ECONOMICS P1 with Memorandum - 2024 Grade 12 June Common Exams

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupMARKS: 150

TIME: 2 hours

INSTRUCTIONS AND INFORMATION

- Answer FOUR questions as follows in the ANSWER BOOK:

- SECTION A: COMPULSORY

- SECTION B: Answer any TWO of the three questions.

- SECTION C: Answer ONE of the two questions.

- Answer only the required number of questions. Answers in excess of the required number will NOT be marked.

- Number the answers correctly according to the numbering system used in this question paper.

- Write the question number above each answer.

- Read the questions carefully.

- Start EACH question on a NEW page.

- Leave 2–3 lines between subsections of questions.

- Answer the questions in full sentences and ensure that the format, content and context of your responses comply with the cognitive requirements of the questions.

- Use only black or blue ink.

- You may use a non-programmable pocket calculator.

- Write neatly and legibly.

SECTION A (COMPULSORY) 30 MARKS – 20 MINUTES

QUESTION 1

1.1 Various options are provided as possible answers to the following questions. Choose the answer and write only the letter (A–D) next to the question numbers (1.1.1 to 1.1.8) in the ANSWER BOOK, for example 1.1.9 D.

1.1.1 The method of calculating GDP whereby compensation of employees is taken into consideration is called the … -method.

A income

B production

C value-added

D expenditure

1.1.2 A business cycle that is caused by changes in the building and construction industry is called the ... cycle.

A Juggler

B Kondratieff

C Kitchin

D Kuznets

1.1.3 The government level that consists of metropoles, districts and municipalities is called a … government.

A provincial

B foreign

C local

D central

1.1.4 The difference between visible exports and visible imports is known as …

A terms of trade.

B trade balance.

C trade liberalisation.

D trade protocol.

1.1.5 Spending that takes place irrespective of the level of income is called …

A induced consumption.

B autonomous consumption.

C government expenditure.

D private expenditure.

1.1.6 An economic indicator showing the general direction in which the economy is moving is referred to as the …

A length.

B amplitude.

C trend line.

D extrapolation.

1.1.7 A duty of an individual or organisation to explain their decisions and actions and accept responsibility for their behaviour is known as ...

A effectiveness.

B self-interest.

C inefficiency.

D accountability.

1.1.8 A decrease in the value of the currency due to market forces is known as …

A depreciation.

B appreciation.

C revaluation.

D evaluation. (8 x 2) (16)

1.2 Choose a description from COLUMN B that matches the item in COLUMN A. Write only the letter (A–I) next to the question numbers (1.2.1 to 1.2.8) in the ANSWER BOOK, for example 1.2.9 J.

| COLUMN A | COLUMN B |

1.2.1 Leakages 1.2.2 New economic paradigm 1.2.3 Merit goods 1.2.4 Special Drawings Rights 1.2.5 Marginal propensity to consume 1.2.6 Cash reserve requirements 1.2.7 Parastatals 1.2.8 Portfolio investment | A special form of credit that the IMF can use when a country experiences balance of payment difficulties B goods that have benefits for their users and the economy C the proportion of additional income that households choose to spend on goods and services D a sum of taxes, imports and savings in a circular flow E the government policy that is aiming at creating economic growth, without causing inflation F buying of financial assets such as shares in companies on the stock exchange of another country G goods that are potentially harmful to the society H businesses owned wholly or partly by the state and run by a public authority I used to control the money supply through the buying and selling of government securities |

(8 x 1) (8)

1.3 Give ONE term for each of the following descriptions. Write only the term next to the question numbers (1.3.1 to 1.3.6) in the ANSWER BOOK. Abbreviations, acronyms and examples will NOT be accepted.

1.3.1 An economy that includes the foreign sector

1.3.2 The point where economic contraction is at its lowest

1.3.3 The use of taxation and government expenditure to achieve macroeconomic objectives

1.3.4 The worldwide integration of economies with trade as an important element

1.3.5 An estimate of income and expenditure for a three-year period during the budgeting process

1.3.6 An increase in the production of goods and services of a country over a period, usually a year (6 x 1) (6)

TOTAL SECTION A: 30

SECTION B

QUESTION 2: MACROECONOMICS 40 MARKS – 30 MINUTES

2.1 Answer the following questions.

2.1.1 Name any TWO characteristics of public goods. (2)

2.1.2 How can competition stimulate aggregate supply? (2)

2.2 Study the information below and answer the questions that follow.

MULTIPLIER IN A TWO SECTOR ECONOMY Country Y has only two participants and has a marginal propensity to consume of 0,6. The country’s autonomous consumption is 30. The equilibrium national income is 75. [Adapted from Clever Economics, p163] |

