ACCOUNTING P1 with Memorandum - 2024 Grade 12 June Common Exams

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupMARKS: 150

TIME: 2 hours

INSTRUCTIONS AND INFORMATION

Read the following instructions carefully and follow them precisely.

- Answer ALL the questions.

- A special ANSWER BOOK is provided in which to answer ALL questions.

- A Financial Indicator Formula Sheet is attached at the end of this question paper.

- Show ALL workings to earn part-marks.

- You may use a non-programmable calculator.

- You may use a dark pencil or blue/black ink to answer questions.

- Where applicable, show ALL calculations to ONE decimal point.

- Write neatly and legibly.

- Use the information in the table below as a guide when answering the question paper. Try NOT to deviate from it.

QUESTION 1: CALCULATION OF NET PROFIT AND STATEMENT OF FINANCIAL POSITION (50 marks; 40 minutes)

1.1 Choose the correct word or term from the list given which best suits each statement below. Write only the word or term next to the question numbers (1.1.1 to 1.1.4) in the ANSWER BOOK.

| Directors’ Report; Shares; Memorandum of Incorporation; Prospectus; Independent Auditor’s Report |

1.1.1 Document offering shares to the public

1.1.2 Unit of ownership in a company

1.1.3 Reflects written information on the operations of the business

1.1.4 Reflects a fair view of the operating results of the Financial Statements of a company (4 x 1) (4)

1.2 LIYABONA LTD

The information relates to the financial year ended on 29 February 2024. The business sells generators.

REQUIRED:

1.2.1 Refer to Information B (i):

Calculate the value of closing stock of AI generators using the Specific Identification-method. (3)

1.2.2 Refer to Information A and B:

Use the table provided to calculate the correct net profit after tax for the year ended 29 February 2024.

Indicate ‘+’ for increase and ‘–’ for decrease at each adjusted amount. (14)

1.2.3 Complete the Statement of Financial Position on 29 February 2024.

NOTE:

- Some amounts have been entered in the ANSWER BOOK.

- Figures are NOT required in the shaded areas.

- Show workings. (29)

INFORMATION:

A. Extract: Balances and totals from the records on 29 February 2024:

R | |

Loan: Naties Bank | 859 100 |

Fixed deposit | 225 000 |

Trading stock | 1 350 000 |

Debtors’ control | 889 500 |

SARS: Income Tax (provisional tax payments) | 990 000 |

Bank (favourable) | 704 249 |

Creditors’ Control | 843 750 |

Shareholders for dividends | 145 000 |

Provision for bad debts (1 March 2023) | 51 180 |

Pension fund | ? |

Sales | 12 128 250 |

Consumable stores | 50 850 |

Insurance | 73 125 |

Bad debts | 49 890 |

Rent income | 213 300 |

Directors’ fees | 1 237 500 |

Ordinary share dividends | 356 250 |

B. The net profit before tax, R3 609 320, was calculated before taking the following into account:

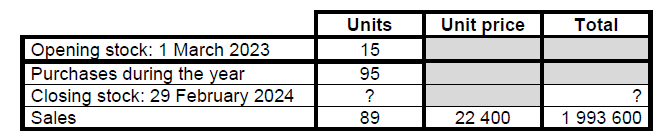

(i) The following stock-sheet relates to AI generators. It was recorded twice when the final stock figures were calculated.

- Liyabona Ltd sells AI generators at a standard rate of R22 400 per unit.

- A mark-up of 40% on cost is applied.

NOTE: The SPECIFIC IDENTIFICATION valuation method is used.

(ii) Debtors with credit balances of R12 350 on 29 February 2024 must be transferred to the Creditors Ledger. Provision for bad debts should be adjusted to 4% of debtors.

(iii) A vehicle bought on 2 January 2019, cost R 450 000, was sold for cash for R65 000 on 1 February 2024. No entries were made for the sale of the vehicle. Vehicles are depreciated at 20% p.a. on cost.

(iv) Insurance includes an annual premium of R21 540 paid on 1 December 2023.

(v) Rent is calculated on a fixed amount per m2 per month. The business rented out 150 m2for the financial year ended 28 February 2023. An additional 30 m2 was rented out from 1 August 2023. Rent was received up to 30 April 2024.

