 000 |

| Total cash | R510 000 | R680 000 | R350 000 |

| AVAILABLE CASH | R360 000 | R653 400 | R572 000 |

| Cash out flow (expenses) | |||

| Casual labour | R102 800 | R120 000 | R200 000 |

| Feed | R71 800 | R80 000 | R100 000 |

| Seed and plants | R40 000 | R50 000 | R60 000 |

| Pesticides and herbicides | R20 000 | R25 000 | R30 000 |

| Transport | R15 000 | R20 000 | R25 000 |

| Other (fixed costs) | R40 000 | R40 000 | R40 000 |

| Sub total | R289 600 | R335 000 | R455 000 |

| Other cash outflows | |||

| Capital purchases | R12 000 | R24 000 | R12 000 |

| Interest paid | R30 000 | R27 000 | R28 000 |

| Rent and shared crop paid | R25 000 | R25 000 | R25 000 |

| Hired management | R10 000 | R10 000 | R10 000 |

| Owners draw | R20 000 | R20 000 | R20 000 |

| Sub total | R97 000 | R106 000 | R95 000 |

| Total cash out | R386 600 | R441 000 | R550 000 |

| CLOSING CASH BALANCE | - R26 600 | R212 400 | R22 000 |

Management as an agric-production factor

1. Farm management and strategic farm risk management

Farm management

Management skills are essential for the success of a business. Farm management involves planning how production will be organised and co-ordinated to achieve the set outcomes in the production process. It should include short- and long-term outcomes.

Farms must be managed to coordinate the aspects of land (soil), labour and capital.

This will ensure that they are all used optimally and in a sustainable way to achieve maximum production.

Strategic farm risk management

Strategic farm risk management involves developing a vision and mission, and setting goals and objectives. Strategies must also be put in place to overcome unexpected events that might affect production such as droughts and thunderstorms.

2. The principles and components of management

Planning

- Planning involves deciding what activities will be done, by whom, when, where and how. Short- and long-term plans must be made. Areas that required planning are finances, marketing of products, and farm activities (including the production chain in each activity). Steps in the planning process include:

- Estimate when a farming activity will be completed and how much it will cost.

- State the aims and objectives of the farming activity, specify what the manager wants to achieve and indicate priorities.

- Draw up the policy to be followed during the production process.

- Draw up a programme that indicates tasks, the persons responsible and when they should be done.

- Draw up guidelines that indicate procedures for each task.

- Draw up rules and guidelines that state how activities are to be carried out.

Organisation and co-ordination

- Organisation is the bringing together of all the parts of an activity to maximise production. Co-ordination ensures that all activities are brought together to perform as a functional unit. There are five elements of organisation:

- identify tasks

- set objectives

- delegate specific functions and tasks

- control

- review.

Decision making

- Decision making is a mental process that involves weighing up alternatives and choosing the best one. There are several important steps in decision making:

- Describe the issue.

- Identify and evaluate all possible alternatives relating to the issue.

- Choose and implement the best alternative.

Decision making involves four important elements

- Decision maker: The farmer is the owner (proprietor) so he is responsible for decisions and any risks taken. The degree of success results in profit or loss. The farmer may delegate decision making to the farm manager.

- Objectives of the decision maker: The decision maker must state the strategic objectives, the mission and the vision of the company in a business plan. The farmer should decide what to produce and how much, the method of production, and where and when to sell produce.

- Conditions/situations for which decisions are taken: Decisions should take into account ideal and abnormal situations. The farmer should insure against drought, disease and disastrous weather phenomena.

- Measuring the effect of a decision: It is important to assess if the decision taken was the best one under the circumstances.

Control

- Control ensures that plans are implemented and this means that the results of decisions must be checked and verified. It is important to state deliverables to ensure good monitoring.

Motivation

- Extrinsic and intrinsic motivation is important in the farming business. Extrinsic forms of motivation are bonuses, incentives, certificates and tokens of appreciation. Intrinsic motivation is achieved by showing respect, creating a pleasant atmosphere and sharing the goals, mission and vision of the business.

3. Management skills needed to manage a farm business

Leadership skills

- Farm managers should show initiative, have vision and be creative. They should be highly motivated, have a positive attitude and be able to oversee all farm activities.

