THE CIRCULAR FLOW MODEL, NATIONAL ACCOUNT AGGREGATES AND THE MULTIPLIER GRADE 12 NOTES - ECONOMICS STUDY GUIDES

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupThe circular flow model, national account aggregates and the multiplier are three key terms in Economics.

According to the circular flow model, the three key sectors of the economy (consumer, business and government) all work together to ensure that society’s needs are provided for through the creation of goods and services.

The national account aggregates are an important means of analysing the performance of a country. The most important of these aggregates is the Gross Domestic Product (GDP).

The marginal propensity to consume is what shows the amount of each rand that people will use for consumption within a country at a particular time.

The multiplier is derived from the marginal propensity to consume. It is a ratio which shows that the increase in income in a country will be greater than the initial increase in spending.

The formula can also be written as K = 1 or α = 1

(1 – mpc) (1 – mpc)

Formula: M = 1

(1 − mpc)

Overview

| TOPIC | CONTENT | CONTENT DETAILS FOR TEACHING, LEARNING AND ASSESSMENT PURPOSES |

| 1. Circular flow | Present the circular flow as a macroeconomic model

Deduce and analyse the national account aggregates and conversions

Derive and apply the multiplier

|

HOT QUESTION: How is expenditure related to income and production?

HOT QUESTION: Explain the multiplier process by using the graph and the following formula: ΔY/ΔE HOT QUESTION: What is the effect of the marginal propensity to consume (mpc) and marginal propensity to save (mps) on the multiplier (1/1-mpc or 1/mps)?

HOT QUESTION: Why is the value of the multiplier in reality a small figure? |

1.1 Key concepts

These definitions will help you understand the meaning of key Economics concepts that are used in this study guide. Understand these concepts well.

| Term | Definition |

| Base year | A year with very small price changes or price fluctuations. The current base year used by the Reserve Bank is 2005 |

| Basic prices (bp) | Used when GDP is calculated according to the production method and represents the production costs of firms |

| Capital market | Market for long-term financial instruments, for example, bonds, shares |

| Circular flow model | Continuous flow of spending, production and income between different sectors |

| Closed economy | An economy that has no foreign sector as a participator |

| Consumption (C) | Consumption spending by the population |

| Domestic figures (GDP) | Value of all final goods and services produced within the borders of a country for a specific period |

| Economic equilibrium | The economy is in equilibrium if leakages are equal to injections: L = J or S + T + M = I + G + X |

| Expenditure method | When the national accountants add together the spending of the four major sectors of the economy: C + G + I + (X – M) |

| Exports (X) | Goods and services produced locally and then sold for consumption outside the borders of the country |

| Factor market | Market where factors of production are traded, e.g. labour market |

| Factor cost/Factor prices | These terms can be used interchangeably and refer to the cost of or price paid for the factors of production (land, labour, capital and entrepreneurship) used by firms. [Note that the term factor income may also be used] |

| Financial market | The market where both short- and long-term financial assets are traded |

| Financial sector | Those financial institutions that are not directly involved in the production of goods and services, e.g. banks, insurance companies, pension funds and the JSE |

| Foreign exchange market | The market in which one currency can be traded for another, e.g. rands for dollars |

| Goods market | Market where goods and services are traded, e.g. cars, milk (also known as Product market) |

| Government (G) | The expenditure of the government sector |

| Imports (M) | Goods and services produced in other countries and purchased by local firms or households. Imports can also be represented by “Z” |

| Income method | Gross Domestic Income is derived by adding all income earned by the owners of the factors of production – GDP(I) |

| Injections (J) | The introduction of additional money into the economy by investment (I), government (G), and payments for exports (X) |

| Investments (I) | Spending by firms on capital goods |

| Leakages (L) | Money withdrawn from the circular flow, e.g through savings (S), taxes (T) and import expenditure (M) |

| Marginal propensity to consume (mpc) | The marginal propensity to consume (mpc) indicates that, as disposable income increases, an increase in personal consumer spending (consumption) occurs. For example, a marginal propensity to consume of 0.65 indicates that for every extra rand earned, the household will spend 65 cents and save 35 cents |