(vi) Unused consumable stores amounted to R5 320.

(vii) The company has four directors. They all receive the same fee. Two directors took an overseas trip and requested that their fees for January and February 2024 be paid in March. The committee agreed.

C. Income tax for the year is calculated at 30% of the net profit before tax. D. The fixed deposit will mature on 31 August 2024.

E. The following financial indicators were calculated on 29 February 2024:

- Current ratio: 2 : 1

- Net Asset Value per share: 425 cents

F. Share Capital:

- The company is registered with an authorised share capital of 1 500 000 ordinary shares.

- 75% of the authorised shares were in issue on 1 March 2023. The average price per share at the time was R3,20.

- The directors issued all unissued shares on 30 April 2023. EFT payments totalling R900 000 were received.

- The company repurchased 250 000 shares at R3,75 per share on 29 February 2024.

G. Loan: Naties Bank

The loan statement showed a closing balance of R928 700. The company plans to increase their loan repayments in order to settle 15% of the capital portion of the loan balance in the next financial year. A fixed interest of R5 800 per month is paid.

QUESTION 2: CASH FLOW STATEMENT AND FINANCIAL INDICATORS (45 marks; 35 minutes)

2.1 Give ONE accounting word/term for each of the following statements:

2.1.1 Shareholders’ Equity plus non-current liabilities equals …

2.1.2 A repayment of loan is shown as an … of cash in the Cash Flow Statement.

2.1.3 The difference between current assets and current liabilities is referred to as … (3 x 1) (3)

2.2 You are provided with information relating to Mimosoa Limited. The financial year-end is 30 September 2023. Information relates to the financial year ended 30 September 2023.

REQUIRED:

2.2.1 Complete the Cash Flow Statement for the year ended 30 September 2023. Show all workings in brackets. (25)

2.2.2 Complete the Retained Income note. (8)

2.2.3 The directors issued more shares to improve the cash flow. Thandi Manning, a shareholder, was against the decision and has raised her concerns at the annual general meeting (AGM).

- Provide a reason for Thandi’s opinion. (2)

2.2.4 Calculate the following financial indicators on 30 September 2023: NOTE: Round off to ONE decimal point.

- Debt-equity ratio (3)

- Acid-test ratio (4)

INFORMATION:

A. The following information was extracted from the Statement of Comprehensive Income for the year ended 30 September 2023:

| Interest expense | 195 750 |

| Income tax | 497 400 |

NOTE: The income tax rate is 30%.

B. Extract from the Statement of Financial Position on 30 September:

| 2023 | 2022 | |

| Current assets | 4 180 200 | 2 892 800 |

| Inventories | 1 228 600 | 1 437 700 |

| Trade and other receivables (see D) | 1 104 300 | 945 600 |

| Cash and cash equivalents | 1 847 300 | 509 500 |

| Ordinary shareholder’s equity | ? | 4 964 020 |

| Ordinary share capital (see F) | 4 240 000 | 4 250 000 |

| Retained Income | ? | 914 020 |

| Loan: Munchie Bank (12% p.a.) | 2 400 000 | 1 850 000 |

| Current liabilities | 1 678 900 | 1 544 700 |

| Trade and other Payables (see E) | 1 678 000 | 1 399 000 |

| Bank overdraft | 0 | 145 700 |

C. Fixed assets on 30 September:

| 2023 | 2022 | |

| Land and Buildings: | ||

| Cost | 2 750 000 | 3 000 000 |

| Accumulated depreciation | 0 | 0 |

| Vehicles: | ||

| Cost | 725 000 | 950 000 |

| Accumulated depreciation | 498 800 | 386 000 |

| Equipment: | ||

| Cost | 310 000 | 268 000 |

| Accumulated depreciation | 158 900 | 112 400 |

- Land and buildings were sold at cost during the year and a vehicle was sold at carrying value at the end of the year. Accumulated depreciation on the vehicle sold was R125 000 at the beginning of the year. Vehicles are depreciated at 20% p.a. on diminishing-balance method. No additions were made during the year to both.