2.2.1 Identify a term that refers to spending, which does not depend on income. (1)

2.2.2 Name ONE participant in a closed economy. (1) 2.2.3 Briefly describe the concept multiplier. (2)

2.2.4 Explain the impact of an increase in savings on the value of the multiplier. (2)

2.2.5 Draw a well-labelled graph of a multiplier using the information from the extract. (4)

2.3 Study the information below and answer the questions that follow.

2.3.1 Identify a reason for public sector failure from the information above. (1)

2.3.2 Name ONE feature of fiscal policy. (1) 2.3.3 Briefly describe the term public sector failure. (2)

2.3.4 Explain the impact of high state debt on the provisioning of public goods and services. (2)

2.3.5 How can public sector failure affect the economy? (4)

2.4 Briefly discuss the real (actual) business cycle without the graph. (8)

2.5 How can the South African government improve the quality of public sector provisioning? (8) [40]

QUESTION 3: MACROECONOMICS 40 MARKS – 30 MINUTES

3.1 Answer the following questions.

3.1.1 Name any TWO indicators underpinning forecasting in business cycles. (2)

3.1.2 How can income tax brackets influence taxpayers? (2)

3.2 Study the information below and answer the questions that follow.

Forecasting is a technique that uses historical data as inputs to make informed estimates, that are predictive in determining the direction of future trends. Following the global financial crisis (GFC) of 2008–09, the South African economy experienced an unusual business cycle for more than a decade. The post-GFC global economic recovery was relatively uneven, with weak economic growth and low interest rates. [Adapted from Investopedia.com.] |

3.2.1 Identify a business cycle phase from the extract above. (1)

3.2.2 Name ONE type of business cycle. (1) 3.2.3 Briefly explain the term business cycles. (2)

3.2.4 Explain the importance of moving averages as a feature underpinning forecasting. (2)

3.2.5 Why is it important for economists to make forecasts? (4)

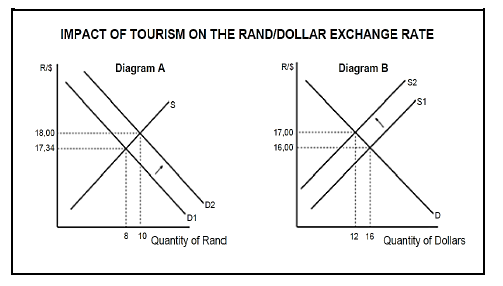

3.3 Study the graph below and answer the questions that follow.

3.3.1 Identify a diagram from above that represents an increase in the number of tourists from the USA to South Africa. (1)

3.3.2 Name the exchange rate system used in South Africa. (1) 3.3.3 Briefly describe the term exchange rate. (2)

3.3.4 Explain the impact on the rand if the number of tourists from South Africa to the USA decreases. (2)

3.3.5 What benefits can countries of the world obtain from international trade? (4)

3.4 Discuss the endogenous (Keynesian) explanation of business cycles. (8)

3.5 How can the national budget promote socio-economic rights? (8) [40]

QUESTION 4: MACROECONOMICS AND ECONOMIC PURSUITS 40 MARKS – 30 MINUTES

4.1 Answer the following questions.

4.1.1 Name any TWO features of public sector failure. (2)

4.1.2 How can the government use taxation to stimulate economic recovery? (2)

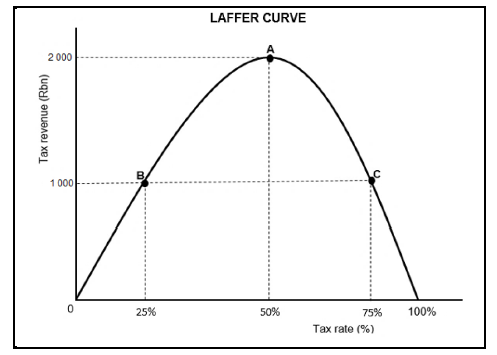

4.2 Study the graph below and answer the questions that follow.

4.2.1 Identify the tax rate at which the government maximises tax revenue. (1)

4.2.2 Name any form of indirect tax paid by households to the government. (1)

4.2.3 Briefly describe the term progressive tax. (2)

4.2.4 Explain the effect of a regressive tax system on income distribution. (2)

4.2.5 Why will tax revenue decrease if the government imposes very high tax rates? (4)

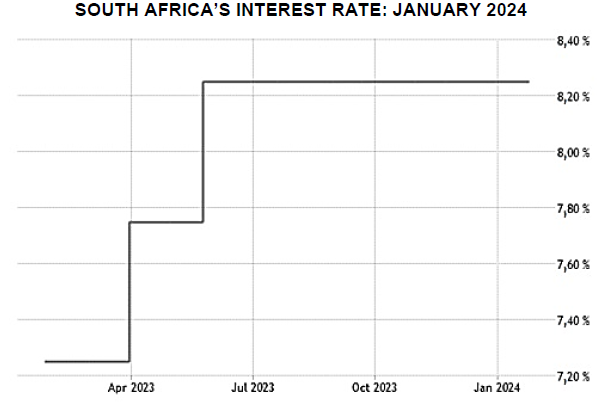

4.3 Study the information below and answer the questions that follow.

The Reserve Bank unanimously decided to keep its key repo rate at 8,25% on January, 2024. It noted that the return of inflation to the target has been slow. Headline inflation fell for a second month to 5,1% in December. [Adapted from tradingeconomics.com] |

4.3.1 Identify the period with the lowest repo rate in the information above. (1)

4.3.2 Name the committee responsible for taking interest rate decisions in South Africa. (1)

4.3.3 Briefly describe the term repo rate. (2)

4.3.4 Explain the relationship between inflation and unemployment in the Phillips Curve. (2)

4.3.5 How can moral suasion be used as a tool to dampen the overheated economy? (4)

4.4 Briefly discuss price stability and economic equity as macroeconomic objectives. (8)

4.5 How will producers respond to the different phases of the business cycle? (8) [40]

TOTAL SECTION B: 80

SECTION C

Answer any ONE question of the TWO questions in the ANSWER BOOK.