Decision making skills

- It is essential to make critical decisions and the manager must take responsibility for these decisions.

Problem solving skills

- Steps in problem solving: define the problem, identify the cause, brainstorm different solutions, choose the most appropriate solution, implement the solution and check the results.

Crisis management skills

- Skills are needed to manage crises, such as sick animals in the middle of the night or a burst dam. Problem solving skills are important in managing crises; so are expertise, experience and knowing where to get assistance.

Organisational/conceptual skills

- Organisational/conceptual skills ensure that production operates smoothly.

This also involves consideration of timing and complexity of production tasks.

Changes in various situations require flexibility and innovation. Training of workers is necessary if new skills are needed.

Communication skills

- Fluent written and oral communication is important. Gestures can also be used to explain how a particular activity should be undertaken.

Production skills

- A good farmer knows how farming units operate and how to synchronise them.

They should also understand the mentality of farm workers to place workers where they will be most productive.

Technical skills

- The correct techniques and technologies should be selected at various stages in the production process to save time and optimise productivity. Over- and under- mechanisation lead to wastefulness and production losses.

Financial skills

- Financial expertise is needed to succeed in farming and make a profit. The farm manager should be able to draw up and use all the financial documents.

Record keeping skills

- It is important to keep records for each activity to make informed decisions and to ensure that previous mistakes are not repeated. It is useful to keep financial, crop and labour records (depending on the type of enterprise).

4. Forces that affect farming businesses

Internal forces that affect/influence farming businesses

Farmers usually have more control over internal forces (e.g. worker motivation) than external ones (e.g. government policy or the weather).

Sufficient capital

- Agriculture requires capital and cashflow to buy machinery, pay labourers and buy farming inputs like seeds. They need to pay for these items before they sell their products. This makes it is difficult for new farmers to compete with established commercial farmers for the market.

Labour efficiency

- It is important that labourers are punctual and work efficiently. Supervision will ensure that labourers achieve the set targets.

Skills

- Skills enable labourers to perform their duties quickly and efficiently. A skills development programme should be introduced on farms to address the needs of managers and labourers.

Management

- Good management is needed to achieve the intended results.

Resources

- Agricultural resources are critical for agricultural production. We can divide agricultural resources into two main categories: natural resources and production inputs.

External forces that affect/influence farming businesses

Farmers must predict and plan for external forces. They also include forces over which the farmer has little control.

Availability of reliable markets

- Many small farmers and co-operatives cannot get easy access to chain supermarkets and big markets.

- Without market access, there is a risk that their businesses will fail.

Consumer purchasing patterns

- Farmers must keep an eye on consumer trends to ensure they produce products that are in demand.

Availability of credit/loans

- Resources are the main financial burden for farmers. These expenses include:

- farming inputs such as seeds, technology and salaries.

- It is difficult for small farmers to get credit and many financial institutions require security.

The number of competitors

- Competitors in the farming business should be viewed in terms of four aspects:

- New entrants have a small chance of success because they lack experience and have fewer skills and resources compared to established farmers.

- Both small and commercial farmers can produce intensively and qualitatively, but the target market is more likely to buy from the commercial farmers.

- Individual farmers will struggle compared to co-operative societies as they have fewer resources.

- Customers are more likely to buy an original product unless the substitute product is cheaper or has more appeal.

The national and global economic situation

- Inflation: means that there will be a lot of money in circulation. The prices of agricultural products will rise. The rise does not always correspond with the rise of salaries which affects the purchasing (buying) power of consumers.

- Recession: affects the economy and therefore leads to unemployment.

Consumers will only buy basic foodstuffs during a recession and so farmers, as producers, will suffer in the process. - Changes in government fiscal policy: impacts how farmers can get loans for production or capital for investments, as it determines interest rates on loans.

Environmental conditions

- They must favour the type of farming business so that the business can succeed.

Deforestation, degradation, desertification, loss of fertility and biodiversity, and air and water pollution negatively affect the environment. Farmers should conduct an environmental impact assessment before they undertake any activity.

They need to specify how they will manage the environmental issues.

Political and socio-economic conditions

- Demographic changes and consumer trends affect consumer purchasing patterns.

- HIV/AIDS influences population growth in South Africa. Infected people cannot always work and they may have less money or purchasing power.

