P1: Macro Economics - Economics Spring Manual Grade 12

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupN.B:

- Any question based on this topic becomes a popular question, most candidates attempt to answer such questions with an average performance.

- Learners poorly perform in paragraph questions (Q 2.4 and Q 2.5) as most of them fail to get full marks.

CIRCULAR FLOW

REAL FLOWS AND MONEY FLOWS

Real flow: Goods and services and Factors of production.

Money flow: The earning of money (income) and payments that is made.

Real flow

- Consumers render production factors to producers and government via the factor market.

- Goods and services are supplied by producers via the product market to government and consumers.

- Government provides public goods and services to consumers and producers.

- Producers receive goods and services (imports) form and deliver goods and services (exports) to the foreign sector.

Money Flow

- Consumers earn an income for their production factors via factors market from businesses.

- Business sector earn an income for goods and services via the product market from consumers and government.

- Government earn an income consumers and businesses

- Businesses earn an income for exports from the foreign sector and make payments to the foreign sector for imports.

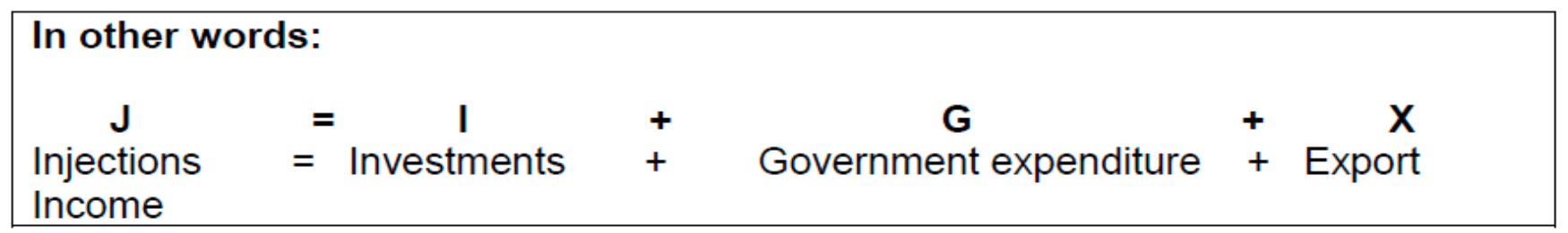

INJECTIONS (J = I + G + X)

Injections

- Injections represents the injection of money into the economic cycle (local economy)

- It refers to the flow of any spending which is not derived from income (Y)

- Additional money enters the economy and it increases income

- Domestic purchases on goods and services increase

- In an open economy, injections are government spending (G), the revenue earned from exports (X) and investment spending (I).

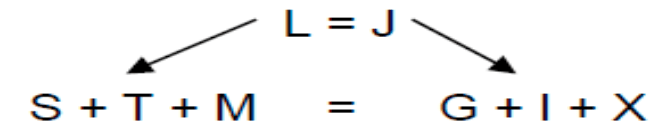

Equilibrium

- The economy is in equilibrium when leakages are equal to injecitons.

- In other words

Disequilibrium

The economy is in disequilibrium when:

- Leakages are more than Injections (L > J).

- Injections are more than Leakages (J > L).

METHODS TO DETERMINE GDP USING DATA TABLES: PRODUCTION GDP(P)

- When using this method, the GDP is determined by calculating the sum of the value added at each stage of the production process.

- This method yields GDP at basic prices.

- It is the quantity multiplied with the market or production price.

- To avoid double counting, only added values are taken.

- The value of intermediate goods and services are not included in the calculation.

| Production method | R Billions |

| Primary Sector | 129 |

| Secondary Sector | 316 |

| Tertiary Sector | 908 |

| Gross value added at basic prices | 1 353 |

| Plus: Taxes on production | 174 |

| Less: Subsidies on products | 4 |

| Gross domestic product at market prices | 1 523 |

N.B:

Teachers to ensure that learners know how to calculate and derive figures from data given

LINK THE OPERATION OF THE FINANCIAL AND FOREIGN EXCHANGE MARKETS TO THE PARTICIPANTS OF THE CIRCULAR FLOW.

