ACCOUNTING SCHOOL BASED ASSESSMENT EXEMPLARS - CAPS GRADE 12 LEARNER'S GUIDE

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupACCOUNTING

SCHOOL BASED ASSESSMENT EXEMPLARS - CAPS

GRADE 12

LEARNER'S GUIDE

| TABLE OF CONTENTS | |||

| CONTENTS | PAGE | ||

| Introduction | 1 | ||

| Task A: First Term Report: Companies | This task is suitable for Grade 12 learners from 2014 (CAPS). | ||

| Question paper | 2 | ||

| Answer book | 5 | ||

| Task B: First Term Test: Financial statements of a company | This task includes shares of no par value and repurchase of shares. This task is suitable for Grade 12 learners from 2014 (CAPS). | ||

| Question paper | 10 | ||

| Answer book | 14 | ||

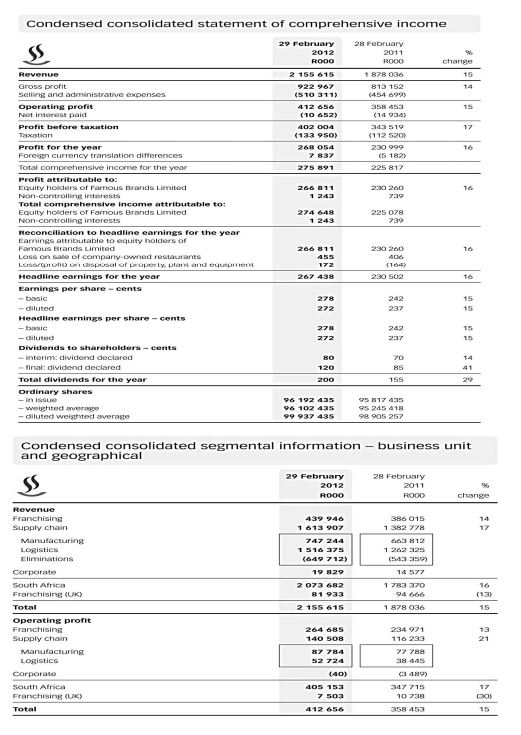

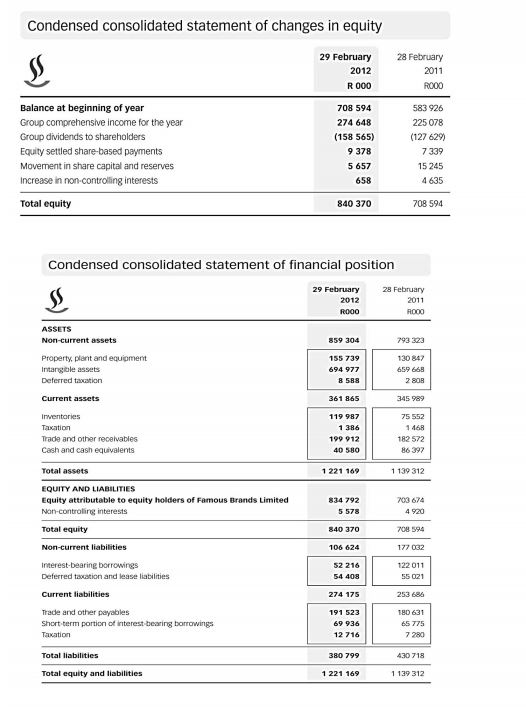

| Task C: Second Term" Project | Published financial statements of Famous Brands Ltd | ||

| Combined question paper and answer book | 18 | ||

| Source material | 25 | ||

| Task D : Third Term Case Study: Cash budget and debtors | This task is suitable for Grade 12 learners from 2014 (CAPS). | ||

| Question paper | 32 | ||

| Answer book | 36 | ||

INTRODUCTION: NOTE TO ALL GRADE 12 ACCOUNTING LEARNERS

You are provided with a book containing four assessment tasks. These are intended to assist you in your Grade 12 studies of Accounting and in preparing you for the National Senior Certificate (NSC) examinations in Accounting.