| Market price (mp) | Prices actually paid by consumers for goods and services plus all taxes less subsidies. Calculated according to the expenditure method |

| Money flow | The flow of income and expenditure between the participants in the circular flow |

| Money market | The short-term and very short-term market for savings and loans |

| Multiplier | A small initial increase in spending produces a proportionately larger increase in aggregate national income |

| National figures (GNP) | Value of all final goods and services produced by the permanent citizens of the country for a specific period |

| Net figures | Net indicates that some amount has been taken away, e.g. net exports reflects the value of exports less imports |

| Open economy | An economy that trades with the foreign sector |

| Production method | The adding of final values of all goods and services calculated as gross value added – GDP(P) |

| Real flow | The flow of goods and services between the participants in the circular flow |

| Savings (S) | Income that is not consumed |

| Subsidies on production | Refers to subsidies that are not linked to specific goods or services, e.g. subsidy made on employment |

| Subsidies on products | Financial incentives to help struggling industries produce, as well as direct subsidies payable per unit exported to encourage exports (e.g. government subsidy on bread) |

| Taxes (T) | Compulsory payments made by private individuals or business enterprises to the government sector with no direct benefit |

| Taxes on production | Refer to taxes on production not linked to a specific good or service (e.g. tax on land and buildings) |

| Taxes on products | Taxes that are payable per unit of some good or service (e.g. VAT, import duties) |

1.2 The open economy circular flow model

Description

- The circular-flow model of the economy is a simplification showing how the economy works and the relationship between income, production and spending in the economy as a whole.

- The circular-flow model of an open economy shows the workings of an economy that is open to foreign trade.

- It is different to a closed economy because it includes the foreign sector.

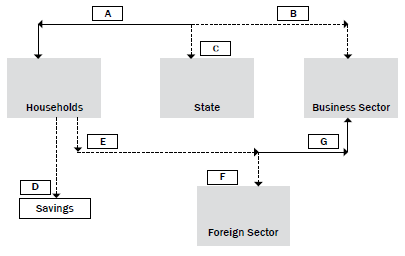

1.2.1 Four sector diagram

Figure 1.1 An open economy circular flow model

1.2.2 Participants Household sector

- Households are the major consumers of economic goods and services – they use their income to buy from firms.

- Households are the primary economic participants because they are the owners of the four factors of production.

- Households sell factors of production in the factor market to firms.

- Households receive a remuneration from the firms in the form of wages, rent, interest and profit.

You must be able to draw a detailed diagram of a circular flow model. Figure 1.1 is a typical example of an open economy circular flow model.

Firms/business sector

- Firms purchase the factors of production from the household in the factor market.

- Firms use the factors of production to produce goods and services.

- Businesses sell goods and services to households, government and the foreign sector.

- Businesses receive an income from the other three participants (households, government and the foreign sector).

The state/public sector

- This refers to local, regional and national government.

- The state provides the households and businesses with public goods and services.

- The state receives taxes from households, e.g. income tax.

- The state receives taxes from the business sector, e.g. company tax.

- The state spends money in the economy. (G)

Foreign sector

- There is a flow of goods or imports that flow from the foreign sector and are paid for by the individual households, businesses and the public sector.

- These imports can be seen as expenditure by individual households, businesses and public sector. (A monetary outflow.)

- There is also a flow of goods and services to the foreign sector from businesses (exports).

- These exports will result in an income for individual households, businesses and public sector. (A monetary inflow.)

Interaction between participants

- Households provide production factors to producers (firms).

- Households receive an income (Y) in return – rent, wages, interest and profits.

- Households purchase goods and services from firms.

- Firms receive income from sales revenue.

- Households and firms purchase goods and services from the foreign sector as imports (M).

- The foreign businesses receive money from firms and households.

- Firms sell goods and services to the foreign sectors, and this is called exports (X).

- Households and firms pay taxes to the government. (T)

- The government provides public goods and services to households and firms.

- The unexhausted (unspent) part of the household and firms’ income earned is saved in the financial sector of the economy. (S)

- The money invested by firms and households is known as savings (S).

- The funds received by the financial sector are used by firms/ businesses to purchase infrastructure for the production of goods and services.