The link between the financial sector and other participants

Financial Institutions manage deposits, offer loans, and engage in foreign exchange transactions to support international trade and investment.

- Households deposit savings into banks and other financial institutions. These savings become available for firms to borrow and invest.

- Households also invest in financial assets such as stocks and bonds, which helps firms raise capital for expansion.

- Firms use financial markets to raise capital by issuing stocks or bonds.

- They also obtain loans from banks for business operations and expansions.

- Financial institutions act as intermediaries, channelling funds from savers (households) to borrowers (firms).

- They play a crucial role in determining interest rates and influencing investment decisions.

- Banks and financial institutions facilitate foreign exchange transactions for businesses and individuals.

- They also engage in speculative activities and offer hedging products to manage currency risk.

The link between the foreign exchange market and other participants

The Foreign Sector involves South African exports and imports, foreign investments, and international capital flows. Exchange rate fluctuations can influence the competitiveness of South African goods abroad and the cost of imported goods.

- Households involved in international travel or with foreign investments engage in foreign exchange transactions.

- They may also be affected by fluctuations in exchange rates if they have savings or investments abroad.

- Firms engaged in international trade need to exchange currency to pay for imports or receive payment for exports.

- Firms that operate globally must manage foreign exchange risk to protect against adverse movements in exchange rates.

- The government influences exchange rates through its monetary policy and by managing foreign reserves.

- Policies such as interest rate adjustments can impact the value of the national currency and the flow of foreign capital.

N.B: Poor language skills makes it difficult for candidates to understand the requirements of questions and to express themselves clearly, especially in paragraph type questions which forms a large part of the question paper.

EXPLAIN THE PURPOSE OF THE FLOW SYSTEM OF NATIONAL ACCOUNTS (SNA) AS OUTLINED BY THE UNITED NATIONS (UN)

- South Africa uses the SYSTEM OF NATIONAL ACCOUNTS (SNA) prescribed by the United Nations in order to determine national account figures

- The System of National Accounts (SNA), as outlined by the United Nations, is a comprehensive framework used for measuring and analysing economic activity within a country.

- The SNA provides a systematic approach to measuring economic activities, including production, income, and expenditure. It helps quantify the total economic output of a country and track how resources are used and redistributed.

- Governments and policymakers use the data generated by the SNA to design, implement, and assess economic policies. Accurate and comprehensive data on economic performance helps in making informed decisions about fiscal policy, monetary policy, and other economic interventions.

- The SNA offers a standardized framework that allows for consistent economic data collection and reporting. This standardization makes it easier to compare economic data across different countries and regions, facilitating international economic analysis and cooperation.

- The SNA tracks various indicators such as Gross Domestic Product (GDP), Gross National Income (GNI), and sectoral contributions to the economy. This monitoring is crucial for assessing overall economic health and identifying areas of concern or improvement.

Basic Prices

- Indirect prices and subsidies are related to production process and not individual products.

- With the production method, taxes on production is subtracted as a cost and subsidies on production are added as an income.

- Taxes on production are payroll taxes (SITE and PAYE), recurring taxes on land & buildings, Business licenses.

- Subsidies on production include employment subsidies and subsidies paid to prevent pollution.

Factor Cost

- GDP at basic prices – other taxes on production + other subsidies on production = GDP at factor cost (factor income).

Market prices

Conversion of values form:

Basic prices to market prices:

- GDP ate basic prices + Taxes on products – subsidies on products = GDP at market prices.

Factor cost to market prices:

- GDP at factor cost + other taxes on production – subsidies on production = GDP at basic prices + taxes on products – subsidies on products = GDP at market prices.

Net figures

Net operating surplus = surplus after taxes

Net income = income after taxes

Net fixed capital formation = After consumption of fixed capital (depreciation)

Net exports = exports – imports

Conversion of Domestic to National figures

Domestic figures relate to the income and production happening within the borders of the country.

National figures relate to the income or production by the citizens of the country.

Eg

| R Billions | |

| GDP at market prices | 1523 |

| Plus: Factor income earned abroad by South Africans | 29 |

| Less: Factor income earned in South Africa by foreigners | 60 |

| GNI at market prices | 1 492 |

Nominal figures vs Real figures

Nominal figures

- It is also known as nominal or money value.