The tasks reflect:

- Selected Grade 12 Accounting topics, namely subject content and knowledge

- The various thinking skills (cognitive levels) that questions demand, namely remembering, understanding, applying, analysing, evaluating and creating and creative problem-solving

- The various degrees of challenge that can be found in all Accounting tasks, namely easy, medium and difficult

You should be aware that the final Grade 12 mark is calculated from the year-end NSC examination that you will write (out of 300 marks) plus school-based assessment (out of 100 marks). The curriculum stipulates the following SEVEN formal tasks that comprise school-based assessment in Accounting:

SCHOOL-BASED ASSESSMENT TASKS: NCS AND CAPS

Term | Details | Marks | Converted to: |

1st term | Report | 50 marks | 10 marks |

Test | 100 marks | 20 marks | |

2nd term | Project | 50 marks | 20 marks |

Mid-year examination | 300 marks | 20 marks | |

3rd term | Case study | 50 marks | 10 marks |

Trial examination | 300 marks | 20 marks | |

100 marks |

The tasks provided in this BOOK are examples of:

- A first term report (Companies and internal control)

- A second term test (Income statement and balance sheet) #

- A second term project (Published financial statements of a company)

- A third term case study (Cash budget)

Your teacher will provide you with a 1st term test, 2nd term examination and 3rd term trial examination, as well as other formative class tasks to assist you in your development of Accounting subject knowledge. You are also advised to use past NSC examination papers to obtain valuable practice in all topics relevant to your curriculum, but please refer to your teacher for changes that need to be made to the past papers (with regard to shares of companies) if you are writing the NSC papers in 2014 or later.

QP Task A

NOTE TO TEACHERS: This task is relevant to Grade 12 learners from 2014 (i.e. relevant to CAPS). This task comprises two parts. You may adapt the material to take the needs of your class group into account. For example, you may require them to do Part A on their own and Part B in class. Or you may require the class to do only Part B as a formal report and undertake Part A as an extension task in class on a weekly basis. If you choose to adapt the material in any way, you should ensure that the task comprises 50 marks as per CAPS.

ACCOUNTING GRADE 12: TASK A FIRST TERM ASSESSMENT TASK REPORT ON COMPANIES QUESTION PAPER 50 marks |

THIS TASK CONSISTS OF TWO PARTS:

PART A Report on a public company listed on the JSE. (26)

PART B Internal auditor’s report on procedures and internal controls in a public company (24)

50

PART A Report on a public company listed on the JSE [26 marks]

For this task you will need to use the page in the Business Report in a morning newspaper which lists the public companies that are traded on the Johannesburg Securities Exchange (JSE). You will need access to this re source on a weekly basis for a period of 5 weeks.

A rich aunt has earmarked R200 000 of her funds for investment purposes. She wants to buy shares of a public company listed on the JSE. She requires your advice. Choose a company that is well-known to you from the share page to complete the following report.

NOTE TO TEACHER: Each learner must choose a different company.

REQUIRED

Prepare a one-page report on the company you have chosen.

PREPARATION AND RESEARCH FOR YOUR REPORT

- On the starting date of this task, calculate the maximum number of shares that your aunt can buy for R200 000 in the company that you have chosen. Ensure that she buys shares in lots of 100, that is, 100, 200, 300, etc. Also calculate how much cash she will have left on this date after the purchase of shares. She will place this in a savings account (ignore interest).

- For a period of five weeks, make a note of the share price on the same day each week. Calculate the value of her investment portfolio each week, that is, the value of the shares and the cash.

- Find out other interesting information about the company you have chosen, e.g. products sold or services provided, community service or sponsorship activities of the company, the size of the company, where it is situated, details of the directors or the CEO, the amount earned by the CEO, or any other news about the company or its history.

THE REPORT MUST INCLUDE THE FOLLOWING:

- Draw up a table and plot a graph of the company's share price.

- Draw up a table and plot a graph of the value of your aunt's investment portfolio in respect of the invest ment in the shares and the cash that she has on hand. Do not consider the interest she will earn on her savings account.

- Further interesting information on the company.

- Recommendation on further investment in this company, with reasons. (Should you aunt consider buying more shares in this company, or should she consider an alternative investment?)

PART B Internal auditor’s report on a public company [24 marks]

You have been appointed as the internal auditor of Exotic Clothing Ltd, a new public company which is about to be established. All stock will be bought on credit. They will sell for cash and they will allow customers to buy on credit. It is expected that there will be approximately 1 000 shareholders. The CEO has asked you to prepare a report on certain procedures that should be put in place in the company.

The company currently has four employees in the Accounting department. The CEO is thinking of appointing Tom to manage fixed assets, Maisy to control trading stock, Bheki to control debtors (accounts receivable) and Shamila to control cash resources.

Your report should include:

- Procedures to establish the company

- The records that should be kept on each shareholder, together with the reasons why these are necessary

- The procedures that should be put in place to ensure that good internal control is exercised over:

- Fixed assets

- Trading stock

- Accounts receivable (debtors)

- Cash collected

TOTAL : 50 marks

ACCOUNTING GRADE 12: TASK A FIRST TERM ASSESSMENT TASK: REPORT ON COMPANIES ANSWER BOOK |

THIS TASK CONSISTS OF TWO PARTS:

PART A Report on a public company listed on the JSE.