- Change of government and/or government policy (or legislation) affects the way businesses operate.

5. Primary sources of risk in farming businesses

Nature risk

- Nature is a source of risk for farming businesses. Natural disasters such as droughts, floods and storms, and unexpected weather patterns like excessive rainfall in winter pose many challenges to farmers.

Resource risk

- The important natural resources in agriculture are soil, water, vegetation, climate and terrain. Each of these resources can contribute to losses in the following ways:

- Removal of vegetation as plant cover exposes soil to erosion. Soil erosion negatively affects the production potential of the soil.

- Terrain can increase the rate of soil erosion if the slope is too steep.

- The overuse of pesticides has a residual poisonous effect on the soil which will lead to soil pollution.

- Sudden changes in climate will affect the growth of plants and the production of farm animals negatively. Plant succession will also be affected since the nutritional value of grasses will be reduced.

- Water pollution affects the water quality and therefore its usefulness and the composition of nutrients that it contains.

Production risk

- Farmers and farm managers should know the production processes and have technical skills needed for production in each enterprise in order to be successful. If they lack these skills, production will decrease and the farm will not generate enough profit.

Financial risk

- Undercapitalisation can lead to low yields and profits.

- The farm might not generate enough cash flow to meet operating expenses or to pay debtors and expand the business.

- Unexpected events such natural disasters pose a risk to the entire market.

- On the other hand, overcapitalisation might lead to a loss if the farmer overestimates his profits and he is unable to repay his debtors.

Strategic risk

- This involves managing strategic aspects of the farming business such as goals, vision, mission and business strategy.

- Strategic risk arises when these are mismanaged, causing operational inefficiency, labour unrest of market confusion.

Human resource risk

- Labourers can lead to losses if they:

- are not skilled to perform their jobs

- are not motivated

- are not supervised

- do not know what is expected of them.

- The farming business will then collapse.

Unfavourable legislative and political environment

- There are several Acts with which businesses need to comply. But there may be risk associated with compliance.

- Compensation for Occupational Injuries and Diseases Act:

→ could lead to financial risk if a payout is required. - Impact Assessment Act:

→ requires businesses to undergo an impact assessment and state their environmental management programme. - Consumer Act:

→ protects the exploitation of consumers. This might be risky for the farmers because some of their actions may seem to exploit consumers. - National Credit Act:

→ states the requirements to access capital. If a farmer expects to receive capital due to the existence of this Act but they are unsuccessful, it may cause their business to collapse.

6. Main risk management strategies/techniques

Diversification strategies

These ensure that farmers do not rely on one type of business or market segment. So if, for example, veld fire destroys the cane plantation and forests, the farmer can still get income from the livestock and dairy farming.

- Concentric diversification

- Related new products are introduced in concentric diversification to increase farm profits. This takes place when there is a relationship between the products and new markets. An example of this might be a farm that produces tomatoes and goes on to produce tomato sauce.

- Horizontal diversification

- This is when new products are not related to the older ones, but can be marketed in the same environment and to the same market segment. The example here is the farmer who has realised that the market segment needs salad dressings as well as vegetables for salads.

- Conglomerate diversification

- Non-related new products are introduced in conglomerate diversification to increase farm profits. In this form of diversification the farmer introduces non-related products to increase profit. An example here might be a vegetable farmer who keeps a few cows and sells their dung as organic manure.

Risk sharing strategies

This involves sharing the burden of loss or the benefit of gain from a risk, and the measures to reduce the risk, with another party.

- Risk spread

- This is when farmers in an insurance pool share the risks of other members in that pool. They can also form a syndicate to spread common risks.

- Risk sharing partnerships

- Farmers form a partnership in order to share suppliers’ profits and losses equally. This can be through backward integration (business increases its control of inputs/suppliers) or forward integration (increases control over the distribution of products).

- Risk transfer and retention

- There are two ways to transfer the risks.

→ Retain risk exposure The farmer might decide to reduce the cover of a less risky operation. For example, the farmer could set aside cash to cover accidents instead of insuring experienced tractor drivers.

→ Transfer exposure There are two ways to transfer risk exposure. Insurance exposure involves the farmer transferring risks to an insurance company.

