ECONOMICS PAPER 1 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS NOVEMBER 2021

Share via Whatsapp Join our WhatsApp Group Join our Telegram Group SECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 B - capital

1.1.2 A - Kuznets

1.1.3 D - nationalisation

1.1.4 C - financial derivatives

1.1.5 C - World Trade Organisation

1.1.6 A - National Development Plan

1.1.7 B - Skills Support Programme

1.1.8 D - head count index (8 x 2) (16)

1.2 MATCHING ITEMS

1.2.1 D - money received without an productive service rendered

1.2.2 F - spending by businesses on capital goods

1.2.3 I - the minimum amount of money required by the South African

Reserve Bank for banks to maintain, in order to manipulate money creation activities

1.2.4 E - charging different prices to different customers for the same product

1.2.5 B - monitors identifiable and definable issues related to human well- being

1.2.6 A - combination of international trade policies suitable for the prevailing conditions in an economy

1.2.7 H - purpose-built industrial estates that are physically enclosed and link to international ports

1.2.8 C - a nationwide government intervention to create employment using labour intensive methods (8 x 1) (8)

1.3 GIVE THE TERM

1.3.1 Absolute advantage

1.3.2 Annual budget / National budget / main budget

1.3.3 Regressive

1.3.4 Export promotion

1.3.5 Economic development

1.3.6 Integrated Manufacturing Strategy (6 x 1) (6)

TOTAL SECTION A: 30

SECTION B

Answer any TWO of the three questions in this section in the ANSWER BOOK.

QUESTION 2: MACROECONOMICS

2.1 Answer the following questions.

2.1.1 Name any TWO participants of the circular flow model.

- Households

- Business sector

- Government

- Foreign sector (2 x 1) (2)

2.1.2 Why does public sector failure lead to social instability?

- The lives of people are destabilised, and their human rights compromised

- The community becomes disgruntled and start making their demands through protesting

(Accept any other correct relevant response) (1 x 2) (2)

2.2 DATA REPONSE

2.2.1 Identify the base year that the South African Reserve Bank uses to compile national accounts aggregates. 2015 (1)

2.2.2 Give the alternative term used for gross value added in national accounts.

Gross domestic product / GDP(P) (1)

2.2.3 Briefly describe the term gross value added.

The value that is added on the goods at every stage of the production process

(Accept any other correct relevant response) (2)

2.2.4 How are basic prices converted to market prices?

Taxes on products are added to and subsidies on products are subtracted from gross domestic product at basic prices to get gross domestic product at market prices / GVA at basic prices PLUS taxes on products MINUS subsidies on products = GDP @ market prices

(Accept any other correct relevant response) (2)

2.2.5 Why would economists prefer constant prices to current prices when measuring economic growth?

- Constant prices are adjusted to exclude the effects of inflation, whereas current prices are not adjusted

- Constant prices provide a true reflection on actual changes in production of goods and services, while current prices gives a distorted reflection

- Current prices give a distorted indication of the actual growth of the economy

- Measuring economic growth using constant prices provides accurate data to policy makers to make informed decisions

- Constant prices help to make accurate comparison of economic performance from year to year

(Accept any other correct relevant response) (2 x 2) (4)

2.3 DATA RESPONSE

2.3.1 Name the government department responsible for the formulation and implementation of fiscal policy.

- Department of Finance (1)

2.3.2 Give the benchmark percentage of public debt in relation to gross domestic product.

- Not more than 60% (1)

2.3.3 Briefly describe the term medium-term expenditure framework.

- It shows government's income and expenditure estimates for a 3-year period.

(Accept any other correct relevant response) (2)

2.3.4 Why is there a need for government to spend more on social development?

- A significant number of the South African population are still living in poverty; thus, the government should allocate more resources to improve their standard of living

- The unemployment figure is the highest in the world due to low level skills, decreased GDP and a lack of investment. High unemployment rate increases the dependency rate on government, this therefore compels the government to increase spending on activities that improves lives of the people

- Many people lost their jobs and sources of income due to the Covid-19 pandemic and would need grants to survive.