- Equipment was bought at the beginning of the year. No equipment was sold during the year. Equipment is depreciated at 15% p.a. on cost.

D. Trade and other receivables include:

| 2023 | 2022 | |

| SARS: Income Tax | 48 090 | 0 |

E. Trade and other payables include:

| 2023 | 2022 | |

| SARS: Income tax | 0 | 53 200 |

| Shareholders for dividends | 530 000 | 390 000 |

F. Ordinary Share capital and dividends:

- 850 000 shares were in issue on 1 October 2022.

- On 1 December 2022, 150 000 additional shares were issued at R7,00 each.

- 200 000 shares were repurchased on 31 March 2023 at R1,70 above average price. These shares qualify for interim dividends.

- Interim dividends of 25c per share were paid on 30 April 2023.

QUESTION 3: INTERPRETATION OF FINANCIAL STATEMENTS (40 marks; 30 minutes)

MABHABS LTD and LANDA LTD

The information relates to TWO companies. Tiger Simelane owns shares and is a director in both these companies. He recently invested another R375 000 in each company by buying shares on the JSE at market value.

REQUIRED:

NOTE: Where comments or explanations are required, you should:

- Quote financial indicators and trends with figures

- Give a reason or explanation for the financial indicators quoted

Refer to information A to C.

3.1 Purchase of shares:

- Explain why directors should be interested in the price of their companies’ shares on the JSE. (2)

- Calculate the number of additional shares in Mabhabs Ltd that Tiger was able to buy on the JSE in 2023. (3)

- Comment on the price that Tiger paid for the shares in each company, and give TWO reasons why he might have been satisfied to pay the price. (6)

3.2 Dividends, earnings and returns:

- Explain your opinion on which company has the better dividend pay-out policy. Give comparative figures. (6)

- Compare and comment on the % return on equity earned by each company. (4)

- Tiger feels that the earnings per share (EPS) of Landa Ltd is much better than that of Mabhabs Ltd. Explain why he feels this way. (5)

3.3 Refer to Information B and C:

Mabhabs Ltd was negatively affected more than Landa Ltd by the poor economy.

(a) Explain TWO decisions taken by the directors of Mabhabs Ltd in response to the state of the economy, and how these decisions will affect the company in future. (6)

(b) Explain TWO decisions taken by the directors of Landa Ltd that affect risk and gearing. Quote and comment on TWO financial indicators. (8)

INFORMATION:

A. Shareholding of Tiger Simelane in two companies:

| MABHABS | LANDA | |

| Number of shares bought in 2021 | 450 000 | 1 300 000 |

| Total shares issued by each company on 28 February 2021 | 950 000 | 2 500 000 |

| Additional shares bought by Tiger | ? | 100 000 |

| Tiger’s % shareholding before buying additional shares | 47,4% | 52% |

B. Financial indicators, market prices and interest rates on 28 February 2023:

| MABHABS | LANDA | |

| Earnings per share | 92 cents | 78 cents |

| Dividends per share | 60 cents | 75 cents |

| Debt-equity ratio | 0,2 : 1 | 0,8 : 1 |

| % return on average shareholders’ equity | 6,1% | 17,9% |

| % return on average capital employed | 10,3% | 16% |

| Net asset value per share | 660 cents | 425 cents |

| Interest rate on loan | 13,0% | 13,0% |

| Interest on investment | 7% | 7% |

| Market price per share | 750c | 375c |

C. Extracts from the Cash Flow Statement for the year ended 28 February 2023:

NOTE: Inflow and outflow of cash are NOT indicated on amounts below:

| MABHABS | LANDA | |

| Tangible assets purchased | 0 | 1 500 000 |

| Tangible assets sold | 2 000 000 | 0 |

| New shares issued | 450 000 | 400 000 |

| Shares repurchased | 940 000 | 0 |

| Loan obtained | 0 | 3 200 000 |

| Loan repaid | 1 700 000 | 0 |

| Investment made | 0 | 850 000 |

| Investment matured | 750 000 | 0 |

QUESTION 4: CORPORATE GOVERNANCE (15 marks; 15 minutes)