PART B Internal auditor’s report on procedures and internal controls in a public company.

Name of learner | |

School | |

Class |

MAXIMUM | MARKS ACHIEVED | |

Part A | 26 | |

Part B | 24 | |

TOTAL | 50 |

PART A: REPORT ON INVESTMENT PORTFOLIO OF ________________ (name of aunt)

1.

Name of company: | |

Category on the share page | |

Starting date of the investment in shares | |

Share price on this date | |

Number of shares purchased (in lots of 100) | |

Total value of shares purchased | |

Cash on hand | |

Total value of investment portfolio | R200 000 |

| 4 |

2.

Share | Number of | Total value of shares | Cash on hand | Total value of investment | |

Week 1 | |||||

Week 2 | |||||

Week 3 | |||||

Week 4 | |||||

Week 5 |

| 5 |

3.

Graph of share price each week:

|

| 4 |

4.

Graph of value of investment portfolio each week:

|

| 4 |

5.

Further information on the company:

|

| 5 |

6.

Recommendation on further investment in this company, with reasons:

|

| 4 |

| 26 |

PART B

Internal auditor’s report on procedures to be implemented for Exotic Clothing Ltd

1.

Procedures to establish the company:

|

| 4 |

2.

Records that should be kept on each shareholder, together with reasons:

|

| 4 |

3.

Internal control procedures for fixed assets:

|

| 4 |

4.

Internal control procedures for trading stock:

|

| 4 |

5.

Internal control procedures for accounts receivable (debtors):

|

| 4 |

6.

Internal control procedures for cash collected: :

|

| 4 |

| 24 |

Signed: _____________________ (Internal Auditor) Date: ______________

IMPORTANT NOTE TO TEACHERS: The test includes entries relating to the new CAPS curriculum to be implemented in 2014, with regard to shares of no par value and the repurchase of shares. The test was adapted from a previous Grade 12 paper (QUESTION 4 of the 2009 NSC backup paper).

ACCOUNTING GRADE 12: TASK B FIRST TERM TEST QUESTION PAPER |

QP Task B

FINANCIAL STATEMENTS OF A COMPANY (100 marks; 60 minutes)

You are provided with figures from the Pre-Adjustment Trial Balance of Simphiwe Limited. They buy and sell uniforms and also repair uniforms for their customers, for which they charge a fee. These fees are credited to the Fee Income Account in the General Ledger.

By the end of the previous financial year, 30 September 2011, the company had issued 400 000 ordinary shares. These shares were all issued at different times and at different issue prices. Many of the existing shareholders had also bought shares on the JSE at prices negotiated with the sellers of those shares. The company also issued 100 000 new shares on 1 March 2013.

REQUIRED

- Refer to Information 10 below.

Calculate the profit or loss on the disposal of the computer. Show workings. You may prepare an Asset Disposal Account to identify the figure. (8) - Income Statement for the year ended 30 September 2012. (64)

- The following notes to the financial statements:

3.1 Ordinary share capital (13)

3.2 Retained income (15)

INFORMATION

SIMPHIWE LTD

PRE-ADJUSTMENT TRIAL BALANCE ON 30 SEPTEMBER 2012

DEBIT | CREDIT | |

Balance Sheet Accounts Section | R | R |

Ordinary share capital (500 000 shares) | 4 410 000 | |

Retained income (1 October 2011) | 812 650 | |

Loan from Stay Bank | 270 000 | |

Land and buildings at cost | 4 884 000 | |

Vehicles at cost | 660 000 | |

Equipment at cost | 570 000 | |

Accumulated depreciation on vehicles (1 Oct 2011) | 123 000 | |

Accumulated depreciation on equipment (1 Oct 2011) | 111 000 | |

Debtors’ control | 109 800 | |

Creditors’ control | 53 880 | |

Trading stock | 1 398 600 | |

Bank | 940 500 | |

Petty cash | 6 600 | |

SARS – Income tax | 390 500 | |

Provision for bad debts | 4 320 |

Nominal Accounts Section | R | R |

Sales | 8 160 000 | |

Cost of sales | 3 930 000 | |

Debtors’ allowances | 18 600 | |

Salaries and wages | 486 000 | |

Discount allowed | 2 710 | |

Fee income | 314 250 | |

Rent income | 168 000 | |

Insurance | 33 000 | |

Sundry expenses | 117 750 | |

Directors’ fees | 870 000 | |

Audit fees | 161 100 | |

Consumable stores | 75 600 | |

Interest income | 7 500 | |

Dividends on ordinary shares (interim) | 264 000 |

ADJUSTMENTS AND ADDITIONAL INFORMATION

- Prepaid expenses in respect of sundry expenses at the year-end, R9 600, have not been taken into account.