(Accept any other correct relevant response) (2)

2.3.5 How can income tax brackets influence taxpayers?

- An increase in income can push taxpayers into higher tax brackets, if tax brackets remain the same, resulting in higher taxes. (Bracket creep)

- Taxpayers do not receive the full benefits of an increase in their wages.

- An increase in income will not shift households to higher tax brackets, if tax brackets increase, thus preventing bracket creep.

- Tax relief will be provided to workers as their existing salary may fall in a lower tax bracket

- Their disposable income can increase allowing them to spend more on goods and services

NB: Accept the explanation for a decrease in the tax bracket which will have a negative impact on the consumer’s disposable income)

(Accept any other correct relevant response) Any (2 x 2) (4)

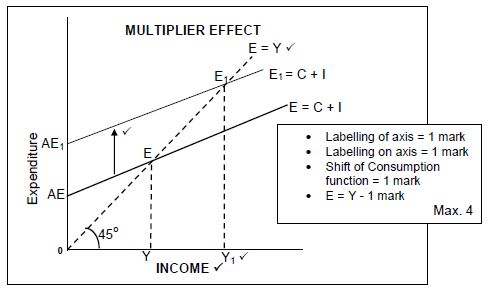

2.4 With the aid of a correctly labelled graph, explain the multiplier concept.

- The multiplier effect occurs when a small increase in spending leads to a proportionately larger increase in national income.

- At an income of Y the expenditure curve intersects the vertical axis at AE.

- An increase from AE to AE1 means more money is injected in the economy.

- This causes a proportionately larger increase in income from Y to Y1. (2 x 2) = (4) 8

(Accept any other correct relevant response)

Explanation must relate to the graph in order to earn marks.

Explanation - 4 marks.

2.5 How can changes in terms of trade influence the South African economy?

- An improvement in the terms of trade comes as a result of an increase in export prices or/and a decrease in import prices

- An increase in export prices would increase economic welfare in the short term, as more revenue is earned with the same/less expenditure on imports

- A decrease in import prices would result in less expenditure or less payments on imports in the short term

- Higher export earnings and lower import payments may reduce Balance of Payments deficit in the short term

- Less resources would be used to produce exports to pay for imports

- Demand for South African exports may decrease in the long run due to higher prices

- A decrease in the terms of trade comes as a result of a decrease in export prices or/and an increase in import prices

- A decrease in export prices would decrease economic welfare in the short term, as less revenue is earned with the same/less expenditure on imports

- An increase in import prices would result in more expenditure or more payments on imports in the short term

- Lower export earnings and higher import payments may increase the Balance of Payments deficit in the short term

- More resources would be used to produce exports to pay for imports

- Demand for South African exports may increase in the long run due to lower prices

OR - An increase in exports will encourage development of the country’s industrial capacity

- More foreign exchange will be earned to pay for imports

- Increased exports may lead to an improvement of the Balance of Payments

- Increase in imports may lead to the depreciation of the exchange rate and it will be expensive for South Africa to buy from other countries

(Accept any other correct relevant response)

(Allocate a maximum of 2 marks for a mere listing of facts/examples)

(8)

[40]

QUESTION 3: ECONOMIC PURSUITS

3.1 Answer the following questions.

3.1.1 Name TWO methods of import substitution.

- Tariffs (ad-valorem tariff, specific tariff)

- Diverting trade / import deposits / quality standards

- Quotas

- Subsidies

- Exchange control

- Physical control / Embargo

(Accept any other correct relevant response) (2 x 1) (2)

3.1.2 How can government use land restitution to achieve its development and redress objectives?

- The government can return land or pay cash compensation to those who lost their land because of discriminatory laws in the past to improve the standard of living for the previously disadvantaged people

(Accept any other correct relevant response) (1 x 2) (2)

3.2 DATA RESPONSE

3.2.1 Identify the energy source that relates to the burning of fossil fuels

- Coal (1)

3.2.2 Give the index that is used to measure society's level of development

- Human Development Index / HDI (1)

3.2.3 Briefly describe the term economic indicator.

- Statistical data used to measure the performance of the economy / statistical information used by government to determine future economic policy and to make predictions about future performance of the economy

(Accept any other correct relevant response) (2)

3.2.4 Explain the negative impact of rural-urban migration on the supply of services in urban areas.

- Population increases in urban areas will put more pressure on the supply of services such as water and sanitation

- Provision of housing will be unable to meet demand, resulting in informal settlements without proper infrastructure

- Electricity demands in urban areas will put pressure on the power grid, leading to more load shedding

- Constraints on local government regarding local budget and planning.