- This flow of money from the financial sector for use by firms is known as investment (I).

Households = consumers

Firms = suppliers

Do you know the difference between an open economy and a closed economy?

1.2.3 Real and money flow

- Real flow: Factors of production flow from the owners (households) to producers via the factor markets. Goods and services flow from the producers via the goods markets to households and other users of goods and services. Factors of production and goods and services flow from foreign countries to South Africa (imports). Factors of production and goods and services flow from South Africa to foreign countries (exports).

- Money flow: Factor remuneration represents the expenditure of producers and the income of households (wages, rent, interest and profit). On the other hand, consumption expenditure represents the expenditure of households and the income of producers.

1.2.4 Leakages and injections

Leakages refer to the outflow of money from the economy.

The following are leakages or withdrawals from the circular flow:

- Savings (S)

- Taxation (T)

- Payment for Imports (M)

| In other words: L = S + T + M Leakages = Savings + Taxes + Import expenditure |

Injections refer to an inflow of money into the economy. The following are injections (additions to) the circular flow:

- Investment (I)

- Government expenditure (G)

- Payments for exports (X)

| In other words: J = I + G + X Injections = Investments + Government expenditure + Export Income |

1.2.5 Equations

Equilibrium

- The economy is in equilibrium when leakages are equal to injections.

- In other words

Leakages is when the economy gets weaker. Injection is when the economy gets stronger.

Disequilibrium

The economy is in disequilibrium when:

- Leakages are more than Injections.

- Injections are more than Leakages.

Restoring the equilibrium causes changes to national income

National Income increases when Injections are more than Leakages

- The amounts of injections which exceed leakages contribute to additional demand.

- This additional demand must be satisfied.

- This causes an increase in the production of goods and services.

National Income decreases when Injections are less than Leakages

- The amount by which leakages exceed the injections contributes to a decreased demand.

J < L

Demand for goods and services drop. - Less goods and services are produced.

- Less income in an economy.

Mathematical and Graph Presentation

- Income (Y) is equal to Expenditure (E)

In other words:

Y = E

Y = C + G + I + (X – M) = E = C + G + I + (X – M)

Mathematical Calculation

| Imports | R40 million |

| Investment Spending | R180 million |

| Consumption Spending | R 110 million |

| Exports | R 25 million |

| Government Spending | R110 million |

The Formula to calculate the Aggregate Income in the economy:

Y = C + I + G + (X – M)

Calculation of the Aggregate Income in the economy.

Y = C + I + G + (X – M)

Y = R110 million + R180 million + R110 million + (R25 million – R40 million)

Y = R385 million

Graphical Presentation

Figure 1.2: Expenditure and income

- Expenditure is (E) and it is shown on the Vertical axis.

- Income is (Y) and it is shown on the Horizontal axis.

- E = Y and it is represented by a 45° line.

- It halves the 90° angle into two equal portions of 45°.

- Aggregate Expenditure (AE) = C + I + G + (X – M)

- This curve shows the amount which consumers, producers, government and the foreign sector plan to spend at every level of income.

- It also equals aggregate demand.

- The curve slopes upwards and to the right.

- At an income of Y the AE intersects the vertical axis at E.

- Assume planned AE increases to E1.

- This means more money is injected into the economy.

- This causes an increase in Y to Y1.

When E increases it means more goods and services are being bought. This is good for the economy.

1.2.6 Markets

| MARKETS | ||||

Goods/Product markets

| Factor markets

| Money markets

| Capital markets

| Foreign Exchange markets

|

| FINANCIAL MARKETS | ||||

Activity 1

Study the diagram below and answer the questions that follow:

1.1 Use the information below and calculate the values A – G: (7)

Total production R25 000 Income Taxation R 5 000

Savings R4 000 Imports R 3 700

1.2 Explain the impact of an increase in income taxes on the level of production. (3)

1.3 Calculate the total leakages (L) in the above diagram. (4)

1.4 Give the identity (equation) used to represent GDP in an open economy. (2)

1.5 If a country has a marginal propensity to consume of 0.1, calculate the value of the multiplier. (4)

[20]

| Answers to activity 1 1.1 A – R20 0003 B – R25 0003 C – R5 0003 D – R4 0003 E – R16 0003 F – R3 7003 G – R12 3003 (7) 1.2 Leads to a decline in production333 (3) 1.3 S + T + M3 R4 000 + R5 000 + R3 7003 R12 70033 (4) 1.4 C + G + I + (X – M)33 (2) 1.5 M = 1/(1 – mpc)3 = 1/(1 – 0,1)3 = 1/0.93 = 1.13 (4) [20] |

1.3 National account aggregates

1.3.1 Deriving national account aggregates

The national account aggregates are methods that are used to determine the value of economic activity. The production method, income method and expenditure method are three different ways the economic activity is measured. They are all used at different times and for different purposes. Be sure you learn how to use these methods.

PRODUCTION METHOD  | INCOME METHOD

| EXPENDITURE METHOD

|

| GDP | GDP | GDP |

| Adds final values of all goods and services produced | Adds all income earned by owners of factors of production | Adds spending of four main economy sectors – consumption, government, investments and exports (minus imports) |

The production (output value added) method

The production method is a method whereby we determine the Gross Domestic Product at basic prices by adding the final values of all goods and services produced in the primary, secondary and tertiary sectors.

In the national accounts Gross Domestic Product at basic prices is usually referred to as Gross Value Added (GVA) at basic prices.

Table 1.3.1 shows the GDP in the different sectors of the economy for 2005–2012 in (R millions).

| Value added (GVA) | 2005 | 2007 | 2009 | 2011 | 2012 |

| 1. Primary sector | 143 394 | 210 803 | 260 176 | 321 229 | 335 409 |

| 2. Secondary sector | 330 669 | 403 129 | 478 627 | 508 953 | 542 821 |

| 3. Tertiary sector | 927 004 | 1 178 144 | 1 439 517 | 1 791 197 | 1 956 857 |

| 4. Gross value added at basic prices | 1 401 067 | 1 792 076 | 2 178 320 | 2 621 379 | 2 835 087 |

| 4.1 Plus – taxes on products | 175 667 | 230 000 | 237 117 | 311 033 | 338 792 |

| 4.2 Less – subsidies on products | 5 652 | 5 891 | 9 036 | 14 873 | 18 684 |

| 5. Gross domestic product at market prices | 1 571 082 | 2 016 185 | 2 406 401 | 2 917 539 | 3 155 195 |

Table 1.3.1: GDP by economic sector for 2005–2012

If we merely add up the market values of all outputs, we obtain a total greatly in excess of the value of the economy’s actual output. Such a calculation would lead to double counting or multiple counting. So, to solve the problem we use ‘value added’.

Activity 2

Study the following data and answer the question that follows:

| Compensation of employees R1 086 907; Final consumption expenditure by households R1 472 824; Net operating surplus R728 426; Final consumption expenditure by government R504 169; Taxes on products R245 198; Subsidies on products R3 113; Taxes on production R38 173; Subsidies on production R 5 092; Gross capital formation R467 878; Exports of goods and services R657 113; Imports of goods and services R667 740; Consumption of fixed capital R332 824; Primary sector R278 518; Secondary sector R466 749; Tertiary sector R1 435 971. |

1. Determine the gross domestic product at market prices according to the production method. [10]

| Answer to activity 2 1. Primary sector R 278 518 Secondary sector R 466 749 Tertiary sector R1 435 971 Gross value added at basic prices 3 2 181 238 Plus taxes on products R 245 198 Less subsidies on products R 3 113 Gross domestic product @ market price R2 423 323 [10] |

The income method

The income method is a method whereby we determine the gross domestic product – GDP at factor prices (factor cost) by adding all the income earned by the owners of the factors of production (gross domestic income).