- On 30 September 2012, R1 700 was received from A Ethic, whose account had previously been written off as irrecoverable. The amount was entered in the Debtors’ Control column in the Cash Journal.

- The provision for bad debts must be adjusted to R5 410.

- There were two directors at the beginning of the accounting period. Directors’ fees have been paid for the first half of the accounting period. On 1 April 2012, a third director was appointed. All three directors earn the same monthly fee. Provide for the outstanding fees owed to the directors.

- Rent has been received for 14 months.

- The following credit note was left out of the Debtors’ Allowances Journal for September in error. The mark up on goods sold was 50% on cost.

SIMPHIWE LTD CREDIT NOTE 4533

28 Sept 2012Credit: Supaclean Ltd

PO Box 340, Westmead, 3610Unit price

Total 48 Uniforms returned

R600

R28 800 Reduction on fee charged for repair of uniforms

R2 250 R31 050 - The loan statement from Stay Bank showed the following:

Balance at beginning of financial year R450 000 Repayments during the year R234 000 Interest capitalised R ? Balance at end of financial year R270 000 - physical stock count on 30 September 2012 showed the following on hand:

- Consumable stores on hand, R3 600

- Stock of uniforms on hand, R1 440 000

- The depreciation rate on vehicles is 20% p.a. on the diminishing-balance method. A new vehicle was bought on 1 May 2012 for R165 000 and properly recorded.

- Depreciation on equipment is calculated at 10% p.a. on cost price. Note that an item of equipment was taken over by one of the directors, Ivor Steele, on 30 June 2012 for personal use for R2 400 cash. The relevant page from the Fixed Assets Register is provided below. No entries have been made in respect of the disposal of this asset.

FIXED ASSETS REGISTER Page 12 Item: VYE Computer Ledger Account: Equipment Data Purchased: 1 April 2006 Cost Price: R66 000 Depreciation Policy: 10% p.a. on cost price Date Depreciation Calculations Current Depreciation Accumulated Depreciation 30 Sep 2009 R66 000 × 10% × 6/12 R3 300 R3 300 30 Sep 2010 R66 000 × 10% × 12/12 R6 600 R9 900 30 Sep 2011 R66 000 × 10% × 12/12 R6 600 R16 500 30 June 2012 ? R? R? - Income tax is levied at 30% of net income before tax.

- Details of authorised and issued share capital:

- Authorised: 600 000 ordinary shares of no par value

- Issued up to 30 September 2011: 400 000 ordinary shares

- New issue on 1 April 2012: 100 000 shares at an issue price of R9,50 each. These shares did not qualify for interim dividends.

- Dividends:

- Interim dividends paid on 31 March 2012, 66 cents per share

- Final dividends declared on 30 September 2012, 82 cents per share

- Repurchase of shares: The directors approved the repurchase of 70 000 shares from several sharehold ers at a repurchase price of R11,20 per share. A direct transfer of funds was made from the bank account to the shareholders on 30 September 2012, but has not yet been recorded. The shares repurchased qualify for final dividends during the current financial period.

Total: 100 marks

ACCOUNTING GRADE 12: TASK B FIRST TERM TEST ANSWER BOOK |

Name of learner | |

School | |

Class |

MAXIMUM | MARKS ACHIEVED | |

Part 1 | 8 | |

Part 2 | 64 | |

| Part 3.1 | 13 | |

| Part 3.2 | 15 | |

TOTAL | 100 |

Answer Book Task B

1.

Calculate the profit or loss on the disposal of the computer. WORKINS:

ANSWER: |

| 8 |

2. SIMPHIWE LTD

INCOME STATEMENT FOR THE YEAR ENDED 30 SEPTEMBER 2012

| Other operating income | |

| Operating expenses | |

| Profit before interest expense | |

| Profit before tax | |

| 64 |

3. NOTES TO THE FINANCIAL STATEMENTS

3.1

ORDINARY SHARE CAPITAL | |

Authorised: | |

Issued: | |

| 13 |

3.2

RETAINED INCOME | |

Balance at beginning of year | |

Add: | |

Less: | |

Less: | |

| Balance at the end of the year |

| 15 |

| 100 |

NOTE TO TEACHERS: This task is relevant to Grade 12 learners from 2014 (i.e. relevant to CAPS). You may adapt the material to cater for more than 50 marks, but you should ensure that the final mark is converted to 50 marks as per CAPS. Teachers may allow learners to refer to textbooks in completing this task.

