ECONOMICS GRADE 12 PAPER 1 MEMORANDUM - NSC PAST PAPERS AND MEMOS NOVEMBER 2017

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupECONOMICS PAPER 1

GRADE 12

NOVEMBER 2017

MEMORANDUM

NATIONAL SENIOR CERTIFICATE

SECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 B – national income will increase ✓✓

1.1.2 A – capital ✓✓

1.1.3 D – merit ✓✓

1.1.4 C - Economic union ✓✓

1.1.5 B – National Development Plan ✓✓

1.1.6 C – fiscal ✓✓

1.1.7 D – life expectancy ✓✓

1.1.8 A – development ✓✓ (8 x 2) (16)

1.2 MATCHING ITEMS

1.2.1 D – Markets are inherently stable and need no government intervention ✓

1.2.2 E – It shows the direction in which the economy might be heading ✓

1.2.3 A – Liquid assets made available by the IMF to finance deficits on the BoP ✓

1.2.4 H – Exchange rate system where the value of the currency is determined purely by market forces only ✓

1.2.5 I – Provided by government for use by all members of society, e.g. public libraries ✓

1.2.6 G – Government takes ownership of privately-owned enterprises and assets ✓

1.2.7 B – Supplies financial development assistance mostly to developing countries ✓

1.2.8 C – Charged by the reserve bank to other financial institutions for loanable funds ✓ (8 x 1) (8)

1.3 GIVE ONE TERM

1.3.1 Gross Domestic Product ✓

1.3.2 Laffer ✓

1.3.3 Import substitution ✓

1.3.4 Corridor ✓

1.3.5 Deregulation ✓

1.3.6 Land Restitution ✓ (6 x 1) (6)

TOTAL SECTION A: 30

SECTION B

Answer TWO of the three questions in this section in the ANSWER BOOK.

QUESTION 2: MACROECONOMICS

2.1 Answer the following questions.

2.1.1 Give any TWO examples of indirect taxes.

- Value added tax (VAT) ✓

- Excise duties / sin taxes ✓

- Import duties / custom ✓

(Accept any other correct relevant response) (2 x 1) (2)

2.1.2 What impact will a decrease in commercial banks’ cash reserve requirements have on the aggregate money supply?

The aggregate money supply will increase ✓✓ / positive impact ✓

(Accept any other correct relevant response) (1 x 2) (2)

2.2 DATA RESPONSE

2.2.1 In the information above, identify the reason why the economy is already in a recession.

The economic growth rate is lower than the population growth rate ✓

The sharp drop in global demand ✓ (1)

2.2.2 What was the GDP growth rate in the 1st quarter of 2016?

-1,2% ✓ (1)

2.2.3 Briefly describe open market transactions as a monetary policy instrument.

- SARB can directly reduce or increase the supply of money in circulation by buying and selling government securities in the open market ✓✓

- Open market transactions influence consumption and investment ✓✓

- The SARB sells government bonds on the open market, that will reduce the money supply ✓✓

- When commercial banks buy government bonds, this absorbs some of their money and they are less able to offer credit ✓✓

(Accept any other correct relevant response) (2 x 2) (4)

2.2.4 How can the South African government use fiscal policy to stimulate the economy?

Fiscal policy can be used to stimulate the economy by:

- raising government spending (G) ✓ with borrowed money (budget deficit) ✓ / Aggregate expenditure and demand will increase ✓ and employment is likely to increase ✓

- decreasing taxes ✓ consumers and producers have a larger part of their incomes available to spend on goods and services ✓ or investment ✓ / aggregate expenditure increases ✓ employment will increase ✓

- raising government spending and simultaneously decreasing taxes ✓✓ will have a strong effect of increased government spending and consumers and producers will have more to spend ✓ or to invest ✓ demand increases substantially ✓ and employment increases ✓ (2 x 2)

(Accept any other correct relevant response) (4)

2.3 DATA RESPONSE

2.3.1 Which sub-account in the Balance of Payments includes reserve assets?

Financial account ✓ (1)

2.3.2 Which institution is responsible for the publishing of the balance of payments?

South African Reserve Bank / SARB ✓ (1)

2.3.3 How can South Africa ensure a net inflow of capital?

A net inflow of capital is ensured by:

- promoting exports via subsidies to producers ✓✓

- reducing imports through import substitution and increased tariffs ✓✓

- encouraging foreign direct investment ✓✓

- reforming structural policy that might maximise the long-term gains from international capital movements ✓✓