In the national accounts this is referred to as Gross Value Added at factor cost. Table 1.3.2 Indicates the gross domestic income for the South African economy for 2005–2011 in (R millions).

| National income or Gross Value added at factor cost (rbn) | 2005 | 2007 | 2009 | 2011 | 2012 |

| 1. Compensation of employees | 699 018 | 882 379 | 1 081 640 | 1 330 315 | 1 447 429 |

| 2. Net operating surplus | 485 761 | 629 116 | 736 427 | 874 877 | 942 903 |

| 3. Consumption of fixed capital | 187 790 | 252 595 | 332 333 | 375 982 | 404 947 |

| 4. Gross value added @ factor cost | 1 372 569 | 1 764 090 | 2 150 400 | 2 581 174 | 2 795 279 |

| 5. Other taxes on production | 32 927 | 35 374 | 40 898 | 51 525 | 54 166 |

| 6. LESS other subsidies on production | 4 421 | 7 388 | 12 978 | 11 320 | 14 358 |

| 7. Gross value added @ basic prices | 1 401 067 | 1 792 076 | 2 178 320 | 2 621 379 | 2 835 087 |

| 8. Taxes on products | 175 667 | 230 000 | 237 117 | 311 033 | 338 792 |

| 9. LESS subsidies on products | 5 652 | 5 891 | 9 036 | 14 873 | 18 684 |

| 10. Gross domestic product @ market prices (GDI) | 1 571 082 | 2 016 185 | 2 406 401 | 2 917 539 | 31 155 195 |

Table 1.3.2: South African GDP (I) for 2005–2012

Activity 3

Refer to Table 1.3.2 (income method) and answer the following questions:

- Which financial institution is responsible for the recording and publishing of GDP figures in South Africa? (2)

- Explain the concept ‘subsidies on products’. (3)

- Give TWO examples of taxes on products. (4)

- Calculate the consumption of fixed capital in 2009 as a percentage of GDP at market price. Show all calculations. (4)

- What is the difference between 2007 and 2011 concerning the GVA @ factor cost? (2)

Answers to activity 3

|

The expenditure method

The expenditure method is a method whereby we determine the gross domestic product – GDP – at market prices by adding the spending of the four main sectors of the economy – households (C), government (G), businesses (I) and foreign sector (X – M).

Differentiate between GDE and Expenditure on GDP: GDE = C + I + G

Expenditure on GDP = C + I + G + (X – M)

Table 1.3.3 shows total spending on GDP at market prices for 2005–2012 (in R millions).

| Gross domestic expenditure and GDP at market prices (Rbn) | 2005 | 2007 | 2009 | 2011 | 2012 |

| 1. Final consumption expenditure by households | 990 773 | 1 264 726 | 1 460 764 | 1 743 989 | 1 907 247 |

| 2. Final consumption expenditure by government | 305 733 | 380 004 | 507 330 | 635 019 | 707 031 |

| 3. Gross capital formation | 282 130 | 428 231 | 470 298 | 568 875 | 612 551 |

| 4. Residual items | –164 | –1 618 | –10 857 | –12 329 | 24 585 |

| 5. Gross domestic expenditure | 1 578 472 | 2 071 343 | 2 427 517 | 2 935 554 | 3 251 414 |

| 6. Exports of goods and services | 430 169 | 634 626 | 657 192 | 854 343 | 891 562 |

| 7. Imports of goods and services | 437 559 | 689 784 | 678 308 | 872 358 | 987 781 |

| 8. Expenditure on gross Domestic product @ market prices | 1 571 082 | 2 016 185 | 2 406 401 | 2 917 539 | 3 155 195 |

Table 1.3.3: Total spending on GDP at market prices for 2005-2012

Table 1.3.3 shows that South Africa imported more goods and services than it exported in 2005. This caused a leakage from the circular flow to the value of about –R7 390 billion in 2005.

1.3.2 National Account Conversions

- All countries use national account figures

- South Africa uses the SYSTEM OF NATIONAL ACCOUNTS (SNA) prescribed by the United Nations.

- GDP, GDE, and GDI have a great deal to do with the prices we use such as nominal and real prices, prices before or after taxes.

- Indirect taxes and subsidies are the most important determinants of the end values of the circular flow aggregates.

Factor Cost

- Factor cost is used with the income method of measuring economic activity.

- GDP at factor cost – other taxes on production – other subsidies on production = GDP at basic prices.

Basic Prices

- Used with the production method.