4.1 Company directors are expected to identify and take account of legitimate expectations of stakeholders.

- Provide TWO consequences of neglecting the expectations of the stakeholders by the company. (4)

4.2 AUDIT REPORTS

Choose the audit opinion from COLUMN B that describes the audit report in COLUMN A. Write only the letter (A–C) next to the question numbers

(4.2.1–4.2.3) in the ANSWER BOOK.

| COLUMN A | COLUMN B |

| 4.2.1 Qualified audit report 4.2.2 Unqualified audit report 4.2.3 Disclaimer of opinion | A We were not able to obtain sufficient evidence to provide for an audit opinion. Accordingly, we do not express an opinion on the financial statements Stwee Ltd for the year then ended. B Except for the effect of the unauthorised bonus to the CEO, the annual financial statements present fairly, in all material respects, the financial position of Twibby Ltd. C The annual financial statements fairly present, in all material respects, the financial position of Natura Ltd. |

(3 x 1) (3)

4.3 (a) Which type of audit report will encourage shareholders to buy shares in a company? (1)

(b) Explain why it is important for an independent auditor to be a member of a professional body. (1)

4.4 Extract from an article in the Saturday News:

| The employees of Riavaia Ltd received a 10% increase in their salaries for the year 2022 while the CEO received an increase of 45%. The employees were not happy about the salary increase difference, and complained about it. Riavaia Ltd defended the decision pointing out that it was approved by the remunerations committee after careful considerations were made. |

Explain the role of the remunerations committee. Give THREE points. (6)

TOTAL: 150

GRADE 12 ACCOUNTING FINANCIAL INDICATOR FORMULA SHEET | |

Gross Profit x 100 | Gross profit x 100 |

Net profit before tax x 100 | Net profit after tax x 100 |

Operating expenses x 100 | Operating profit x 100 |

Total assets : Total liabilities | Current assets : Current liabilities |

(Current assets – Inventories) : Current liabilities | Non-current liabilities : Shareholders' equity |

(Trade and other receivables + Cash and cash equivalents) : Current liabilities | |

Average trading stock x 36 | Cost of sales . |

Average debtors x 365 | Average creditors x 365 |

Net income after tax x 100 Average shareholders’ equity 1 | Net income after tax x 100 (*See note below) |

Net income before tax + Interest on loans x 100 | |

Shareholders’ equity x 100 | Dividends for the year x 100 |

Interim dividends x 100 | Final dividends x 100 |

Dividends per share x 100 | Dividends for the year x 100 |

Total fixed costs . | |

NOTE: * In this case, if there is a change in the number of issued shares during a financial year, the weighted average number of shares is used in practice. | |

MARKING GUIDELINE

MARKS: 150

MARKING PRINCIPLES:

- Unless otherwise stated in the marking guideline, penalties for foreign items are applied only if the candidate is not losing marks elsewhere in the question for that item (no penalty for misplaced item). No double penalty applied.

- Penalties for placement or poor presentation (e.g., details) are applied only if the candidate is earning marks on the figures for that item.

- Unless otherwise stated, give full marks for correct answer. If the answer is incorrect, mark workings.

- If a pre-adjustment figure is shown as a final figure, allocate the part-mark as a working mark for that figure (not the method mark for the answer). NOTE: If figures are stipulated in marking guideline components of workings, these do not carry the method mark for final answer as well.

- Unless otherwise indicated, the positive or negative effect of any figure must be considered to award the mark. If no + or – sign or bracket is provided, assume that the figure is positive.

- Where indicated, part-marks may be awarded to differentiate between differing qualities of answers from candidates.

- If candidates provide more than the required number of responses, inspect all responses to give benefit to the candidate. Penalties may be applied for foreign entries if candidates earn full marks on a question (max. -2 per Q)

- Where penalties are applied, the marks for that section of the question cannot be a final negative.

- Where method marks are awarded for operation, marker must inspect the reasonableness of the answer.

- Operation means ‘check operation’. ‘One part correct’ means operation and one part correct. NOTE: Check operation must be +, -, x, ÷, as per candidate’s calculation (if valid) or per marking guideline.

- In calculations, do not award marks for workings if numerator and denominator are swapped – this also applies to ratios.