- It is also known as national product at current price.

- Production is calculated by multiplying the volume of the final goods and services by their prices.

- Inflation has not yet been taken into consideration.

Real figures

- It is also known as national product at constant prices.

- The rate of inflation as expressed by the consumer price index (CPI) has been taken into account.

- Real values of production are the nominal values of national product adjusted for price increase.

- Real national product is the national product express in prices which applied in a certain base year.

BUSINESS CYCLE

COMPARE BOTH EXOGENOUS (MONETARIST) EXPLANATION AND THE ENDOGENOUS (KEYNESIAN) EXPLANATION

| EXOGENOUS (MONETARIST) EXPLANATION | ENDOGENOUS (KEYNESIAN) EXPLANATION |

| It is also called the sunspot theory / exogenous approach | Also known as the Keynesian Approach or Interventionists |

| Monetarism is largely associated with Milton Friedman and emphasizes the role of external factors in driving economic changes. | Keynesian Economics, associated with John Maynard Keynes, offers a different perspective, focusing on internal factors and the role of aggregate demand |

| Believe markets are inherently stable. | Hold the view that markets are inherently unstable. Business cycle is an inherent feature of market economy |

| Departures from the equilibrium state are caused by exogenous factors (factors outside of the market system). | Level of economic activity constantly tend to be continually above or below its potential |

| When disequilibrium exist in the economy, Market forces (supply and demand) kick in and bring the economy back to its natural state or equilibrium route. | Price mechanism fails to co-ordinate demand and supply in markets. Prices are not flexible enough e.g. wages. The potential growth path is indicated by the thin black line. |

| Government interferences are not part of the normal forces operating in the market. Governments should not interfere in the markets. | The cyclical bold line around the thin black line indicates the real path of the economy. |

| The straight bold line indicates the natural growth of the economy | Governments must intervene in the economy processes to smoothen the peaks and the troughs as far as possible. |

| Focuses on the following: money supply, inflation and money growth and limited role of fiscal policy. | Focuses on the following: aggregate demand and economic fluctuations, role of government and fiscal policy, investment and multiplier effect: |

EXPLAIN THE COMPOSITION OF THE MONETARY POLICY

- Monetary policy uses Interest rates and Money supply too expands or contract aggregate demand.

- Large increases in money supply lead to inflation

- Monetary policy can be utilised more effectively to dampen an overheated economy with severe inflationary pressures.

Monetary policy instruments:

- Interest Rates

- Cash reserve requirements

- Open market transactions

- Moral Persuasion

- Exchange rates

1. Interest Rates

Overheated economy / Boom – Increase interest rates and decrease money supply

- This will make credit more expensive and reduce and discourage consumer credit.

- Demand will decrease.

Recession / Slump - Decrease Interest Rates and Increase Money supply

- This will make credit cheaper and it will increase and promote consumer credit.

- Consumer Demand will increase.

- Stimulate the economy

2. Cash reserve requirements

- Banks are required by law to keep cash reserves at the SARB.

- SARB can increase or decrease these cash requirements.

Overheated economy / Boom

- An increase in the cash reserve requirements - Decrease the supply of capital to commercial banks, so that banks have less money to lend to consumers.

- Demand will decrease.

Recession / Slump

- A decrease in the cash reserve requirements – Increase in the supply of capital to commercial banks, so that banks have more money to lend to consumers.

- Demand will increase.

3. Open market transactions

- The SARB can directly increase or decrease the amount of money in the economy.

Overheated Economy / Boom

- If they want to reduce the supply of money in the economy, they can sell government bonds / securities on the open market.

Recession / Slump

- If they want to increase the supply of money in the economy, they buy government bonds / securities on the open market.

4. Moral persuasion

- The SARB can enter into discussion with banks, to morally persuade them to limit credit and increase the cooperation to fight inflation

5. Exchange rate policy

Central banks (SARB) can use the following two ways to stabilise exchange rates.

- Free floating

- Control (Managed) floating

Free floating

- Demand and supply determine the price of foreign currency.

- The central bank interferes in the foreign exchange markets by buying and selling the currency in order to stabilise it.