Your answer will be assessed as follows:

STRUCTURE OF ESSAY | MARK ALLOCATION |

Introduction The introduction is a lower-order response. • A good starting point would be to define the main concept related to the question topic. • Do NOT include any part of the question in your introduction. • Do NOT repeat any part of the introduction in the body. • Avoid mentioning in the introduction what you are going to discuss in the body. | Max. 2 |

Body Main part: Discuss in detail/In-depth discussion/Examine/Critically discuss/Analyse/Compare/Evaluate/Distinguish/Differentiate/ Explain/Draw a graph and explain/Use the graph given and explain/Complete the given graph/Assess/Debate A maximum of 8 marks may be allocated for headings/ examples. Additional part: Critically discuss/Evaluate/Critically evaluate/ Debate/ Deduce/Compare/Distinguish/Interpret/How?/Suggest A maximum of 2 marks may be allocated for mere listing of facts. | Max. 26 Max. 10 |

Conclusion Any higher-order conclusion should include: • A brief summary of what has been discussed without repeating facts already mentioned • Any opinion or value judgment on the facts discussed • Additional support information to strengthen the discussion/analysis • A contradictory viewpoint with motivation, if required • Recommendations | Max. 2 |

TOTAL | 40 |

QUESTION 5: MACROECONOMICS 40 MARKS – 40 MINUTES

- Discuss in detail the markets within the four-sector circular flow model. (26 marks)

- How can the increase in injections impact on the South African economy? (10 marks) [40]

QUESTION 6: ECONOMIC PURSUITS 40 MARKS – 40 MINUTES

- Discuss in detail the reasons for international trade. (26 marks)

- How can a currency (rand) depreciation affect the economy? (10 marks) [40]

TOTAL SECTION C: 40

GRAND TOTAL: 150

MARKING GUIDELINE

SECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 A – income method ✓✓

1.1.2 D – Kuznets cycle ✓✓

1.1.3 C – local ✓✓

1.1.4 B – trade balance ✓✓

1.1.5 B – autonomous consumption ✓✓

1.1.6 C – trend line ✓✓

1.1.7 D – accountability ✓✓

1.1.8 A – depreciation ✓✓ (8 x 2) (16)

1.2 MATCHING ITEMS

1.2.1 D – A sum of taxes, imports and savings in a circular flow ✓

1.2.2 E – The government policy that is aiming at creating economic growth without causing inflation ✓

1.2.3 B – Goods that have benefits for their users and the economy ✓

1.2.4 A – Special form of credit that IMF can use when a country experiences balance of payment difficulties ✓

1.2.5 C – The proportion of additional income that households choose to spend on goods and services ✓

1.2.6 I – Used to control money supply through buying and selling of government securities ✓

1.2.7 H – businesses owned wholly or partly by the state and run by a public authority ✓

1.2.8 F – Buying of financial assets such as shares in companies on the stock exchange of another country ✓ (8 x 1) (8)

1.3 GIVE ONE TERM

1.3.1 Open economy ✓

1.3.2 Trough ✓

1.3.3 Fiscal policy ✓

1.3.4 Globalisation ✓

1.3.5 Medium term expenditure framework ✓

1.3.6 Economic growth ✓ (6 x 1) (6)

SECTION B

Answer TWO of the three questions in this section in the ANSWER BOOK. QUESTION 2: MACROECONOMICS

2.1

2.1.1 Name any TWO characteristics of public goods.

- Non-excludable ✓

- Non-rivalry ✓

- Indivisible ✓

- Infinite/Endless consumption ✓

- Non-rejectable ✓

(Accept any other correct relevant response.) (Any 2 x 1) (2)

2.1.2 How can competition stimulate aggregate supply?

- Competition allows the establishment of new businesses in different industries which will increase the production of goods and services, stimulating aggregate supply. ✓✓

- Competition encourages existing businesses to use more efficient production methods which will increase productivity, stimulating aggregate supply. ✓✓

- (Accept any other correct relevant response.) (Any 1 x 2) (2)

2.2 DATA RESPONSE

2.2.1 Identify a term that refers to spending which does not depend on income.

Autonomous consumption ✓ (1 x 1) (1)

2.2.2 Name ONE participant in a closed economy

- Government/The State ✓

- Household/Consumers ✓

- Firms/Businesses/Producers ✓ (Any 1 x 1) (1)

2.2.3 Briefly describe the concept multiplier.

A small initial increase in spending produces a proportionately larger increase in aggregate national income. ✓✓ (Accept any other correct relevant response.) (2)