- In awarding method marks, ensure that candidates do not get full marks for any item that is incorrect at least in part. Indicate with a ⌧.

- Be aware of candidates who provide valid alternatives beyond the marking guideline. Note that one comment could contain different aspects.

- Codes: f = foreign item; p = placement/presentation.

QUESTION 1

1.1

1.1.1 Prospectus ✓

1.1.2 Shares ✓

1.1.3 Directors’ Report ✓

1.1.4 Independent Auditors’ Report ✓

1.2.1 Calculate: The value of closing stock of AI generators using the Specific Identification-method.

22 400 x 100/140 = 16 000 ? one part correct (either 22 400 or 100/140)

15 + 95 – 89 = 21 ✓ x 16 000 336 000 ?

One part correct 3

1.2.2 Calculate the correct net profit after tax for the year ended 29 February 2024. Indicate ‘+’ for increase and ‘–’ for decrease at each adjusted amount. -‘

(i) No WORKINGS ANSWER Incorrect net profit before tax 3 609 320

(ii) Provision for bad debts adjustment (51 180 – 36 074) = + 15 106 ✓?*

(iii) Profit on sale of asset (65 000 – 1) = + 64 999 ✓

(iv) Insurance (21 540 x 9/12) = + 16 155 ✓?*

(v) Rent Income (213 300/2 370 = 90) 90 ✓ x 180 ✓ x 2 ✓ = - 32 400 ?*

(vi) Consumable stores = + 5 320 ✓

(vii) Directors’ fees (1 237 500 x 4/44) = - 112 500 ✓?*

Net profit before tax 3 566 000

Income tax (3 566 000 x 30%) = - 1 069 800 ?*

Correct net profit after tax operation 2 496 200 ? *One part correct

1.2.3 LIYABONA LTD

STATEMENT OF FINANCIAL POSITION ON 29 FEBRUARY 2024

| ASSETS | |

| NON-CURRENT ASSETS | |

| Fixed assets | |

| Financial assets | |

| CURRENT ASSETS | 2 895 500 ?* |

| Inventories (1 350 000 - 336 000 ? + 5 320 ✓) | 1 019 320 ?* |

Trade and other receivables (889 500 + 12 350 ✓ – 36 074 ? + 16 155 ?) | 881 931 ?* |

Cash and cash equivalents (704 249 + 225 000 ✓ + 65 000 ✓) | 994 249 ?* |

| TOTAL ASSETS | |

| EQUITY AND LIABILITIES | |

SHAREHOLDERS' EQUITY (425c x 1 200 000) | 5 100 000 ✓?* |

Ordinary share capital (3 600 000 ✓ + 900 000 ✓ – 750 000 ✓) | 3 750 000 ?* |

| Retained income | |

| NON-CURRENT LIABILITIES | 789 395 |

| Loan: Naties Bank (928 700 – 139 305 ✓) | 789 395 ?* |

| CURRENT LIABILITIES (2 895 500 ÷ 2) | 1 447 750 ?* |

| Trade and other payables (843 750 + 12 350 ✓ + 32 400 ✓ + 112 500 ✓ + 82 645 ✓?) | 1 083 645 ?* |

| #SARS (income tax) (1 069 800 – 990 000) | 79 800 ?* |

| #Shareholders for dividends | 145 000 ✓ |

| Short term portion of loan | 139 305 ?* |

| TOTAL EQUITY AND LIABILITIES |

QUESTION 2

2.1

2.1.1 Capital employed ✓

2.1.2 Outflow ✓

2.1.3 Net current assets / net working capital ✓

2.2 MIMOSOA LTD

2.2.1 Cash Flow Statement for the year ended 30 September 2023

| CASH EFFECTS OF OPERATING ACTIVITIES | 795 500 ? |

| Cash generated from operations | 2 229 940 |

| Interest paid | (195 750) |

| Taxation paid (53 200 ✓ + 497 400 ✓ + 48 090 ✓) | (598 690) ? |

| Dividends paid (390 000 ✓ + 250 000 ✓) or (390 000 + 780 000 – 530 000) | (640 000) ? |