- e.g. financial and product market regulation – have a large impact on net foreign capital positions ✓✓

(Accept any other correct relevant response) (2 x 2) (4)

2.3.4 Use figures in the table to calculate the trade balance (A). Show ALL calculations.

Trade balance = Merchandise exports = 276 349 ✓

+ Net gold exports = 13 777 ✓

– Merchandise Imports = 270 258 ✓

= R19 868m ✓

OR

(276 349 ✓ + 13 777 ✓ – 270 258 ✓ = 19 868 ✓) (4)

2.4 Differentiate between money flows and real flows in the circular flow model.

Money flow:

- Factor remuneration represents the expenditure of producers ✓✓

- And the income of households e.g. wages, rent, interest and profit ✓✓

- Consumption expenditure represents the expenditure of households and the income of producers ✓✓

- Government and foreign sector payments ✓✓

- Import payments (expenditure) and export earnings (income) ✓✓

(Max 4)

Real flow:

- Factors of production flow from the owners (households) to producers via the factor markets ✓✓

- Goods and services flow from the producers via the goods markets to households and other users of goods and services ✓✓

- Factors of production and goods and services flow from foreign countries to South Africa (imports) ✓✓

- Factors of production and goods and services flow from South Africa to foreign countries (exports) ✓✓

(Allocate a maximum of 4 marks for mere listing of facts/examples)

(Accept any other correct relevant response)

(Accept tabular format or a diagram of the circular flow model)

(Max 4) (8)

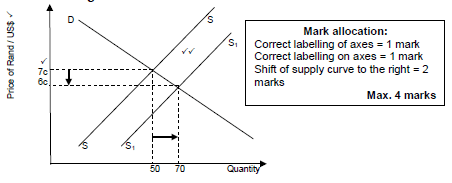

2.5 Explain by means of a neatly-labelled graph, the effect on the value of the Rand if there is a sharp increase in the number of South African tourists visiting the USA.

- An increase in tourists visiting the USA will result in SA tourists offering more rands ✓✓

- This will shift the supply curve (for dollars) to the right (from SS to S1S1) ✓✓

- This will result in the value of the US dollar appreciating and the rand depreciating (from R0,76 to R0,66) ✓✓

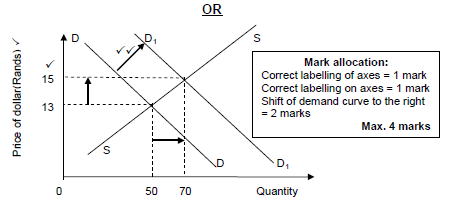

OR

- An increase in tourists visiting the USA will result in SA tourists demanding more dollars ✓✓

- This will shift the demand curve (for dollars) to the right (from DD to D1D1) ✓✓

- This will result in the value of the dollar increasing (from R13 to R15) ✓✓

(Accept any other correct relevant response) (8)

[40]

QUESTION 3: ECONOMIC PURSUITS

3.1 Answer the following questions.

3.1.1 Name any TWO areas addressed by the Reconstruction and Development Programme

- Housing ✓

- Water supply ✓

- Electricity ✓

- Healthcare ✓

- Development of human resources ✓

- Building the economy ✓

- Land reform ✓

(Accept any other correct relevant response/township or informal settlement mentioned) (2 x 1) (2)

3.1.2 What effect does a low economic growth rate have on poverty?

A low economic growth rate will cause an increase in poverty ✓✓ / negative effect ✓

(Accept any other correct relevant response) (1 x 2) (2)

3.2 DATA RESPONSE

3.2.1 Identify the social indicator in the information above.

Education / urbanisation ✓ (1)

3.2.2 What percentage of the GDP is spent on education?

6,2 ✓ (1)

3.2.3 Briefly explain urbanisation as a social indicator.

- Urbanisation refers to the movement of people from the rural areas into the urban areas ✓✓

- It happens because of:

- The founding of new towns ✓✓

- The natural growth of the urban population ✓✓

- The percentage of the population living in urban areas ✓✓

- Migration, which can be rural-urban or international ✓✓

(Accept any other correct relevant response) (2 x 2) (4)

3.2.4 What led to the high dropout rate (82,2%) from secondary to tertiary institutions?

- Matric failure ✓✓

- Failure to meet admission requirements ✓✓

- Lack of motivation ✓✓

- Socio economic reasons ✓✓

(Accept any other correct relevant response) (2 x 2) (4)

3.3 DATA RESPONSE

3.3.1 Identify a foreign country that is a BRICS member in the information.

China ✓ (1)