- Unlawful occupation of land that was set aside for agricultural production.

(Accept any other correct relevant response) (2)

3.2.5 How will renewable sources of energy affect poor households in rural areas positively?

- Cost of living for the households will decrease as they pay less for electricity/energy, resulting in an improved standard of living

- Households will have more disposable income to spend on other basic goods and services

- Electricity becomes more accessible to vulnerable communities

- Clean energy sources will impact positively on the health of communities

(Accept any other correct relevant response) (2 x 2) (4)

3.2 DATA RESPONSE

3.3.1 Identify the financial incentive that allows for the importing of intermediate goods without paying any tariffs.

- Duty-free (1)

3.3.2 Name any ONE special economic zone in South Africa.

- Coega SEZ (Eastern Cape)

- Richards Bay SEZ (KZN)

- East London SEZ (Eastern Cape)

- Saldanha Bay SEZ (Western Cape)

- Dube Tradeport SEZ (KZN)

- Maluti-a-phofung SEZ (Free State)

- OR Tambo IDZ (Gauteng)

- Musina/Makhado SEZ (Limpopo)

- Atlantis SEZ (Western Cape)

- Nkomazi SEZ (Mpumalanga)

- Tshwane Automotive SEZ (1)

3.3.3 Briefly describe the term corridors.

- A corridor is a track of land that forms a passageway allowing access from one area to another and is developed as part of regional development.

(Accept any other correct relevant response) (2)

3.3.4 How is the government using corporate tax to attract investments into special economic zones?

- The government reduced corporate tax from 27% to 15% for businesses that are established in SEZs

- The tax relief makes it possible for new businesses to survive the first few years in production by reducing operational cost for them

(Accept any other correct relevant response)

(2)

3.3.5 Explain the importance of public-private partnerships in spatial development initiatives.

- It allows for private sector businesses to take advantage of the economic potential of underdeveloped areas.

- The private business may provide investment capital, while government provides infrastructure such as roads water and electricity

- More factors of production will be employed as more investments will be attracted

- Businesses benefit from profits and government benefits from taxes, levies and decreased unemployment

- Allows moving towards international competitiveness, regional cooperation and more diverse ownership base.

(Accept any other correct relevant response) (2 x 2) (4)

3.4 Outline the aims of regional development.

- Reduce unequal development of economic activities within a country

- Stimulate development in poorer areas

- Prevent new imbalances from emerging / enhance competitiveness of all provinces

- Implement and coordinate the implementation of national and regional industrial policies

- Stimulate the growth of SMMEs in the economy

(Accept any other correct relevant response)

(Allocate a maximum of 4 marks for the mere listing of facts/examples)(4 x 2) (8)

3.5 Analyse the environmental effects of economic activities of countries in the north.

- Mass production and consumption in the north damages the ozone layer, caused by pollution and toxic substances

- Northern countries are guilty of using big burners of oil and coal where CO2 damages the environment and creates climate change experienced worldwide

- Greenhouse gases produced by large industries affect lives in the south more negatively due to their way of living

- Climate change has necessitated international agreements like the Kyoto Protocol, to reduce greenhouse gases

- Climate change results in less agricultural output due to poor soil conditions, inadequate and unreliable rainfall.

- The south is badly affected by degradation of land, and contamination of water and vegetation which causes malnutrition and hunger

- Trade expansion can have an obvious direct impact on the environment due to higher pollution or degrading natural resources

- Open markets can improve access to new technologies that make local production processes more efficient by diminishing the use of inputs such as energy, water, and other environmentally harmful substances.