| CASH EFFECTS OF INVESTING ACTIVITIES | |

| Fixed assets purchased (310 000 – 268 000) | (42 000) ✓? |

Proceeds from sale of fixed assets (250 000 ✓ + 80 000 ✓) | 330 000 ? |

| CASH FLOWS OF FINANCING ACTIVITIES | 200 000 ? |

| Proceeds from sale of shares (150 000 x 7) | 1 050 000 ✓? |

| Repurchase of shares (200 000 ✓ x 7 ✓) | (1 400 000) ? |

| Change in loan (2 400 000 – 1 850 000) | 550 000 ✓? |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | 1 483 500 ? |

| Cash (balance at the beginning of the year) (509 500 – 145 700) | 363 800 ✓? |

| Cash (balance at the end of the year) | 1 847 300 ? |

NOTE: Allocate method mark for both ‘one part correct’ and ‘correct sign’.

2.2.2 RETANED INCOME NOTE

| Balance on 1 October 2022 | 914 020 |

| Net profit after tax (497 400 x 70/30) | 1 160 600 ✓?* |

| Repurchase of shares (200 000 x R1,70) | (340 000) ✓?* |

| Ordinary share dividends | (780 000) |

| - Paid (25/100 x 1 000 000) | 250 000 ✓?* |

| - Recommended | 530 000 ✓ |

| Balance on 30 September 2023 | 954 620 ?* |

2.2.3

| The directors issued more shares to improve the cash flow. Thandi Manning, a shareholder, was against the decision and has raised her concerns at the AGM. Provide a reason for Thandi’s opinion. |

| ONE valid answer ✓✓ Issuing more shares dilutes the returns to existing shareholders. |

2.2.4

| Calculate: Debt-equity ratio | |

| WORKINGS | ANSWER |

| 5 194 620 TWO marks 2 400 000 : (4 240 000 ✓ + 954 620 ✓) | 0,5 : 1 ? ONE part correct |

| Calculate: Acid test ratio | |

| WORKINGS | ANSWER |

| 2 951 600 TWO marks (1 104 300 ✓ + 1 847 300 ✓) : 1 678 900 ✓ OR 2 951 600 two marks (4 180 200 – 1 228 600) : 1 678 900 | 1,8 : 1 ONE part correct ? |

QUESTION 3

3.1 Purchase of shares:

Explain why directors should be interested in the price of their companies’ shares on the JSE.

Any ONE valid answer ✓✓

- To compare with other companies.

- Shareholders will want to have capital growth on their investment.

- Directors will be judged on the performance of the shares as this reflects the performance of the company.

- It shows public confidence in the company. 2 Calculate the number of additional shares in Mabhabs Ltd that Tiger was able to buy on the JSE in 2023.

CALCULATION | Answer |

375 000 ✓ / 7,50 ✓ | 50 000 shares ? |

Comment on the price that Tiger paid for these shares and give TWO reasons why he might have been satisfied to pay the price.

FOR EACH COMPANY: - Comment with figures ✓ ✓ Reason ✓

MABHABS

JSE price exceeds NAV by 90 cents (R7,50 – R6,60)

Reason:

- He wants to be a majority shareholder.

- JSE price reflects public demand for the shares.

- He feels that there is potential for high returns.

- He can have more influence over decisions by the board of directors.

LANDA

JSE price is lower than NAV by 50 cents (R4,25 – R3,75)

Reason:

- Landa is earning high returns for him. (ROSHE 17,9%)

- The JSE price is a good deal compared to NAV.

- Optimistic about the future. 6

3.2 Dividends, earnings and returns:

Explain your opinion on which company has the better dividend pay-out policy. Give comparative figures.

- Mabhabs Ltd ✓

- Retaining funds for future expansion ✓

OR

- Landa Ltd ONE mark

- Rewarding shareholders to keep them happy. ONE mark

FIGURES:

- Mabhabs Ltd pays out 65% of their earnings (60c of 92c) ✓✓

- Landa Ltd pays out 96% of their earnings (75c of 78c) ✓✓

Compare and comment on the % return on equity earned by each company.