In comparison, non-insurance exposure can be done by hiring a company to offer certain services (outsourcing), hiring equipment and vehicles, or utilising services on a special order basis.

Topic Questions

- Answer the questions below. Check your answers afterwards and do corrections.

- Give yourself one hour.

- Marks: 100

- Choose the correct answer for each question below.

1.1 In agricultural industries the production factors are:

- soil, land, labour and entrepreneur

- land, labour, capital and entrepreneur

- land and entrepreneur

- inputs and outputs.

1.2 ONE of the following is NOT a form of capital:

- Fixed capital

- Working capital

- Product capital

- Movable capital

1.3 Land is regarded as a safe investment because of its _______

- durability.

- variation in production potential.

- restrictedness.

- susceptibility to the law of diminishing returns.

1.4 The Act that deals with labour practices and procedures for labour disputes is the:

- Basic Conditions of Employment Act

- Compensation for Occupational Injuries and Diseases Act

- Skills Development Act

- Labour Relations Act.

1.5 A tractor is an example of ______ .

- fixed capital

- working capital

- movable capital

- credit. (5 × 2 = 10)

- Decide whether the descriptions in the first column match (i) only, (ii) only, both (i) and (ii), or neither (i) nor (ii). Indicate your answer using these keys:

- i only

- ii only

- both i and ii

- neither i nor ii.(6 × 2 = 12)

2.1 Restrictedness i Soil fertility decreases with time

ii Crops do well in a specific type of soil2.2 Ways of getting enough information on the suitability of land for production i Soil analysis

ii Soil tests2.3 Durability i The life of the soil is unlimited

ii The soil regenerates2.4 Availability of the soil is limited i 12% of the soil can be ploughed

ii Located in a specific environment2.5 Consolidation of uneconomical farm units i Similar farm units combined

ii Running costs reduced2.6 Labour practices and procedures for labour disputes i Basic Conditions of Employment Act

ii Skills Development Act

- Select the most appropriate definition of capital as a production factor:

- Capital is the budget and how you spend it.

- Capital is wealth accumulated through savings and employed in the production process.

- Capital only refers to money used in the production process. (1 × 2 = 2)

- Differentiate between:

4.1 assets and liabilities

4.2 fixed capital and movable capital. (2 × 4 = 8) - Describe the three sources of capital and give one example of each. (3 × 3 = 9)

- Substitute the underlined term in the following statements to make them correct.

6.1 Labour is accumulated through saving and employed in the production process.

6.2 The strategy in farming where farmers share common risks is called risk sharing.

6.3 Casual labourers are employed during a particular season.

6.4 Motivation is the management principle dealing with who will do what, when and how.

6.5 Human resource management is the form of management that involves developing the vision, mission and objectives of a business. (5 × 1 = 5) - Provide FOUR conditions of service as a method of increasing labour productivity. (4)

- List the FOUR main components or features of a good employment contract. (4)

- Name the Act that:

9.1 Addresses the safety of workers in the workplace (1)

9.2 States that workers injured at work should be compensated. (1) - Compare a whole farm budget and an enterprise budget. (6)

- A farm manager should be able to plan activities in advance for labour productivity.

11.1 Briefly explain the necessity of using seasonal workers for the shearing of sheep. (3)

11.2 Name THREE techniques that the sheep farmer can apply to manage climatic risks. (3)

11.3 Mention THREE ways the farmer can increase labour productivity. (3)

11.4 Suggest THREE ways the farmer can increase labour productivity. (3) - Farmer Brown gathered this data about the financial operations of his farm in this financial year. Study the table and answer the questions that follow.

12.1 Use the data to design a budget for Farmer Brown. (4)Description of item Amount Bought 2 000 chicks R2 each Paid for labour R15 000 Sold chicken manure R19 000 Bought chicken feeders R10 000 Paid for water R2 000 Paid for holiday from investments R7 000 Bought vaccines R500

12.2 Predict the profit of Farmer Brown’s business. (3)

12.3 Is his a viable and healthy business? Give a reason for your answer. (2) - Describe FOUR ways you could use to solve the problem of the shortage of farm labourers and discourage them from leaving farms and going to work in cities. (4)

- Briefly explain the difference between permanent and temporary labourers. (6)

- Discuss lack of skilled labour as a problem related to labour as a production factor. (7)