- As a country becomes more integrated within the world economy, its export sector becomes more exposed to environmental requirements imposed by the leading importers.

(Accept any other correct relevant response)

(Allocate a maximum of 2 marks for a mere listing of facts/examples)

(8)

[40]

QUESTION 4: MACROECONOMICS AND ECONOMIC PURSUITS

4.1 Answer the following questions.

4.1.1 Name any TWO international benchmark criteria for regional development.

- Free-market operation

- Competitiveness

- Sustainability

- Good governance

- Provision of resources

- Investment in social infrastructure

- Integration

- Partnerships (2 x 1)

(Accept any other relevant response)

(2)

4.1.2 Why are liabilities added when calculating net direct investments on the financial account of the balance of payments?

- Liabilities represent a capital inflow or money flow from the foreign sector into South Africa (1 x 2) (2)

4.2 DATA RESPONSE

4.2.1 Identify the supply reason for international trade addressed in the extract above

- Natural resources

- Technology

(1)

4.2.2 Name the product explicitly recorded in the current account, due to its historic importance.

- Gold

(1)

4.2.3 Briefly describe the term mass production.

- The production of goods in large quantities which may reduce the average cost of production.

(Accept any other correct relevant response) (2)

4.2.4 Explain the reason for South African consumers importing products that are available on domestic markets

- Imported products may be of better quality than local products.

- Imported products may be available at lower prices.

- Some local consumers enjoy shopping exclusively because of brand loyalty, increase in income and due to different tastes.

(Accept any other correct relevant response)

(2)

4.2.5 How could natural disasters such as drought influence the South African trade balance?

- Reduced local agricultural production will result in a decrease in exports

- Local consumers will be forced to import more food products due to shortages on local markets

- The trade balance will weaken as exports decrease while imports increase

(Accept any other correct relevant response) (2 x 2) (4)

4.3 DATA RESPONSE

4.3.1 Identify ONE component of aggregate demand from the information above.

- Exports

- Household spending / consumer spending (1)

4.3.2 Name the employment indicator that relates to the size of the labour force in the country.

- Economically active population / EAP

(Accept any other correct relevant response)

(1)

4.3.3 Briefly describe the term economic growth.

- An increase in the production of goods and services over time / an increase in real GDP

(Accept any other correct relevant response)

(2)

4.3.4 Explain the impact of an increase in consumer spending on the production of goods and services.

- Demand of goods and services will increase, encouraging businesses to produce more

(Accept any other correct relevant response) (2)

4.3.5 How can small, medium and micro enterprises (SMMEs) contribute to economic growth and development?

- More job opportunities will be created in both the formal and informal sector resulting in more sources of income

- Increase in the aggregate demand will lead to higher production levels

- Competition will increase, resulting in lower prices for goods and services

- Tax revenue for the government will increase, leading to more social expenditure on the poor

- Surplus products will be exported, and foreign currency will be earned to pay for imported inputs.

- Government support to create programs for the training of workers (Accept any other correct relevant response) (2 x 2) (4)

4.4 Briefly discuss exchange rate stability and price stability as macro-economic objectives of the state.

Exchange rate stability:

- Depreciation and appreciation of a currency create uncertainty for producers and traders and should therefore be limited

- The government should manage the economy through monetary and fiscal policies so that the exchange rate remains relatively stable for as long as possible

- South Africa pursues stable exchange rates to attract foreign capital

Price stability: - In a mixed economy, prices fluctuate as demand and supply change

- Frequent and dramatic changes in prices affect economic growth and employment

- The government attempts to guard against price instability

- In South Africa, price stability means an inflation rate of between 3% and 6%

- Stable prices enable firms and households to predict income and expenditure.

- Investor confidence is boosted by stable prices and attracts foreign direct investment.