- Mabhabs Ltd is not performing well ✓

- ROSHE is 6,1% which is below the interest on investment of 7%. ✓

- Landa Ltd is performing well ✓

- ROSHE is 17,9% which is above the interest on investment of 7%. ✓4

Tiger feels that the earnings per share (EPS) of Landa Ltd is much better than that of Mabhabs Ltd. Explain why he feels this way.

- Comparison of EPS for both companies ✓ ✓

- EPS of Mabhabs Ltd is 92 cents

- EPS of Landa Ltd is 78 cents

- Any ONE comparative comment – Financial indicator ✓ figure/s ✓✓

MABHABS | LANDA |

EPS is earned on 450 000 shares – R414 000 | EPS is earned on 1 300 000 shares – R1 014 000 |

ROSHE is 6,1% | ROSHE is 17,9% |

Cost of shares is high – 750c or 660c | Cost of shares is low – 375c or 425c |

Net profit after tax is R874 000 (92c x 950 000) | Net profit after tax is R1 950 000 (78c x 2 500 000) |

*Accept if a learner calculated EPS yield.5

3.3 Mabhabs Ltd was negatively affected more that Landa Ltd by the poor economy.

(a) Explain TWO decisions taken by the directors of Mabhabs Ltd in response to the state of the economy, and how these decisions will affect the company in future.

TWO valid decisions ✓ ✓ Figures ✓ ✓ Effect of decision on company ✓ ✓

DECISION | EFFECT ON COMPANY |

Sold tangible assets, R2 000 000 / No new assets purchased, R0 | Decrease in the infrastructure resulting in decrease in profits. Reduced infrastructure / no asset purchased could lead to cost saving. |

Reduced investment, R750 000 | Use of own funds invested to stabilise business. |

Loan repaid, R1 700 000 | Saving on interest / less risk. |

Issued shares, R450 000 | Use of more own capital to reduce risk. |

Shares repurchased, R940 000 | Downsizing to focus business activities on those that are more profitable. |

(b) Explain TWO decisions taken by the directors of Landa Ltd that affect risk and gearing. Quote and comment on TWO financial indicators.

TWO valid decisions ✓ ✓ Figures ✓ ✓

- Increased loan, R3 200 000

- Sold shares, R400 000

- Repurchased shares, R0

TWO financial indicators with figures ✓ ✓ Comment on risk ✓ Comment on gearing ✓

FINANCIAL INDICATOR | COMMENT |

ROTCE of 16% is higher than interest rate of 13%. | There is positive gearing. |

Debt-equity ratio is 0,8 : 1 | The degree of risk is high even though gearing is positive. |

QUESTION 4

4.1 Provide TWO consequences of neglecting the expectations of the stakeholders by the company.

TWO valid points ✓✓ ✓✓

- Stakeholders will lose trust and confidence in the company

- Promote calls for boycotts, resignations or lawsuits. 4

4.2 Choose the audit opinion from COLUMN B that describes the audit report in COLUMN A. Write only the letter (A–C) next to the question numbers (4.2.1–4.2.3) in the ANSWER BOOK.

4.2.1 | B ✓ |

4.2.2 | C ✓ |

4.2.3 | A ✓ |

4.3 (a) Which type of audit report will encourage shareholders to buy shares in a company?

Unqualified audit report ✓ 1

(b) Explain why it is important for an independent auditor to be a member of a professional body.

ONE valid point ✓

- So that readers of financial statements can have confidence in his opinion.

- Assurance to the public that he/she is well trained on an on-going basis.

- Disciplinary action if negligent in performing duties.

- Aware of latest legislation, e.g., IFRS, Companies Act, King Code, etc.

- Act in ethical manner.

- To benchmark quality of work. 1

4.4 Explain the role of the remunerations committee.

Give THREE points. Any THREE valid points ✓✓ ✓✓ ✓✓

- Review salaries, bonuses, and other earnings.

- Prevent directors from paying themselves too much.

- They must approve and give advice on proposals with regards to fees, bonuses, etc.

- Ensure fairness / transparency in the payment of fees / salaries.

- Detect and prevent fraud / corruption / wastage. 6

TOTAL MARKS 15

TOTAL: 150