ALSO REFER TO THE SOURCE MATERIAL FOR THIS TASK

(PAGES 25-31)

ACCOUNTING GRADE 12: TASK C PUBLISHED FINANCIAL STATEMENTS OF A COMPANY QUESTION PAPER AND ANSWER BOOK 50 marks; 90 minutes |

Name of learner | |

School | |

Class |

| MARKS ACHIEVED |

| 50 |

FAMOUS BRANDS LIMITED

REQUIRED

Study the information provided. Answer the questions which follow. As this task is intended as a project, you may use your textbook as a resource.

You are also provided with the following financial indicators for the 2011 financial year:

Current ratio = 1,4 : 1 Acid-test ratio = 1,1 : 1 Dividend pay-out rate = 64%

Debt-equity ratio = 0,2 : 1 Net asset value per share = R7,44 % return on shareholders’ equity = 33,9%

EPS = 242 cents DPS = 155 cents

1. General information

1.1 Refer to page 1 of the source material for the icons of the well-known brands that comprise Famous Brands Ltd. Name FOUR of these brands and describe the product or service in which each brand specialises.

|

| 2 |

1.2

Give the names of the persons who fill the following positions: Chairman of the Board of Directors, Chief Executive Officer, Group Financial Director and Company Secretary. Briefly explain the work done by each of them.

|

| 3 |

1.3

Who are the independent auditors of Famous Brands Limited, and how much were they paid for their services? Their report is not provided in this summary, but there is a reference to it in Note 3. Briefly explain what this audit report would contain.

|

| 3 |

1.4

How many directors does the company have, how many of them are executive directors and how many of them are non-executive directors? Briefly explain the difference in the roles of these two types of director.

|

| 3 |

2.

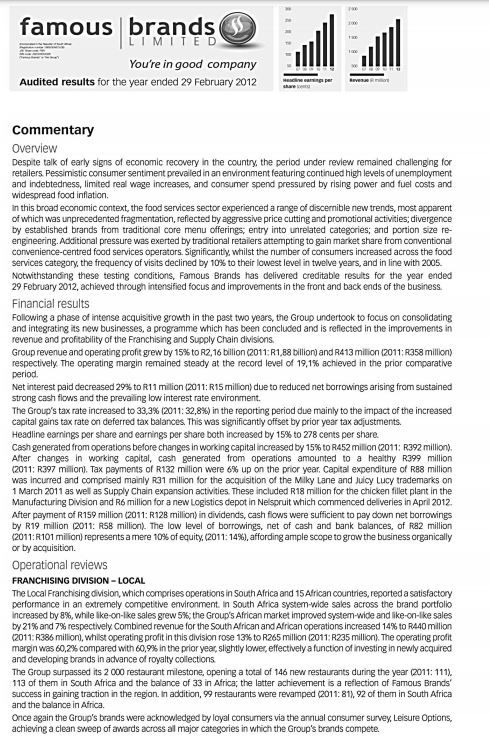

Why did the directors decide to show the graphs of the Earnings per Share and Total Revenue at the top of the page? Briefly explain what these graphs reflect about the company for the past five years.

|

| 2 |

3.

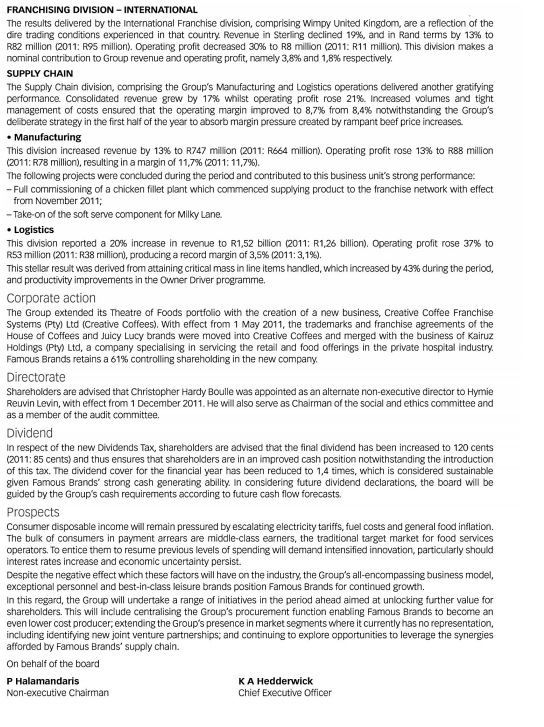

Refer to the commentary by the directors, particularly the Overview and the Financial results. What did the directors say about the changing habits of their customers, and how did the directors respond to these changes?

Briefly explain the major challenges that the company has faced in the current financial year.

The Operational Review states that the company was involved in three main areas: Franchising, Manufacturing and Logistics. Explain what is meant by each of these activities, with specific reference to the work that the company does.