2.2.4 Explain the impact of an increase in savings on the value of the multiplier.

If savings increase, there will be less money available to spend on local goods and services and the value of the multiplier will be small. ✓✓ (Accept any other correct relevant response.) (2)

2.2.5 Draw a well-labelled graph of a multiplier using the information from the extract.

Marking grid

Correct drawing and labelling of axes = 1 mark

Correct drawing and indication of autonomous consumption = 1 mark

Correct indication of the consumption function = 1 mark

Correct indication of the equilibrium national income amount = 1 mark

Correct drawing and indication of the equilibrium line (E = Y) = 1 mark (Max. = 4) (4)

2.3 DATA RESPONSE

2.3.1 Identify a reason for public sector failure from the information above.

- Politicians ✓

- Bureaucracy ✓ (Any 1 x 1) (1)

2.3.2 Name ONE feature of fiscal policy.

- Goal-bound ✓

- Demand-biased ✓

- Cyclical ✓ (Any 1 x 1) (1)

2.3.3 Briefly describe the term public sector failure.

Public sector failure occurs when the public sector fails to optimally manage the economy and resources under its control. ✓✓ / When government intervention in the economy results in a more inefficient and ineffective allocation of resources. ✓✓ (Accept any other correct relevant responses.) (Any 1 x 2) (2)

2.3.4 Explain the impact of high state debt on the provisioning of public goods and services.

- A high state debt hinders the ability of a government to provide public goods but instead focus on repaying the debt. ✓✓

- With the existing debt, the government is unable to borrow from the same institution to provide social services. ✓✓ (Accept any other relevant and correct response.) (Any 1 x 2) (2)

2.3.5 How can public sector failure affect the economy?

- The country can experience macro-economic problems such as low economic growth and high unemployment ✓✓

- Social instability can happen as a result of government failure to provide services ✓✓

- Poor implementation of progressive taxation can result in growth in unequal income distribution ✓✓ (Accept any other correct relevant responses.) (Any 2 x 2) (4)

2.4 Briefly discuss the real (actual) business cycle without the graph.

- A real business cycle is obtained when the effects of irregular events, seasons and long-term trends are removed from time series data ✓✓ • Real business cycle fluctuations are the result of exogenous changes in the real economic environment ✓✓

- Exogenous factors, like technological advances, cause fluctuations in real output/supply ✓✓

- Such supply-side shocks in the production function cause fluctuations of output and employment ✓✓

- It causes the rise and decline of the economic activities taking place in an economy, that is, the expansion and recession of the economy ✓✓

- Random technological changes cause permanent effects on potential output. ✓✓ (Accept any other correct relevant response.) (Any 4 x 2) (8)

2.5 How can the South African government improve the quality of public sector provisioning?

The South African government can improve the quality of public sector provisioning by:

- awarding government contracts for service delivery to companies with a positive track record ✓✓

- allocating adequate resources to different departments to ensure service delivery without failure ✓✓

- eliminating unnecessary rules and procedures (bureaucracy) to ensure efficient service delivery ✓✓

- eliminating corruption among government officials by implementing whistle blowing channels such direct telephone lines to report corruption ✓✓

- employing government officials based on qualifications, skills and experience to ensure high competence level in the public sector ✓✓

- offering incentives such as performance bonuses to civil servants to motivate them to perform their tasks successfully ✓✓

- improving or upgrading the aging infrastructure to ensure reliable service delivery ✓✓

- avoiding nepotism, favouritism, bribery and cadre deployment in recruitment procedures in the public sector ✓✓

- privatising some government assets to improve efficiency in service delivery, ✓✓ e.g. if Eskom could be privatised electricity supply could improve ✓

- holding government officials accountable for their decisions and actions. ✓✓

- implementing strict measures to reduce the mismanagement of taxpayers’ money, ✓✓ e.g. Intensifying the implementation of the Public Financial Management Act (PFMA) ✓

- forming Private Public Partnerships to enable a faster, more efficient delivery of goods and services ✓✓

- encouraging a competitive work culture by hiring and retaining talented individuals through competitive compensation packages ✓✓

- developing a framework for the appointment and payment of members to the boards of state-owned companies ✓✓

- focusing on scarce resources for highest financial impact ✓✓

- setting clear costing and development mandates with financial implications clearly set out ✓✓

(Accept any other correct relevant response.) (Any 4 x 2)

(Allocate a maximum of 2 marks for a mere listing of facts)

QUESTION 3: MACRO ECONOMICS

3.1

3.1.1 Name any TWO indicators underpinning forecasting in business cycles.

- Leading indicator ✓

- Lagging indicator ✓

- Co-incident indicator ✓

- Composite indicator ✓ (Any 2 x 1) (2)

3.1.2 How can income tax brackets influence taxpayers?

- An increase in income can push taxpayers into higher tax brackets, if tax brackets remain the same, resulting in higher taxes. (Bracket creep) ✓✓

- Taxpayers do not receive the full benefits of an increase in their wages. ✓✓

- An increase in income will not shift households to higher tax brackets, if tax brackets increase, thus preventing bracket creep. ✓✓

- Tax relief will be provided to workers as their existing salary may fall in a lower tax bracket ✓✓

- Their disposable income can increase allowing them to spend more on goods and services ✓✓

NOTE: Accept the explanation for a decrease in the tax bracket which will have a negative impact on the consumer’s disposable income.