3.3.2 How many potential job opportunities does China’s investment promise to create for South Africa?

More than 2 500 jobs ✓ (1)

3.3.3 Briefly describe the role of the Industrial Development Corporation in the South African economy.

- National development financing institution ✓✓

- Ensures adequate financial and non-financial assistance for industrial development ✓✓

- Promotion of entrepreneurship by building competitive industries and enterprises based on sound business principles ✓✓

- Diversification of the economy by moving away from the economy’s reliance on traditional commodities ✓✓

- Increased value-added activities by increasing downstream beneficiation, by participating in higher-value activities ✓✓

- Long-term intensification of South Africa’s industrialisation process and movement towards a knowledge-driven economy ✓✓

- Promotion of a more labour-intensive industrialisation approach ✓✓

- Broad based industrial growth by engaging greater levels of participation from historically disadvantaged people and marginalised regions in the mainstream of the industrial economy ✓✓

- Contributing to industrial development on the African continent with active support of productive capacity and increased regional trade integration ✓✓

- Job creation ✓✓

(Accept any other correct relevant response) Any (2 x 2) (4)

3.3.4 Explain the positive impact, other than job creation that this investment might have on the South African economy.

- It opens up new markets ✓✓

- Adds a positive value on the country’s balance of payments/current account ✓✓

- Improve continental relations ✓✓

- Earn foreign exchange ✓✓

(Accept any other correct relevant response) Any (2 x 2) (4)

3.4 Explain any TWO challenges of globalisation for developing countries (North/South divide)

Poverty ✓

- The poverty gap still continue to increase between the rich and poor despite globalisation ✓✓

- The number of desperately poor people still increases ✓✓ (Max 4)

Growth ✓

- Developed countries which managed to install honest governments keep their inflation rate down and balances their budgets while those developing countries fail and as a result fail to attract FDI necessary for economic growth ✓✓

- If the developed countries struggle with recession, they will scale down their purchase from developing countries ✓✓ (Max 4)

Trade ✓

- Rich countries continue to subsidise their agricultural production making it difficult for developing countries to compete ✓✓

- They insist on the developing countries to eliminate their tariffs on manufactured goods ✓✓

- Most of the poor countries have little foreign trade ✓✓ (Max 4)

(Accept any other correct relevant response)

(Allocate a maximum of 4 marks for mere listing of facts/examples)

Any (2 x 4) (8)

3.5 How can the implementation of regional development policies improve the standard of living in South Africa?

Regional development policies might improve the standard of living by:

- limiting the effects of economic centralisation and decentralises operations into neglected areas ✓✓

- attempting to promote the advantages of more even regional development by using labour, other natural resources and infrastructure in neglected areas ✓✓

- the alleviation of large scale unemployment hence the availability of new job opportunities ✓✓

- directing foreign direct investment into the rural areas that will lead to infrastructure development ✓✓

- promoting increased inward investment by creating more diverse production units ✓✓

- networking and sharing innovations would arise and lead to a changed way of doing things in communities ✓✓

- assisting in the improvement of running a business by creating a sustainable business culture ✓✓

- sustaining the capacity of a region to support its own development and the natural, as well as human resources should create employment and sustainable development ✓✓

- providing sufficient resources in resource-poor areas, such as the development of infrastructure/development is a multi-dimensional process ✓✓

- improving the quality of education and healthcare in a region through well-trained/skilled roleplayers ✓✓

- following an integration approach to ensure that benefits in one region can spill over to other industries and areas ✓✓

- building private-public partnerships to stimulate local development and to access state resources ✓✓

- developing regional industrial road maps with unique programmes for the various regions, based on their specific strengths and opportunities ✓✓

- developing SEZ’s in rural areas/smaller towns ✓✓

- diversifying the economy from a traditional mineral/ agricultural base towards manufacturing and exportable service activities ✓✓

- intervening by government in education and training to develop the skills base, to regulate the inflow of technology and to promote domestic research ✓✓

- developing and maintaining appropriate incentives for producers, capabilities and institutions at both national and regional levels ✓✓

- stimulating cooperation between the private sector, public sector and the local community – communities have specific needs and must provide labour and skills for development ✓✓

(Accept any other correct relevant response)

(Allocate a maximum of 2 marks for mere listing of facts/examples)

(Max 8) (8)

[40]