(Accept any other correct relevant response)

(Allocate a maximum of 4 marks for a mere listing of facts/examples) (2 x 4) (8)

4.5 Analyse the challenges of the South African government in reducing the unemployment rate in the economy.

- The South African government faces the following challenges in reducing unemployment: -

- Corruption among state-own enterprises creates a negative sentiment among potential investors

- Lack of skills among the South African youth reduces the employability of many people

- Lack of information among some of the youth reduces accessibility of employment opportunities

- Covid-19 recession resulted in thousands of workers losing their jobs, sharply increasing the unemployment rate

- Negative sentiment towards the economy resulted in less foreign direct investments

- Lack of start-up capital among the youth result in many potential entrepreneurial ideas not invested in

- Poor infrastructure in some regions of the country reduces industrial activities in such areas

- Unreliable electricity supply further cripples any prospects of increasing job opportunities in South Africa

(Accept any other correct relevant response)

(Allocate a maximum of 2 marks for a mere listing of facts/examples) (8)

[40]

TOTAL SECTION B: 80

SECTION C

Answer any ONE of the two questions in this section in the ANSWER BOOK.

QUESTION 5: MACROECONOMICS

- Discuss in detail the new economic paradigm in smoothing-out business cycles. (26 marks)

- Evaluate the South African government's initiatives to reduce the economic downturn caused by the Covid-19 pandemic. (10 marks)

INTRODUCTION

- The new economic paradigm suggests that it is possible to implement measures to promote economic growth and reduce unemployment without provoking inflation.

- The new economic paradigm is embedded in both demand-side and supply-side policies.

(Accept any other relevant introduction) (Max 2)

BODY: MAIN PART

Demand-side policies:

- Traditional monetary and fiscal policies focus on aggregate demand

Monetary policy: - When the level of economic activity is depressed the SARB can use expansionary measures to stimulate economic activities

- An expansionary monetary policy is implemented when the economy is in recession in order to stimulate economic activities

- Interest rates can be reduced to make borrowing cheaper and encourage spending by households and businesses

- The increased spending increases the level of economic activity. Investment will increase and more factors of production will be employed

- Higher levels of production and income and expenditure will be achieved

- If the supply of goods and services does not increase in line with increase in demand, inflation will increase

Fiscal policy: - When the level of economic activity is low the minister of finance can use expansionary fiscal measures to stimulate growth and reduce unemployment

- An expansionary fiscal policy can be implemented when the economy is in recession in order to stimulate economic activities

- An increase in government expenditure will increase aggregate demand

- When there is an increase in injection in the economy, production which will result in a higher employment of factors of production

- The result will be higher income and higher expenditure

- Taxes can be reduced, which will lead to an increase in disposable income

- This will increase consumer spending and investments, stimulating aggregate demand 16

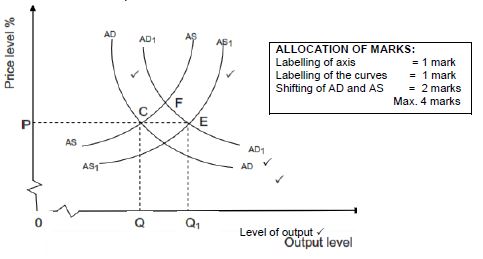

Inflation: - When the demand increases, the supply will react in the same way.

- If the supply does not react to an increase in demand, prices will increase (a new equilibrium).

- Aggregate demand and supply are in equilibrium where AD = AS at point C, and again where AD1 = AS1 at point E.

- When the demand increases, the supply will react in the same way.

- Fig (a) below illustrates that if AD1 increases and AS does not respond, the new equilibrium will be at point F. Therefore, real production will increase and prices will also increase. Inflation will prevail.

Unemployment: - Demand-side policies are effective in stimulating economic growth.

- The demand for labour will increase due to economic growth, and that leads to reduced unemployment.

- A decrease in unemployment results in an increase in inflation because more people are employed, which causes an increase in demand for labour.

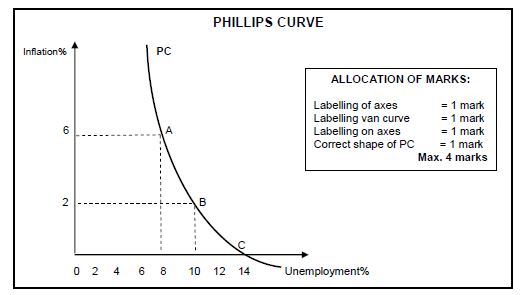

- This relationship between unemployment and inflation is illustrated using the Phillips curve.