(Accept any other correct relevant response.) (Any 1 x 2) (2)

3.2 DATA RESPONSE

3.2.1 Identify a business cycle phase from the extract above.

Recovery ✓ (1)

3.2.2 Name ONE type of business cycle.

- Kitchin ✓

- Jugler ✓

- Kuznets ✓

- Kondratieff ✓ (Any 1 x 1) (1)

3.2.3 Briefly explain the term business cycles.

A business cycle refers to successive periods of increasing and decreasing economic activity over a period of time. ✓✓

(Accept any correct relevant response.) (2)

3.2.4 Explain the importance of moving averages as a feature underpinning forecasting.

- Moving averages involves repeatedly calculating a series of different average values along a time series to produce a smooth curve. ✓✓

- It is used to analyse the changes in a series of data over a certain period of time ✓✓

- Economists use moving averages to eliminate the effect of sharp fluctuations in the business cycle ✓✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

3.2.5 Why is it important for economists to make forecasts?

- Forecasts indicate when the next change in the business cycle will occur. ✓✓

- Forecasts are used to get an idea of where the economy is headed. ✓✓

- Investors use forecasts to adjust their strategy to take advantage of future market events that will affect their income. ✓✓

- Businesses use forecasts to determine economic events. ✓✓

- Policymakers use forecasts to make possible changes to monetary policy ✓✓

(Accept any relevant correct relevant answer.) (Any 2 x 2) (4)

3.3 DATA RESPONSE

3.3.1 Identify a diagram from above that represents an increase in the number of tourists from the USA to South Africa.

Diagram A ✓ (1)

3.3.2 Name the exchange rate system used in South Africa.

Free-floating exchange rate system ✓ (1)

3.3.3 Briefly describe the term exchange rate.

Exchange rate is the price of one currency in terms of another currency. ✓✓

(Accept any other correct relevant response.) (2)

3.3.4 Explain the impact on the rand if the number of tourists from South Africa to the USA decreases.

- A decrease in the number of tourists from South Africa to the USA will cause a decrease in the demand for dollars, therefore the USA will decrease the supply of dollars to South Africa ✓✓

- The decreased number of tourists will shift the supply curve from S1 to S2 ✓✓

- The exchange rate will rise as the rand depreciates against the dollar ✓✓ (Any 1 x 2) (2)

3.3.5 What benefits can countries of the world obtain from international trade?

- International trade is an important stimulant for the economic growth of a country. ✓✓

- Demand for certain products by citizens of countries will increase as trade increases, leading to increased production, job opportunities, increased income and increased expenditure. ✓✓

- This will lead to a higher economic growth rate for countries of the world. ✓✓

- Being able to import also gives citizens access to a variety of goods ✓✓

- Infrastructure, such as harbour and transport networks, will be developed in order to move the high volumes of goods. ✓✓

- Unrestricted international trade increases competition. ✓✓

- Competition on the other hand increases efficiency because it demands the elimination of unnecessary costs and all wastage. ✓✓

- Increases in efficiency result in lower prices. ✓✓ (Any 2 x 2) (4)

3.4 Discuss the endogenous (Keynesian) explanation of business cycles.

- These are factors that will affect the economy from within the market system ✓✓

- They believe that markets are inherently unstable ✓✓

- Government intervention is needed ✓✓

- Price mechanism gives rise to upswings and downswings ✓✓

- For example: changes in patterns of consumer spending lead to investment spending ✓✓ (Any 4 x 2) (8)

3.5 How can the national budget promote socio-economic rights?

- More funds should be allocated in areas that are critical for promoting, protecting, fulfilling and respecting human rights. ✓✓

- The government should spend more on early childhood development, basic education and healthcare. ✓✓

- The budget should ensure adequate provision of financial resources to local authorities to improve basic service delivery such as water and sanitation ✓✓

- The government should adjust welfare payment according to inflation to ensure that households afford their basic needs such as food ✓✓ (Accept any other correct relevant response.) (8) [40]

QUESTION 4: MACROECONOMICS AND ECONOMIC PURSUITS

4.1

4.1.1 Name any TWO features of public sector failure.

- Ineffectiveness ✓

- Inefficiency ✓ (2)

4.1.2 How can the government use taxation to stimulate economic recovery?

- Reduce personal income tax to increase households' disposable income and stimulate aggregate demand in the economy. ✓✓

- Decrease corporate income tax to increase profit prospects for businesses, such that they can produce more goods and services. ✓✓

- Indirect taxes such as VAT and some excise duties may be reduced to stimulate consumer spending. ✓✓

- Provide tax exemptions or tax holidays to newly established businesses such that they can establish themselves and produce more output. ✓✓

- Increase taxes on imports (tariffs) to increase demand for local goods and stimulate domestic production. ✓✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

4.2 DATA RESPONSE

4.2.1 Identify the tax rate at which the government maximises tax revenue.

50% ✓ (1)