QUESTION 4: MACROECONOMICS AND ECONOMIC PURSUITS

4.1 Answer the following questions.

4.1.1 Name any TWO growth strategies used in South Africa.

- Growth Employment and Redistribution (GEAR) ✓

- Accelerated and Shared Growth Initiative for South Africa (Asgisa) ✓

- Joint initiative on Priority Skills acquisitions (JIPSA) ✓

- New Growth Path (NGP) ✓

- National Development Plan (NDP) ✓

- Small Business Development Promotion Programme ✓

- Industrial Policy Action Plans ✓ (IPAP)

(Accept any other correct relevant response) (Any 2 x 1) (2)

4.1.2 What determines the size of the multiplier?

The marginal propensity to consume/save / mpc / mps ✓✓ (1 x 2) (2)

4.2 DATA RESPONSE

4.2.1 Identify the nations represented by the ants in the information.

Developing ✓ (1)

4.2.2 Which international organisation above, promotes free trade?

World Trade Organisation (WTO) ✓ (1)

4.2.3 What are the benefits of import substitution for developing countries?

- It is easy to implement through the imposing of tariffs and quotas ✓✓

- Industrial development is encouraged which increases economic growth ✓✓

- Increased employment opportunities ✓✓

- A decrease in imports has a positive effect on the BoP ✓✓

- Leads to a broader industrial base as a greater variety of goods are manufactured / more choice ✓✓

- The country is less vulnerable to foreign actions and conditions e.g. sudden price increases and sanctions ✓✓

- The promotion of trade in local agricultural goods ✓✓

- Access to international funds / capital needed for growth and development ✓✓

- Reduced dependence on labour intensive industries as workers become more skilled ✓✓

(Accept any other correct relevant response) (Any 2 x 2) (4)

4.2.4 Why are developing countries (developing nations) opposed to free trade?

Developing nations are opposed to free trade because:

- local industries are destroyed ✓✓

- there is increased unemployment and decreased economic growth ✓✓

- developed nations expect developing countries to remove their trade barriers without them doing the same ✓✓

- they find it difficult to compete with developed nations due to subsidies received by industries in developed countries ✓✓

- it causes more poverty ✓✓

- monopolies could be created which dictate prices and trade conditions ✓✓

- trade dependencies – countries are exposed to economic shocks ✓✓

- undermining cultural diversity – the indigenous culture is lost as the local people are uprooted of culture ✓✓

- the theft of intellectual property – they don’t have some protection for patents and inventions ✓✓

- the reduction of tax revenue due to the removal of tariffs ✓✓

- increased production levels lead to large-scale pollution ✓✓

- the developed countries implement strict sanitary and health standards for goods from developing countries ✓✓

- “Poorest countries are pushed aside for a more ambitious corporate agenda…” ✓✓

(Accept any other relevant correct response) (Any 2 x 2) (4)

4.3 DATA RESPONSE

4.3.1 Identify the most important sector to jumpstart (grow) the economy.

Advanced manufacturing ✓ (1)

4.3.2 Name ONE problem in the information, currently experienced in South Africa that prevents economic growth.

- Major job losses ✓

- Low economic growth levels ✓

- A lack of confidence by foreign investors ✓

- Uncertainty in the implementation policies ✓ (1)

4.3.3 Briefly describe the main objectives of the National Development Plan.

- Uniting all South Africans around a common programme to achieve prosperity and equity ✓✓

- Promoting active citizenry strengthens development ✓✓ through democracy and accountability ✓✓

- Faster economic growth ✓✓ due to high investment leading to greater labour absorption ✓✓

- Focusing on key capabilities of people and the state ✓✓

- Encouraging strong leadership throughout society to work together to solve problems ✓✓

- Building an inclusive economy ✓✓ such as rural development, township revival and stronger African trade ✓✓ (2 x 2)

(Accept any other correct relevant response) (4)

4.3.4 How can the government and the private sector join forces to create enough jobs?

- Government can develop a closer relationship with the private sector ✓✓ e.g. build roads while the private sector maintains them / PPP and NEDLAC ✓

- Both share a common vision and responsibility towards growing the economy ✓✓

- Government develops labour friendly laws that will contribute positively towards labour peace because the private sector will invest more in job creation opportunities ✓✓

- Government provides subsidies to the private sector especially for youth employment ✓✓ e.g. internships / social corporate investment ✓

(Accept any other correct relevant response) (Any 2 x 2) (4)

4.4 Briefly discuss good governance and competitiveness as appropriate regional development measures in terms of benchmark criteria.