The company does not operate only in South Africa. Provide evidence from the information to prove this point.

|

| 6 |

4.

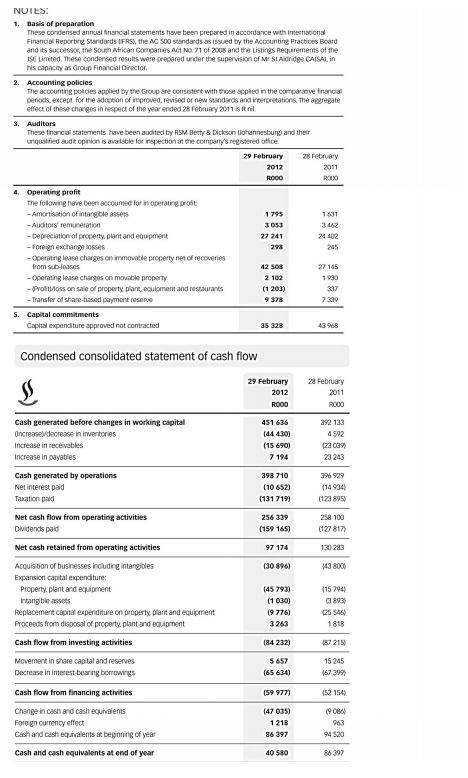

Identify the following figures from the financial statements. Also state where you found each figure, i.e. in the Income Statement (IS), Balance Sheet (BS) or Cash Flow State ment (CFS).

|

| 4 |

5.

| Refer to Page 1 of the source material for the highlighted indicators. Provide workings for the following calculations: % increase in revenue

% increase in operating profit

% increase in headline earnings per share (use basic HEPS)

% increase in dividends per share

|

| 4 |

6.

Calculate the following financial indicators for 2012. Refer to the end of the Income Statement for the number of shares.

|

| 4 |

7.

Comment on the liquidity position of the company. Quote TWO financial indicators to support your opinion.

|

| 3 |

8.

Comment on whether the company tends to retain or distribute its profits. Provide evi dence to support your opinion. Briefly explain how this could affect the share price on the JSE.

|

| 3 |

9.

Comment on the gearing of the company. Should the company repay loans or take out more loans? Provide evidence to support your opinion.

|

| 3 |

10.

In February 2012 the share price of the company on the JSE was R53,00. The price in creased to R79,00 in February 2013. Comment on whether or not you feel the company’s shares are fairly valued. Provide evidence to support your opinion.

|

| 3 |

11.

Should the shareholders be satisfied with the percentage return, earnings and dividends for the 2012 financial year? Explain. Provide evidence to support your opinion.

|

| 4 |

12.

What do the directors say about the prospects for the future? Would this influence you in buying shares in Famous Brands Limited?

|

| 3 |

TOTAL: 50 marks

SOURCE MATERIAL FOR TASK C SECOND TERM PROJECT Refer to the attached extract from the published annual report of 6 pages to follow (p 26–31) |

NOTE TO TEACHERS: This task is relevant to Grade 12 from 2014 (i.e. relevant to CAPS). Teachers may choose to increase the marks on specific items and mark the case study out of 75 or 100 marks, as long as the final weighting is as per CAPS.

| ACCOUNTING GRADE 12: TASK D THIRD TERM ASSESSMENT TASK CASE STUDY: CASH BUDGET AND DEBTORS QUESTION PAPER 50 marks; 60 minutes |

Preamble |

REQUIRED

- Bennie Bekker feels that his wife made two mistakes in compiling the budget. He says that she incorrectly left out the following:

- The monthly depreciation of R4 800 per month

- The new delivery vehicle, valued at R240 000, provided as capital by Mtini

What would you say to Bennie regarding the mistakes he thinks his wife made? (2)

- Complete the Debtors’ Collection Schedule for December 2012 and January 2013. (4)

- Calculate the following for January 2013:

- Percentage increase in the budgeted salaries and wages (2)

- Percentage decrease in the amount budgeted for commission income (2)

- The R9 000 per month is the monthly repayment on the purchase of the existing vehicle. This was bought several months ago for R196 000. At the time of purchase, a deposit of R46 000 was paid. Instalments are paid over 24 months. Calculate the total finance charges incurred in the purchase of this vehicle. (2)

- Bennie’s son, Bart, used the business vehicle to attend his matric farewell party and was involved in an accident. The insurance company refused to repair the vehicle as Bart was not listed as a designated driver and the vehicle was not being used for business purposes. Bennie authorised payment for the repairs to the damaged vehicle and charged this to Vehicle Expenses. The business has over-budgeted on normal vehicle expenses and spends 75% of the budgeted amount.