4.2.2 Name any form of indirect tax paid by households to the government.

- Value Added Tax / VAT ✓

- Excise duty (Sin tax, Fuel levy, Carbon tax, Sugar tax) ✓

- Import duty / Import tariff ✓

(Accept any other correct relevant response.) (1)

4.2.3 Briefly describe the term progressive tax.

Tax system whereby people in higher-income groups pay higher tax rates than those in lower-income groups. ✓✓

(Accept any other correct relevant response.) (2)

4.2.4 Explain the effect of a regressive tax system on income distribution

Regressive tax system makes income to be more unequally distributed / The income inequality amongst the population will increase / The gap between low-income earners and high-income earners will increase as low-income earners pay higher tax rates than high-income earners. ✓✓

(Accept any other correct relevant response.) (2)

4.2.5 Why will tax revenue decrease if the government imposes very high tax rates?

- Some businesses and individuals may be forced to evade tax, resulting in lower tax revenue for the government. ✓✓

- Some workers may be discouraged to enter the labour market, which will reduce the tax base for the government. ✓✓

- Businesses may reduce production or withdraw their investments from the economy, which shrinks the tax base. ✓✓

(Accept any other correct relevant response.) (4)

4.3 DATA RESPONSE

4.3.1 Identify the period with the lowest repo rate in the information above.

January 2023 – April 2023 ✓ (1)

4.3.2 Name the committee responsible for taking interest rate decisions in South Africa.

SARB Monetary Policy Committee ✓ (1)

4.3.3 Briefly describe the term repo rate.

It is the interest rate at which the central bank of a country lends money to commercial banks. ✓✓

(Accept any other correct relevant response.) (2)

4.3.4 Explain the relationship between inflation and unemployment in the Phillips curve.

- A reduction in unemployment will cause an increase in inflation because of the increased amount of spending by people that were previously unemployed. ✓✓

- Inverse relationship occurs when unemployment decreases, and inflation will increase. ✓✓ (Any 1 x 2) (2)

4.3.5 How can moral suasion be used as a tool to dampen the overheated economy?

- When the South African Reserve Bank persuade banks to be more careful when they grant credit, excessive spending is curbed therefore business cycles are stabilised. ✓✓

- By exerting moral pressure on banks, they encourage their clients to save rather than spending thereby reducing inflationary pressure. ✓✓

- Strict measures applied by banks when lending money reduce unnecessary borrowing thereby curbing demand pull inflation. ✓✓

(Accept any other relevant and correct response.) (Any 2 x 2) (4)

4.4 Briefly discuss price stability and economic equity as macro economic objectives.

Price stability

- Prices are stable when inflation is kept within certain limits. ✓✓

- Interest rates as the main instrument of monetary policy are used to keep prices within these limits. ✓✓

- Stable budget deficits also have a stabilising effect on the inflation rate. ✓✓

- An inflation target of 3%–6%, has been successful in keeping inflation within certain limits. ✓✓

- Stable prices result in job creation and economic growth. ✓✓

(Accept any other relevant and correct response.) (Any 2 x 2) (Max. 4)

Economic equity

- There is equity in the economy when there is neither the rich, nor the poor. ✓✓

- Redistribution of income and wealth is essential for this equity. ✓✓ • Progressive taxation, taxation on wealth, taxation on profits, taxation on spending and capital gains tax, are the redistribution methods used in South Africa. ✓✓

- Progressive taxation means that higher income earners will pay higher or more tax. ✓✓

- Social services such as free basic education and primary health care are some of the redistribution methods. ✓✓

(Accept any other relevant and correct response.) (Any 2 x 2) (Max. 4)

(Allocate a maximum of 4 marks for mere listing of facts or examples) (4 + 4) (8)

4.5 How will producers respond to the different phases of the business cycle?

- When the repo rate is low, during the recovery phase, businesses produce more and employment increases ✓✓

- During the prosperity phase, businesses take out loans to expand their businesses as production increases due to increased demand ✓✓

- When recession occurs, businesses suffer as interest rates increase. ✓✓

- Businesses lay off workers, reduce production ✓✓ and reduce payments on delivery vehicles and equipment purchased on credit during the prosperity phase ✓✓

- Rising repo rate during the depression phase makes it difficult for businesses to stay afloat. ✓✓ Many businesses close their doors during this phase as banks seize property and equipment purchased in the prosperity phase. ✓✓

(Accept any other correct relevant response.) (Any 4 x 2) (8) [40]

SECTION C

QUESTION 5: MACROECONOMICS

- Discuss in detail the markets within the four-sector model. (26 marks)

- How can the increase in injections impact on the South African economy? (10 marks)

INTRODUCTION

- Markets coordinate economic activities and determine prices for goods and services ✓✓

- The circular flow model is a simplified representation of the interaction between the participants of the economy ✓✓

(Accept any other relevant introduction.) (2)

MAIN PART

Product/Goods market ✓

- Product market is where goods and services are bought and sold ✓✓

- Firms, government and foreign sector supply goods and services and their movement is called real flow ✓✓