- The Phillips curve shows the relationship between unemployment and inflation.

- PC shows the initial situation, where at point C the PC curve intersects x/axis i.e. natural rate of unemployment is 14%.

- If unemployment falls to D i.e. 9% causes wages to increase, thus inverse relationship between unemployment and inflation.

- Supply-side measures that can relocate the Phillips curve to shift to the left, due to improved education, effective training and fewer restrictions on immigration of skilled workers,

- Demand-side policies are effective in stimulating economic growth.

- Economic growth can lead to an increase in demand for labour.

- As a result more people will be employed and unemployment will decrease.

- As unemployment decreases inflation is likely to increase.

Supply-side policies: - A demand-side approach does not render desirable outcome because growth has to be cut due to problems in inflation

- Aggregate supply needs to be managed as well by focusing on increased flexibility of supply components

- If the cost of increasing production is completely flexible, a greater output can be supplied at any given price level

- The governments can arrange things in the economy in a way that is cooperative to changes in demand.

- Reduction of costs allows greater output to be supplied at any given price level.

Government measures that can reduce costs - Infrastructural services like communication, transport and energy costs

- Administrative costs like inspections and regulations add to overall costs

- Cash incentives such as subsidies lower the production cost

- Compensation to exporters to encourage increased production aimed at foreign markets

- Measures to improve efficiency of inputs

- Lower rates of personal income tax are incentives for high productivity and increase aggregate supply

- Capital consumption by replacing capital goods on a regular basis that will create opportunities for businesses to keep up with technological development

- Human resources development where the quality of labour can be improved by

improving health care, education and training which will increase the efficiency

of businesses - Free advisory services to promote opportunities to export and establish business activities in foreign countries which includes weather forecasts, veterinary services and research

Measures to improve efficiency of markets - Deregulation where laws and regulations are removed to make markets free

- Competition is encouraged to establish new businesses, invite foreign direct investment and remove power imbalances

- Levelling the economic playing fields because private businesses cannot compete with public enterprises due to legislative protection (Max 26)

(Accept any other correct relevant response)

(Allocate a maximum of 8 marks for mere listing of facts / examples)

ADDITIONAL PART

- Reduction in repo rate to keep the cost of borrowing low has stimulated consumer spending and investments

- Loan guarantees for businesses with low turnover has helped them survive extra costs brought by covid-19

- Relaxing regulatory requirements has supported the flow of credit to households and businesses

- The government introduced temporary payment holidays and other measures to support debtors

- Tax deferral and postponement of new taxes has encouraged businesses to continue operating saving some several jobs

- Temporary employment relief scheme has supported workers and reduce retrenchments

- Expansion of social grants and other social reliefs increased demand for goods and services encouraging businesses to produce more.

- Reallocation of funds among government departments resulted in some departments failing to deliver services e.g. infrastructure development

- Restrictions in the trading of non-essential products such as alcohol and tobacco resulted in a decline in tax revenue for the government

- Borrowing of funds to fight the pandemic has increased the public debt

(Accept any other correct higher order, relevant response) (Max 10)

CONCLUSION

It is critically important for the government to focus on both demand-side and supply-side measures to ensure stability in the economy

(Accept any other correct higher order, relevant conclusion) (Max 2)

[40]

20

QUESTION 6: ECONOMIC PURSUITS

- Discuss the arguments in favour of protectionism. (26 marks)

- How can South Africa benefit from trading in global markets? (10 marks)

INTRODUCTION

- A trade policy whereby state implements measures to protect local industries against unfair competition from abroad (Max 2)

(Accept any other correct relevant response)

BODY: MAIN PART

Industrial development

- Some developing countries are suitable for establishing certain kinds of industries

- Free trade makes it impossible to compete with well-established older countries, due to the first few years of existence of an industry being the most difficult

- Older industries use unfair methods of price-cutting and dumping – therefore young industries need protection until properly established

- Protection will prevent competition, because it is difficult to do away with, once applied

Infant industries - It is difficult for a young industry to survive, due to their average costs being higher than well-established foreign competitors

- If they are given protection in their early years, they may grow and take advantage of economies of scale/lower their average costs/become competitive

Stable wage levels and high standard of living - A country with high wages has a view that standard of living will be undermined if cheaper goods are imported from countries with low wages

- In reality, high wages are paid to workers with high productivity

Increased employment - Local industries cannot find profitable markets, may stop production and cause unemployment.