- What effect did the damage caused by Bart have on the budget? (2)

- Mtini has become aware of this. What is he likely to say to Bennie? State TWO points. (2)

- Refer to the Rent in the Cash Budget. A rent increase of 10% takes effect on 1 January 2013. The actual rent received in December was as per the budget.

- Calculate the rent income for December 2012. (2)

- Provide a suitable explanation for the actual amount of rent collected in January 2013 being different from the budgeted amount. (1)

- Payments to creditors:

- Calculate the budgeted amount to be paid to creditors in January 2013. (2)

- Mtini feels that the business need not buy any goods for cash, and that all goods should be bought on credit. In your opinion, will this improve the business Cash Budget? Explain. (2)

- Bennie Bekker decided to repay the existing loan from Alpha Lenders in full on 31 December 2012 as the interest rate was very high. The interest of 15% p.a. on this loan was not capitalised. He then decided to take out a new loan with Minty Bank on 1 January 2013. Interest is capitalised on this loan and according to the agreement a monthly amount of R4 000 is to be paid to Minty Bank on the 25th day of each month.

- Explain the difference between interest capitalised and interest not capitalised. (1)

- Calculate the amount of the loan to be repaid on 31 December 2012. (2)

- Use the Cash Budget to identify the missing figures, totals and balances designated A-D. You are NOT required to identify the other missing figures. (4)

- Mtini is worried that the business is not controlling the debtors properly. He asks you for a short report. Include the following in your report:

- Calculation of average debtors’ collection period (in days) (2)

- The percentage of debtors who are complying with the credit terms (as indicated in the Debtors Age Analysis) (2)

- A brief comment on the above two calculations (1)

- Details of the main mistakes that the business is making with regard to debtors. Also provide the names of specific debtors to illustrate these main problems and suggest a solution for each mistake. (6)

- Consider the actual and budgeted figures for Advertising, Telephone and Insurance. (Note that Mtini has not drawn any funds as yet.) Comment on each item, and offer ONE point of advice in each case. (6)

- Bennie has made two significant decisions by taking out a new loan and admitting a partner to the business. What would you say to Bennie about these decisions and the effect on the cash flow of the business? (3)

INFORMATION ON NEXT TWO PAGES …

INFORMATION

1.

Cash Budget for two months ending 31 January 2013 (actual figures in shaded columns):

December 2012 January 2013

| Receipts | December 2012 | January 2013 | ||

| BUDGET | ACTUAL | BUDGET | ACTUAL | |

| Cash sales | 480 000 | 452 000 | 330 000 | 208 000 |

| Receipts from debtors | ? | 189 980 | ? | 222 685 |

| Commission income | 24 000 | ? | 20 400 | 12 000 |

| Loan from Minty Bank | 0 | 0 | 0 | 120 000 |

| Rent income | ? | ? | 15 950 | 31 900 |

| Capital from M Mtini | 0 | 250 000 | 0 | 0 |

| Total Receipts | 778 798 | 926 480 | ? | 594 585 |

| Payments | ||||

| Cash purchases | 222 500 | 245 750 | 155 000 | 110 380 |

| Payments to creditors | 181 800 | 162 000 | ? | 184 000 |

| Telephone | 2 800 | 4 500 | 2 800 | 4 200 |

| Repayment on existing vehicle | 9 000 | 9 000 | 9 000 | 9 000 |

| Vehicle expenses | 8 000 | 6 400 | 8 000 | 37 500 |

| Salaries and wages | 68 000 | 82 800 | 72 080 | 72 080 |

| Advertising | 5 000 | 5 000 | 5 000 | 5 000 |

| Sundry operating expenses | 23 380 | 19 400 | 17 300 | 17 320 |

| Insurance | 22 000 | 16 000 | 22 000 | 16 000 |

| Drawings by Bennie Bekker | 25 000 | 25 000 | 25 000 | 35 000 |

| Interest on overdraft | 4 020 | ? | ? | 0 |

| Interest on loan | 500 | 500 | 500 | 0 |

| Repayment of loans | 0 | ? | 0 | 4 000 |

| Total payments | 572 000 | 620 370 | 516 930 | 494 480 |

| Cash surplus/shortfall | 206 498 | 306 110 | ? | 100 105 |

| Bank(Opening balance) | (325 400) | (325 400) | A | C |

| Bank (Closing balance) | ? | (19 290) | B | D |

2. Purchases and sales of trading stock

Stock is replaced on a monthly basis.

50% of stock is usually purchased on credit.