- Consumers, firms, government and foreign sector buy goods and services and their payments represent money flow ✓✓

- Goods are defined as any tangible items such as food, clothing and cars that satisfy some human needs ✓✓

- In capital goods market products such as buildings and machinery are exchanged ✓✓

- Consumer goods market involves the trading of durable consumer goods, semi durable consumer goods and non-durable consumer goods ✓✓

- Services are defined as non-tangible actions and includes wholesale and retail, transport and financial markets ✓✓

Factor/Resources/Input market ✓

- Factor market is where factors of production are exchanged, ✓✓ e.g. the labour market, property market and the financial markets ✓

- Households are the owners of the factors of production and they sell them to firms to produce goods and services ✓✓

- The factors of production are labour, entrepreneurship, capital and land and they are exchanged for wages, profit, interest, and rent respectively ✓✓

- Factor services are real flows, and they are accompanied by counter flows of income on the factor market ✓✓

Financial markets ✓

- Financial markets render financial services to the other participants in the economy by gathering surplus funds and lending them to those who need funding ✓✓

- Banks, insurance companies and pension funds form part of the financial markets ✓✓

- Financial markets are not directly involved in production of goods and services, but act as a link between households and businesses with surplus income and other participants who require it ✓✓

Money market ✓

- The money market is the market for short-term and very short-term savings and loans ✓✓

- The South African Reserve Bank (SARB) is a key institution in the money market ✓✓

- The SARB administers the function of legislating and managing the money market ✓✓

- Money market includes inter-bank lending for a period as short as overnight ✓✓

- The securities traded include short term deposits, short term debentures and treasury bills ✓✓

Capital market ✓

- The capital market is the market for long-term savings and loans ✓✓

- The Johannesburg Securities Exchange (JSE) is a key institution in the capital market ✓✓

- The securities traded in this market are long term deposits, mortgage bonds and shares ✓✓

Foreign exchange market ✓

- The foreign exchange market is a multi-national market where currencies of all the countries are traded, ✓✓ e.g. The South African rand can be exchanged for the US dollar ✓

- The foreign exchange market originates when one country imports goods from another country and domestic currency has to be exchanged in order to pay for such imports ✓✓

- Foreign exchange can be bought and sold at the banks and foreign exchange agencies ✓✓

- The South African rand is freely traded in the forex markets and its value is determined by the market forces of demand and supply ✓✓

(Accept any other correct relevant response.)

(Allocate a max. of 8 marks for headings/subheadings/examples.) (Max. 26) (26)

ADDITIONAL PART

Increases in injections may impact on the South African economy as follows:

- Increase in investments will expand the tax base thereby increasing tax revenue for the government ✓✓

- The government's capacity to develop infrastructure such as energy and transport will increase ✓✓

- Establishment of new businesses and infrastructure development projects will create more employment ✓✓

- Consumer spending may increase as households receive more income leading to an increase in aggregate demand ✓✓

- Increase in government expenditure on welfare payments and social development improves the standard of living especially for the poor people ✓✓

- Increase in government spending in the form providing subsidies and incentives to businesses will encourage production of more goods and services ✓✓

- Increase in subsidies may reduce the cost of production which will reduce inflation in the economy ✓✓

- Increase in South African exports may result in the appreciation of the rand which will reduce the cost of importing production inputs such as oil ✓✓

- Increase in export production contribute to an increase in the real GDP of the country ✓✓

- Balance of payments problems may decrease as the trade balance increases due to an increase in exports ✓✓

- Through the multiplier process, the country's national income will increase by a bigger margin ✓✓

(Accept any other correct relevant response)

(Allocate a maximum of 2 marks for a mere listing of facts/examples.)

(Accept any other correct higher order response.) (Max. 10) (10)

CONCLUSION

Markets are critically important institutions in our economic system, because they regulate the market, to safeguard price stability and general business confidence. ✓✓ (Max. 2) (Accept any other correct relevant response.) (2) [40]

QUESTION 6: ECONOMIC PURSUITS

- Discuss in detail the reasons for international trade. (26 marks)

- How can a weaker rand affect the economy? (10 marks)

INTRODUCTION

International trade gives consumers and countries the opportunity to be exposed to goods and services not available in their own countries, or which would be more expensive domestically. ✓✓ / International trade is described as the exchange of goods or services across international borders. ✓✓

(Accept any correct relevant introduction.) (2)

MAIN PART

Demand reasons

Total demand for goods and services is influenced by:

The size of the population ✓

- If the population growth increases, it causes an increase in demand, there are more needs that must be satisfied. ✓✓

- If the country does not have sufficient goods and services, they must be imported from other countries. As local suppliers may not be able to satisfy this demand. ✓✓

Income levels ✓

- Change in income causes a change in the demand for goods and services. ✓✓

- If the per capita income of people in the country rises – this leads to greater disposable income that can be spent on goods and services. ✓✓

- This increased demand must be satisfied – if there are not enough goods and services in the country – goods and services must be imported. ✓✓