- Includes taxes on production and excludes subsidies on production.

- Taxes on production are payroll taxes (SITE and PAYE), recurring taxes on land & buildings, business licenses.

- Subsidies on production include employment subsidies and subsidies paid to prevent pollution.

Market prices

- Used with the expenditure method.

- Conversion of values from:

- Basic prices to market prices:

GDP at basic prices + taxes on products – subsidies on products

= GDP at market prices. - Factor cost to market prices:

GDP at factor cost + other taxes on production – subsidies on production = GDP at basic prices + taxes on products – subsidies on products = GDP at market prices.

- Basic prices to market prices:

- Taxes on products are payable per unit, e.g. VAT.

- Subsidies on products include direct subsidies paid per unit.

Net figures

Net operating surplus = surplus after taxes

Net income = income after taxes

Net fixed capital formation = After consumption of fixed capital (depreciation)

Net exports = exports – imports

Conversion of Domestic to National figures

Domestic figures (GDP) relate to the income and production happening within the borders of the country.

National figures (GNP) relate to the income or production by the citizens of the country.

GDP: Domestic production includes foreigners operating in South Africa.

GNP: Only includes the production/income of South Africans.

E.g.

| R Billions | |

| GDP at market prices | 1 523 |

| Plus: Factor income earned abroad by South Africans | 29 |

| Less: Factor income earned in South Africa by foreigners | 60 |

| GNI at market prices | 1492 |

Nominal figures vs Real figures

Nominal figures

- It is also known as market or money value.

- It is also known as national product at current prices.

- Nominal value of production is calculated by multiplying the volume of the final goods and services by their prices.

- Inflation has not yet been taken into consideration.

Real figures

- It is also known as national product at constant prices.

- The rate of inflation as expressed by the consumer price index (CPI) has been taken into account.

- Real values of production are the nominal values of national product adjusted for price increase.

- Real national product is the national product expressed in prices which applied in a certain base year.

Activity 4

Two key national accounts conversions

A. How to convert domestic totals to national totals:

| 2005 | 2007 | 2009 | 2011 | |

| GDP @ MARKET PRICES | 1 571 082 | 2 016 185 | 2 398 155 | 2 964 261 |

| PLUS: Primary income from the rest of the world | 29 550 | 48 448 | 34 075 | 38 118 |

| MINUS: Primary income to the rest of the world | 60 975 | 117 266 | 87 593 | 104 689 |

| GNP @ MARKET PRICES | 1 539 657 | 1 947 367 | 2 344 637 | 2 897 690 |

Table 1.3.4: How to convert domestic totals to national totals

PLEASE NOTE! Table 1.3.4

shows you how to apply the conversion of domestic figures to national figures and vice versa. You must learn these conversions.

Study Table 1.3.5 below and answer the questions that follow.

| NATIONAL ACCOUNT AGGREGATES | R MILLIONS |

| Final consumption expenditure by households | 1 473 490 |

| Final consumption expenditure by government | 505 040 |

| Gross capital formation | 467 878 |

| Residual item | –18 092 |

| Gross Domestic Expenditure (GDE) | 2 428 316 |

| Export of goods and services | 657 113 |

| Import of goods and services | 677 740 |

| Expenditure on GDP at market prices | A |

Table 1.3.5: National account aggregates

- Explain the concept gross capital formation. (2)

- Calculate the value of A. Show all calculations. (4)

- Differentiate between GVA at basic prices and Expenditure on GDP at market price. (3)

[9]

Answers to activity 4

|

B. How to convert GDP at factor cost to GDP at basic prices or market prices:

GDP @ factor cost to GDP at basic prices, or GDP at market prices:

GDP at basic price = GDP @ factor cost

+ tax on production

– subsidies on production

GDP at market price = GDP at basic price

+ tax on products

– subsidies on products

1.4 The Multiplier

- The multiplier effect is the process whereby an initial change in spending changes the level of output and income by more than the initial change in spending.

- The formulae to calculate the value of the multiplier (M) is:

M = 1 OR 1

1 – mpc mps

The multiplier in a two sector model

The multiplier is derived from the marginal propensity to consume (mpc)

- The size of the multiplier depends on the proportion of any increase in income that is spent.