Good governance:

- Regional development strategies should be managed effectively and free of corruption ✓✓

- Democratic decision-making takes into account the views of different role players in the economy ✓✓

- Transparency means engaging freely and openly with people to ensure that they gain a sense of ownership ✓✓

- Proper financial management and control would ensure that resources are not wasted ✓✓

- To exercise control over the limitation, monitoring and performance of industrial policies as well as regular reporting ✓✓ (2 x 2)

Competitiveness:

- Industries or businesses establish as a result of regional policies should be competitive ✓✓

- Will then not need on-going financial aid from government ✓✓

- To promote sustainability so that regions support their own development ✓✓

- Provide the needed infrastructure in all areas so that they can be competitive ✓✓ (2 x 2)

(Allocate a maximum of 4 marks for mere listing of facts/examples)

(Accept any other correct relevant response) (8)

4.5 Use the GDP data to explain the importance of moving averages in the forecasting of business cycles.

- A moving average is a tool used to analyse changes that occur in a series of data over a period of time ✓✓

- It is calculated to iron out small fluctuations and reveal trends in the business cycles ✓✓

- The data given can be used to calculate the moving average for the business cycle for the past three years in order to smooth out any minor fluctuations and to indicate the trend over the past three years ✓✓

- The quantitative method does forecasting based on mathematical models, statistics and historical time series data ✓✓

- It is evident from the historical time series data given, that numbers that were collected at regular intervals or for a certain period showed a specific trend ✓✓

- These can be the GDP figures over the past five years ✓✓

- This method is accurate when used for short-term to medium-term forecasting ✓✓

- Moving averages are calculated over a certain time (e.g. a few months) to smooth out minor fluctuations in the data ✓✓

- By using moving averages determined from the given data, economists get a clearer picture of the general trends in the business cycle ✓✓

- The qualitative method does forecasting based on intuitive judgement, own opinions, market research and subjective probability estimates ✓✓

- It is also known as the judgemental method ✓✓

- This method is appropriate to use when previous data is not available and when long-term forecasting is done ✓✓

- E.g. is when various economics experts use their knowledge and their intuitions about the future to make predictions about the economy ✓✓

- The five year moving average for above table would be:

- (5 + 8 + 9 + 11 + 4) / 5 = 7.4 ✓✓

- (8 + 9 + 11 + 4 + 6) / 5 = 7.6 ✓✓

- (9 + 11 + 4 + 6 + 10) / 5 = 8 ✓✓

- By calculating the moving average, economists or businesses will be able to analyse economic trends (by 7 to 8%) ✓✓

(Allocate a maximum of 2 marks for mere listing of facts/examples)

(Accept any other correct relevant response)

(Accept the graph on moving averages max 2)

(A maximum of 4 marks may be allocated if no reference was made to the data given) (8)

[40]

TOTAL SECTION B: 80

SECTION C

Answer any ONE of the two questions in this section in the ANSWER BOOK.

QUESTION 5: MACROECONOMICS

- Discuss any FIVE problems of public sector provisioning in South Africa in detail. (26 marks)

- How can the unfair distribution of income in South Africa be resolved? (10 marks)

[40]

INTRODUCTION

All countries need a public sector to provide services that the markets fail to deliver/ The public sector consists of the central government responsible for national matters (e.g. security), provincial government responsible for regional matters e.g. housing and local government responsible for street lighting ✓✓

(Accept any other correct relevant response) (Max 2)

BODY: MAIN PART

- Lack of Accountability ✓

- Accountability means to give an explanation for one’s decisions, actions and expenditures ✓✓

- The people require the state to use the taxes for the purpose for which they are raised and not to abuse the powers it was granted ✓✓

- People employed by the state do not always serve the interests of the public ✓✓

- They seek to maximize their salaries, status and power and are not required to produce a profit and loss statement. They are budget driven ✓✓

- The state tries to overcome this problem by making civil servants accountable to the public ✓✓

In South Africa, accountability is underpinned by: - Ministerial responsibilities: ministers are spokespersons for their departments. ✓✓

The Director General of each department is accountable for the activities of the Department ✓✓ - Portfolio Committees: monitor individual departments and make recommendations to Parliament ✓✓

- Treasury control: the national treasury is responsible for expenditure control ✓✓

- The Treasury committee, chaired by the Minister of Finance, evaluates all requests for additional funding throughout the year ✓✓

- The Auditor-General reports on each government department ✓✓ The AG reports on the standard of financial management and points out fraudulent and

unauthorized spending ✓✓ (Max 6)