Change in the wealth of the population ✓

- An increase in wealth leads to increased demand for goods ✓✓

- People have more access to loans and can buy bigger and more luxuries. ✓✓

- If the country itself cannot provide these luxury and highly technological products – such goods must be imported ✓✓

- These factors are favourable for developed countries but not for developing countries. ✓✓

- Developed country benefits more from international trade than developing countries. ✓✓

Preferences and tastes ✓

- Preferences and tastes can play a role in determining prices, e.g., customers in Australia prefer a particular product that they do not produce and have to import, and it will have a higher value than in other countries. ✓✓

The difference in consumer patterns ✓

- This is determined by the level of economic development in a country ✓✓

- The consumption patterns of developed countries will differ from those of developing countries. ✓✓

- For example, a poorly developed country will have a high demand for basic goods and services, but a lower demand for luxury goods. ✓✓

- The need for basic necessities, such as food in developing countries may result in more needed goods being imported. (Demand for technical items) ✓✓

Supply reasons ✓

Natural resources (factors of production) ✓

- Natural resources are not evenly distributed between all countries of the world. ✓✓

- They vary from country to country and can only be exploited in places where such resources are found. ✓✓

- Each country has its own unique mix of natural resources that enable them to produce certain goods and services more effectively and at a relatively lower price. ✓✓

- For example, South Africa's gold and diamond resources have given us an advantage in the production of gold and diamonds. ✓

- South Africa is well equipped with different natural resources, but less resourced with skilled labour and capital. ✓✓

- Japan and Ireland which have an abundance of skilled labour, but they lack natural resources. ✓✓

Climatic conditions ✓

- Differences in climatic conditions between countries make it possible for certain countries to produce certain goods at a lower price than other countries. ✓✓

- Many crops can only be grown in certain climatic conditions in certain areas and certain types of soil. ✓✓

- Countries with favourable climate conditions make it possible for others to produce certain goods at a lower price. ✓✓

- An example is Brazil, which is the largest producer of coffee in the world. ✓

Labour resources ✓

- Labour differs between different countries in terms of skills, knowledge, training, quality, quantity and also costs. ✓✓

- Some countries have highly skilled, well-paid workers, and high productivity levels, such as Switzerland (watch manufacturing) ✓✓

- This enables them to produce goods and services at lower prices than they could be produced by other countries. ✓✓

Technological resources ✓

- The developmental levels and innovation processes of countries will always differ and as a result other countries may have them in abundance, while others may not. ✓✓

- Countries such as Germany and the USA are able to use capital which embodies high levels of technology, while other countries do not have access to the latest technology, such as basic internet services and healthcare. ✓✓

- Those countries that have high technological labour forces are able to produce certain goods and services at a low unit cost, such as the developed countries. ✓✓

Specialisation ✓

- Some countries specialise in the production of certain goods and services. ✓✓

- By specialising in the production of a certain good or service, it enables a country to take advantage of economies of scale and can therefore produce the good at a comparative unit cost advantage. ✓✓

- For example, Japan specialises in the production of certain electronic goods and sells them at a much lower price than they can be produced in other countries. ✓✓

- This often leads to mass production due to division of labour, automation, and mechanisation. ✓✓

- Cost differences occur because goods and services can be produced at lower costs in one country than another country due to the theory of comparative advantage. ✓✓

- Most of these surplus productions get exported to other countries and the revenue earned from these exports can be used to finance their imports. ✓✓

Capital ✓

- Capital cannot be obtained as easily in certain countries as in others. ✓✓

- Developed countries enjoy an advantage over developing countries. ✓✓

- Due to a lack of capital, certain countries cannot produce all the goods they need, or they do not enjoy the favourable conditions as in other countries ✓✓

- In some countries they need to modernise their industries and economies with advanced machinery, equipment (plants), but cannot manufacture this equipment, because they lack the capital to do so. ✓✓

- This factor has therefore increased the need for international trade. ✓✓

(Accept any other correct relevant answer.)

(Allocate a maximum of 8 marks for headings, listing of facts and examples.) (Max. 26 marks) (26)

ADDITIONAL PART

How can a currency (rand) depreciation affect the economy?

Currency depreciation can affect the economy positively when:

- It is used as an expansionary monetary policy to counter cyclical measures to stimulate demand, profits, output and jobs when an economy is in recession. ✓✓

- It brings an improvement in the balance of trade through higher export sales. ✓✓

- It provides a competitive boost to an economy through increasing the value of profits and income for a country’s businesses with investments overseas. ✓✓

- It leads to a positive multiplier within the circular flow of income and spending. ✓✓

Currency depreciation can negatively affect the economy when:

- It makes it harder for the government to finance a budget deficit if foreign investors lose confidence. ✓✓

- It increases the cost of imports e.g., rising prices for essential foodstuffs, raw materials, which affects long-run productive potential of an economy. ✓✓

- It makes it hard to pay for a trade deficit that is owed to overseas creditors. ✓✓

(Accept any other correct relevant response.) (Max. 10) (10)

CONCLUSION

International trade is important for countries to survive economically, as barriers to trade would disadvantage all countries, due to their interdependency globally. ✓✓

(Accept any other relevant higher order conclusion.) (Max. 2) (2) [40]