- Protection will result in less unemployment

Economic self-sufficiency and strategic key industries - War causes cut off, or friction between countries, depression, shifts in demand, all factors that are vital to be self-supporting

- Protection is granted especially to key industries to ensure survival

Maintaining domestic employment, to reduce unemployment and provide more job opportunities - Countries with high levels of unemployment are pressured to stimulate employment creation.

- Protectionism policies are used to stimulate industrialisation.

- Domestic employment is encouraged through imposing import restrictions.

- Domestic employment creation at the expense of other countries is known as “Beggar thy neighbour” policies.

Prevent dumping - Countries selling goods in a foreign country at lower prices than cost of production in home country

- Dumping is used to capture new markets and forces financially weaker industries out of competition

- Foreign enterprises may engage in dumping because government subsidies permit them to sell goods at very low prices or below cost or because they are seeking to raise profits through price discrimination.

- The initial reason for exporting products at a low price may be to dispose of accumulated stocks of goods.

- In the short term, consumers in the importing country will benefit.

- However, their long-term objective may be to drive out domestic producers and gain a strong market position.

- In this case consumers are likely to lose out as a result of the reduction in choice and the higher prices that the exporters will be able to charge.

- Protectionism prevents foreign industries from dumping their surpluses and out-of-season goods at low prices, which may be harmful to home industries.

Stabilising exchange rates and balance of payments - Traders buy on cheapest markets and sell on most expensive ones

- Countries export primary products and import manufactured goods causing a disrupted balance of payments and exchange rates

- Prices of imports increase through tariffs and quotas

- A stable exchange rate and BoP increases government revenue/prevents harmful goods from entering the country/develop greater technical skills

Protection of natural resources - Free trade will exhaust resources because the world shares

- Protection ensures that industries survive

Ensures greater economic stability - Over-specialisation is a result of free trade and is harmful in times of war and friction (more guns than food)

- Protection prevents over-specialisation, thereby creating a more differentiated economy and greater stability

- It also promotes secondary industries and the welfare of people dependent on protected industries

- If imports are greater than exports, a country may introduce import controls such as customs duty and quotas eliminate the deficit on the balance of payments

- Developing countries rely on the export of primary products. Selling processed goods is more beneficial to a country as more foreign exchange can be earned. Protection ensures the processing of primary goods until completion

(Accept any other correct relevant response) (Max 26)

(Allocate a maximum of 8 marks for mere listing of facts/examples)

BODY: ADDITIONAL PART

South Africa will benefit from global markets as follows:

- Production of goods and services will increase as local businesses will sell their products to larger markets

- Quality of goods and services will improve as businesses try to match world standards

- Competition from foreign products will encourage local businesses to be more innovative

- Efficiency in the production of goods and services will improve resulting in businesses charging lower prices

- South African consumers will have more choice on goods and services, as they will have access to foreign products

- More job opportunities may be created as production of goods and services increase

- Inflation may be controlled as local prices will be linked to international prices

- South Africa will increase its trade relations with other countries which will result to it gaining a larger market share internationally

- Earn foreign currency which will strengthen the domestic currency

- South Africa will specialise in the production of goods on which they have a comparative advantage

(Accept any other correct higher order, relevant response) (Max 10)

CONCLUSION

The policy of restriction of international trade (protectionism) with the aim of preventing unemployment or capital losses in industries threatened by imports, might not affect the internal distribution of income sufficiently or improve the country's terms of trade, because it is not based on international monopoly power and expert knowledge

(Accept any other correct, higher order, relevant response) (Max 2)

[40]

TOTAL SECTION C: 40

GRAND TOTAL: 150