- The larger the mpc the bigger the multiplier and the smaller the mpc the smaller the multiplier.

- It is the money that stays in the economy.

E.g.

Y = R100 000

S = R40 000 = 40% 0.4

E = R60 000 = 60% 0.6 - Marginal Propensity to consume = 0.6 (mpc)

- Marginal propensity to save = 0.4 (mps)

The total of the mpc + mps is always = 1 (one)

FORMULA to calculate the Multiplier:

α = 1

1 – mpc

α = 1 = 1 = 1

1 – mpc 1 – 0.6 0.4

= 2½ (Multiplier)

The multiplier in a four sector circular flow model

- The following leakages are found

- mps = marginal propensity to save

- mrt = marginal rate of taxation

- mpm = marginal propensity to import

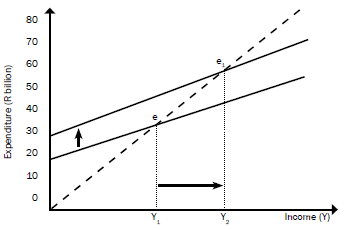

The multiplier in a graph

Figure 1.4.1: An increase in aggregate expenditure

Use the following formula to calculate the multiplier

M = ΔY

ΔI

- I = R40 000 m and it increases to R50 000 m

- Δ I = R10 000 m : in other word investment in infrastructure and development and building of houses

- Y = R100 000 m increases to R125 000 m

- ΔY = R25 000 m

M = ΔY

ΔI

R25 000= 2.5 = 2½

R10 000

- In the above sketch:

- E = Original equilibrium.

- Y = Original income.

- Change in investment spending is added.

- The AE curve (Aggregate expenditure) shifts upwards to AE1.

- Total spending at each level of income (Y) increases to Y1.

- Planned spending determines aggregate expenditure. Aggregate

- Demand increases to AD1.

- The new equilibrium position is at E1.

- The multiplier effect shows that the increase in Y (ΔY) is greater than the change in I (ΔI).

- National Income changes when:

- Total spending ≠ to Production

- Total Demand ≠ to Total supply

- Planned leakages ≠ to planned Injections

Explain the multiplier effect

- The multiplier relates to how much national income changes as a result of an injection or withdrawal.

- Assume an increase in injections into the economy (investment, government spending or exports), which would lead to a proportionate increase in national income.

- The extra spending would have a knock-on effect and create even more spending.

- The size of the multiplier will depend on the level of leakages.

- (E.g.) assume firms increase investment spending by R1000. This is done by ordering capital goods from domestic firms to the value of R1000.

- Initially total spending has increased by R1000. Total production has increased by R1000, which also leads to an increase in R1000 in income. The increase in spending = the increase in production which = an increase in income.

- But when households earn income (R1000) leakages can occur, through income tax, savings and spending on imports.

- If this amounts to R300, then spending on domestic goods will increase by R700. At this stage the multiplier starts to kick in.

Application

Keynesian approach

- Keynes argues that if the government wants the economy to grow, they can increase (G). Increase (G) and finance it with loans.

- They can decrease taxation, put more money in the pockets of the consumer.

- The consumer spends this extra money, aggregate demand will increase, production will increase and employment will increase.

- Government can decrease company taxes and this can lead to greater investment by businesses (I).

John Keynes was a famous economist who believed that an economy needs to spend in order to grow.

Activity 5

Study the graph below of the Keynesian model in a two-sector economy where the consumption function is given by C = c0 + c(Y) and answer the questions that follow.

- Define the term multiplier. (3)

- With reference to the graph, name the TWO sectors involved in deriving the macro-economic multiplier. (4)

- Indicate what is represented by the dotted line. (2)

- What is the value of autonomous consumption for the original consumption function? (2)

- Suppose the marginal propensity to save (MPS) = 0.4. Use the multiplier formula to calculate the eventual change in aggregate income, if there was an injection of R10 billion into the economy. Show ALL the calculations. (6)

- Describe the relationship between the mpc and the multiplier. (3)

[20]

Determine the size of the multiplier first.

Answers to activity 5

|