Creditors are paid in the month after the purchases, to take advantage of a 10% discount. Goods are sold at a constant mark-up of 80% on cost.

The budget is worked out on the following total sales figures:

October 2012 | November 2012 | December 2012 | January 2013 |

R603 00 | R727 200 | R801 000 | R558 000 |

Credit sales constitute 40% of the total sales.

3. Expected collections from debtors:

Debtors are told that they are expected to pay in the current month or in the month following the sales transaction month. However, the budget is compiled as follows:

10% is collected in the transaction month. A discount of 5% is allowed for any payment received in the transaction month.

50% is collected in the month after the transaction month.

35% is collected in the second month after the month of sale.

4. Debtors Age Analysis on 31 December 2012

| DEBTORS | CREDIT LIMIT | SEPTEMBER | OCTOBER | NOVEMBER | DECEMBER | TOTAL |

| M Minaj | 45 000 | 49 100 | 49 100 | |||

| U Usher | 85 000 | 7 800 | 40 680 | 48 480 | ||

| B Beiber | 30 000 | 24 000 | 24 000 | |||

| B Britney | 100 000 | 49 125 | 45 240 | 9 050 | 25 865 | 129 280 |

| J Jemson | 12 000 | 6 500 | 6 500 | |||

| W West | 50 000 | 22 000 | 22 000 | |||

| D Drake | 120 000 | 29 800 | 39 000 | 24 000 | 26 680 | 119 480 |

| H Hannah | 25 000 | 31 100 | 9 300 | 40 400 | ||

| W Wayne | 45 000 | 4 350 | 23 270 | 8 740 | 36 360 | |

| Other debtors | ? | ? | ? | ? | ? | |

| R156 725 | R234 250 | R172 500 | R201 300 | R764 775 | ||

| 90 days | 60 days | 30 days | Current | |||

| Percentage | % | % | % | % | 100% | |

5. Actual figures from financial statements for year ended 31 December 2012:

For the year | ||

Total sales | R4 600 000 | |

Cash sales | R2 200 000 | |

Credit sales | R2 400 000 | |

1 January 2012 | 31 December 2012 | |

Trade debtors | R295 225 | R764 775 |

TOTAL: 50

ACCOUNTING GRADE 12: TASK D THIRD TERM ASSESSMENT TASK CASE STUDY: CASH BUDGET AND DEBTORS ANSWER BOOK |

Name of learner | |

School | |

Class |

MARKS ACHIEVED |

| 50 |

1.

What would you say to Bennie about the mistakes that he says his wife made in compiling the budget with regard to the depreciation and the contribution of a new delivery vehicle?

|

| 2 |

2.Debtors’ Collection Schedule for December 2012 and January 2013

| MONTH | CREDIT SALES | DECEMBER 2012 | JANUARY 2013 |

| October | |||

| November | |||

| December | |||

| January | |||

| Cash from debtors |

| 4 |

3.

Calculate % increase in budgeted salaries and wages in January 2013.

Calculate % decrease in amount budgeted for commission income in January 2013.

|

| 4 |

4.

Calculate total finance charges incurred in the purchase of the vehicle.

|

| 2 |

5.

Effect on the budget:

TWO points that Mtini would mention to Bekker:

|

| 4 |

6.

Calculation of rent income for December 2012:

Suitable explanation:

|

| 3 |

7.

Calculate the budgeted payments to creditors in January 2013.

Mtini feels that the business need not buy any goods for cash, and that all goods should be bought on credit. In your opinion, will this improve the business Cash Budget? Explain.

|

| 4 |

8.

Explain the difference between interest capitalised and interest not capitalised.

Calculate the amount of the loan repaid on 31 December 2012.

|

| 3 |

9.

Use the Cash Budget to identify the missing figures, totals and balances designated A–D. You are NOT required to identify other missing figures.

|

| 4 |

10.

Calculation of average debtors’ collection period (in days): (2)

Calculation of % of debtors who are complying with the credit terms (as indicated in the Debtors Age Analysis): (2)

Brief comment on the above two calculations: (1)

Details of the main mistakes that the business is making with regard to debtors. Also provide the names of specific debtors to illustrate these main problems and suggest a solution for each mistake. (6)

|

11. Consider the actual and budgeted figures for Advertising, Telephone and Advertising. (Note that Mtini has not drawn any funds as yet.) Comment on each item, and offer ONE point of advice in each case.

| COMMENT | ADVICE | |

| ADVERTISING | ||

| TELEPHONE | ||

| INSURANCE |

| 6 |

12.

Bennie has made two significant decisions by taking out a new loan and admitting a partner to the business. What would you say to Bennie about these decisions and the effect on the cash flow of the business?

|

| 3 |

| 50 |