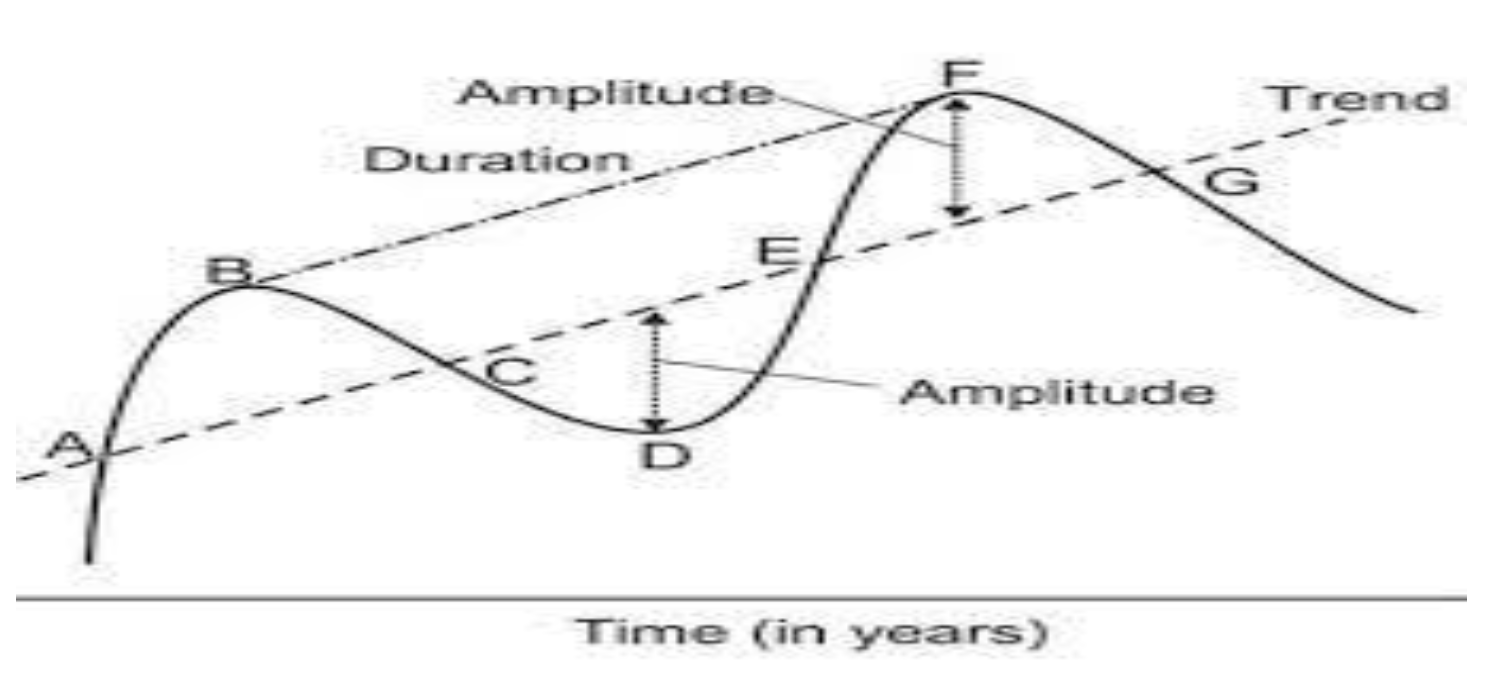

USE A DIAGRAM AND DISCUSS THE CYCLE LENGTH, AMPLITUDE AND THE TREND LINE AS FEATURES UNDERPINNING FORECASTING.

1. LENGTH of a cycle

- It is measured from peak to peak or from trough to trough.

- It is the number of years it takes for the economy to get from one peak to the next. ▪ It is useful to know the length of the cycle because the length tends to remain relatively constant over time.

- If a business cycle has the length of 10 years it can be predicted that 10 years will pass between successive peaks or troughs in the economy.

- Longer cycles show strength and shorter cycles show weakness

- Cycles can overshoot

2. AMPLITUDE

- The amplitude refers to the vertical difference between a trough and the next peak of a cycle.

- The larger the amplitude the more extreme changes may occur e.g. during an upswing unemployment may decrease from 20% to 10 % ▪ (i.e. 50 % decrease)

- A large amplitude during an upswing indicates strong underlying forces – which result in longer cycles

3. TREND LINE

- It represents the average position of a cycle.

- Indicates the general direction in which the economy is moving.

- An upward trend suggests that the economy is growing.

- Trend line usually has a positive slope, because production capacity increases over time.

PUBLIC SECTOR FAILURE

BRIEFLY EXPLAIN THE FOLLOWING EFFECTS OF PUBLIC SECTOR FAILURE:

1. Allocation of resources

- When the government fails an optimal allocation of resources is not achieved and consequently resources are wasted.

- Public sector failure often leads to inefficient allocation of resources. This occurs when government agencies or public enterprises are unable to effectively allocate resources where they are most needed or where they can be most productive.

- Inefficiencies: Examples include mismanagement of state-owned enterprises (SOEs) like Eskom and South African Airways, leading to underperformance and wastage of resources.

- Sectoral Imbalances: Poor planning and execution in public projects can result in mismatches between infrastructure needs and actual development, hampering economic growth and development.

2. Economic instability

- Government failure can lead to macroeconomic instability. Government is unable to use fiscal policy effectively.

- Failure in the public sector can contribute to economic instability by causing fluctuations in key economic indicators and undermining confidence in economic governance.

- Fiscal Challenges: Inefficient public spending and corruption can lead to budget deficits and increased public debt, causing fiscal instability.

- Market Confidence: Instability in SOEs and frequent government interventions can reduce investor confidence, affecting both domestic and foreign investments.

3. Distribution of income

- If government fails to use the tax system effectively then there will be an unfair distribution of income in the economy.

- Public sector failure can exacerbate income inequality by failing to effectively implement policies and programs aimed at equitable income distribution.

- Unequal Access: Inefficiencies in public services such as education and healthcare can disproportionately affect lower-income groups, widening the income gap.

- Social Programs: Misallocation of funds intended for social welfare programs can lead to inadequate support for the poor, further entrenching existing disparities.

INTERNATIONAL TRADE (FOREIGN EXCHANGE MARKETS)

N.B:

- The challenge is usually on the additional part as only few candidates perform well in this question.

- There is still a need for candidates to improve on how they respond to the additional part, although some candidates are showing little understanding of such a question but they are unable to evaluate/examine which leads to them losing a lot of marks (getting max 2 out of 10). Most candidates are listing facts without evaluating, while some are just describing concepts.

- Although guided in the question paper as to what a conclusion should entail, the writing of a relevant conclusion is a challenge for most candidates. Some candidates are repeating content from the introduction and the main part in the conclusion.

DISCUSS IN DETAIL THE REASONS FOR INTERNATIONAL TRADE

International trade is exchange of goods or services between different countries. This exchange allows countries to obtain products they do not produce domestically or to obtain them at a lower cost than if they produced them themselves.

Demand reasons

- Countries trade with other countries because they have a demand for goods which they cannot produce themselves.

- Sometimes countries have no goods at all. E.g. Namibia imports oil.

- Sometimes countries have the product but they do not produce enough themselves, they must import it. E.g. South Africa produces oil, but they produce too little, therefore they must import it. S.A. only produces 30% of the oil that is needed in the country, the rest they import from Saudi- Arabia.

1. Size of population

- If there is an increase in population growth, it causes an increase in demand, as more people’s needs must be satisfied

- Local suppliers may not able to satisfy the demand, thereby creating demand imports.

- As a result, members of the population can import some of the goods and services from other countries.

2. The population’s income levels

- Changes in income cause a change in the demand for goods and services

- An increase in the per capita income of people results in more disposable income that can be spent on local goods and services.

- Local supply maybe insufficient to fulfil the local demand, which creates a platform for imported goods and services.

3. Change in population wealth

- An increase in wealth of the population leads to greater demand for goods.

- When people have access to credit facilities, they will spend more on expensive luxury goods and services such as Ferrari and Rolls Royce

- In case where luxury goods and services cannot be produced locally, people will have to import them from other countries

4. Preferences and tastes

- People’s tastes and preferences evolve and are often influence by social media and globalisation

- Changes in preferences create markets for goods and services that are not always manufactured domestically

- Preferences and tastes play a part in determining of prices for goods and services

- Customers in Australia may have a preference for a specific product which which they do not produce and thus need to import, and it will have a higher value than in other countries

- Apple iPhones are not produced in South Africa, yet there is a huge demand for them locally, causing them to be imported from USA.

5. The difference in consumption patterns

- The difference in consumption patterns is determined by the level of economic development in the country.

- In countries where the levels of disposable income are high, demand for luxury goods is high, which creates a larger market for imports.

- On the other hand, a poorly developed country will have high demand for basic goods and services but a lower demand for luxury goods.

SUPPLY REASONS

1. Natural resources

- Natural resources are not evenly distributed across all countries of the world

- South Africa has large deposits of Gold while Nigeria has crude oil.

- Natural resources vary from country to country and can only be exploited in places where these resources exist.

- Availability of natural resources creates a platform for specialisation and an opportunity to earn valuable export revenue.

2. Climate conditions

- Every country has a unique climate conditions which allow it to grow specific crops.

- Climatic conditions make it possible for some counties to produce certain goods at a lower price than other countries

- Specialisation provides countries with an opportunity to develop a competitive edge over other countries

- China has the ideal climate to produce rice and tea and it is therefore the largest producer of rice and tea in the world

3. Labour resources

- Labour resources differ in quality, quantity and cost between countries.

- Some countries are more productive than others because they have highly skilled workers

- Some countries have bigger or smaller labour force depending on their population size

- Some countries have highly regulated labour forces, where minimum wage may be higher while others have no regulations regarding remuneration.

- The quality, quantity and cost of labour have a huge impact on productivity and cost of production.

- Certain countries have specialist labour in the production of certain goods and services

- Germany has the most skilled labour force in the production of BMW, VW, Mercedes Benz cars, which gives it the capacity to export cars to other countries.

4. Technology

- Some countries have access to advances technological resources such as machinery and equipment.

- Technological resources available in some countries empower them to produce certain goods and services at a low unit cost.

- Japan and Singapore are considered to be technologically advanced which gives them a competitive advantage.

5. Specialisation

- Specialisation in the production of a limited range of goods and services allows some countries to produce them than lower cost than others.

- Japan specialises in the production of electronic goods and sells them at lower prices

- Specialisation ensures that mechanisation, division of labour and economies of scale associated with mass production are achieved.

- Countries therefore earn international reputation for specialising in the production of certain product.

6. Capital

- Access to capital allows developed countries to enjoy an advantage over underdeveloped countries

- Developed countries are usually highly industrialised and have well-developed infrastructure which promotes higher levels of productivity.

- Due to a lack of capital, some countries cannot produce all the goods they require themselves.

EFFECTS OF INTERNATIONAL TRADE

1. Specialisation

- Specialisation increase the standard of living of people.

- Specialisation and trade causes countries to have more goods which they can sell at the same costs.

- Certain countries would not have had certain goods without International trade. E.g. Mozambique have no oil and Greenland have no citrus fruit.

- Without international trade countries would only have goods that they produced in the country.

- Only the rich would have been in a position to access or get to certain goods.

2. Mass production

- If domestic demand is added to foreign demand, it makes large scale production (mass production) possible.

- The production of manufactured goods requires that it should take place on large scale in order to make it affordable and to make it profitable. E.g. The manufacturing of computers, cell phones, motorcars, etc.

- Small countries can only compete with larger countries if they can export successfully.

- South African businesses export to African countries.

3. Efficiency

- Unlimited international trade increase competition.

- Competition increase efficiency because eliminate and reduce unnecessary cost and waste.

- Increase efficiency leads to lower cost and thus lower prices.

- Lower prices mean that the same income can buy more goods and services. ▪ It causes an increase in standard of living.

4. Globalisation

- International trade is at the heart (core) of globalization.

- Other elements of international trade are Information technology, Transport, Communication, Multi National Enterprises (MNE), Capital liberalization and standardization.

- As countries become involve in international trade, it spills over to other elements of globalization. India and China experience it.

- As these elements expand and improve it stimulate international trade. ▪ Domestic economic growth follows and it lead to an increase in the standard of living.