- Inefficiency ✓

Accountability does not guarantee efficiency. ✓✓

Public goods must be efficiently provided (Pareto efficiency where the welfare of the community is at its maximum and it is therefore impossible to increase the welfare of one individual without making another worse off) ✓✓

Three major reasons for inefficiency:- Bureaucracy: ✓(official rules and procedures) ✓✓ Officials may focus on correct procedures and rules and are indifferent to the quantity (e.g. the number of patients attended to ✓✓) and quality of the service (e.g. explaining the use of the medicine) ✓✓ Some may be insensitive to the needs of their clients ✓✓

- Incompetence: ✓ i.e. lack of skill or ability to do a task properly ✓✓ This may be due to improper qualifications, lack of training, experience and an attitude of apathy. ✓✓

- Corruption: ✓ i.e. exploiting of a person’s position for personal gain ✓✓ Taking bribes, committing fraud, nepotism, behaving dishonestly and committing discrimination. ✓✓ (Max 6)

- Difficulty in assessing needs ✓

- In the private sector, the forces of demand and supply dictate prices ✓✓

- The market prices act as signals to the producers, communicating the needs of consumers and the quantity demanded ✓✓

- State-owned enterprises do not operate according to the forces of demand and supply ✓✓

- It therefore becomes difficult for state-owned enterprises to assess the needs of consumers and they are prone to under-or over-supplying public goods ✓✓ (Max 6)

- Pricing policy ✓

- In the private sector, price is determined by the intersection of the demand and supply curves, at the point where quantity demanded equals quantity supplied ✓✓

- State-owned enterprises do not work within the market system of demand and supply ✓✓ This creates problems in determining the price for public goods and services ✓✓

- The state sets the price of goods in the following ways:

- Free of charge e.g. police – completely funded by taxes ✓✓

- User charges e.g. Toll road- a fee is levied on the user ✓✓

- Subsidies where the state may charge the user a reduced fee ✓✓

- The price strategy used depends on:

- technical factors (i.e. How easy it is to charge a fee e.g. a toll road) ✓✓

- economic factors (e.g. provision of electricity - difficult to provide for free) ✓✓

- political factors (e.g. free health care to the unemployed and very poor) ✓✓

(Max 6)

- Parastatals (SOEs- state owned enterprises) ✓

- Created in one of two ways by Government starting an enterprise or by Government nationalising an existing enterprise ✓✓

- They have to act within the framework of the public policy ✓✓

- Some parastatals do not understand their constitutional obligations and are not able to deliver on the economic and social rights ✓✓

- SOEs have limited liability but have been moves to restructure SOEs (profit-seeking with the limited liability) ✓✓ (Max 6)

- Privatisation ✓

- Some economists believe that the problems associated with public provision of goods and services are good grounds for handing state-owned enterprises to the private sector. ✓✓

Privatisation the process by which state-owned-enterprises and state-owned assets are sold to private individuals ✓✓ Nationalisation: the process whereby the state takes control and ownership of privately-owned assets and privately-owned enterprises ✓✓ - There are three arguments in favour or against privatization:

- The costs of maintaining and managing state-owned enterprises are very high. ✓✓

Positive -- These costs result in higher taxes and higher public debt. ✓✓

- Transferring ownership of these enterprise and assets to the private sector could result in lower personal income tax and it could reduce public debt✓✓

Negative - - Privatisation may lead to job losses (to ensure maximum profits) ✓✓

- Privatisation may further lead to price increases to ensure sustainable profits ✓✓

- Some people believe that private enterprises are more efficient than public enterprises. ✓✓

Positive -- These people argue that the profit motive in the private sector ensures that firms operate efficiently and produce goods and services at the lowest possible price. ✓✓

- State-owned enterprises, on the other hand, are bureaucratic, inefficient, unresponsive to consumer needs, poorly managed, uncreative and have low levels of productivity. ✓✓

- Privatisation is thought to lead to greater economic efficiency and better management of the enterprise. ✓✓

Negative- - Private owned enterprises cannot provide goods and services at the same low prices than SOE’s and might result in market failure ✓✓

- Since state-owned enterprises do not operate according to the profit motive, they sometimes incur large losses, which result in budget deficits. ✓✓

Positive -- These budget deficits have to be financed by higher taxes or increased public debt. Privatisation eliminates these fiscal problems.✓✓

Negative - - Privatisation might exclude a large part of the population who cannot afford higher prices charged by private enterprises, especially merit / consumer goods providing in basic needs ✓✓ (Max 6)

- These budget deficits have to be financed by higher taxes or increased public debt. Privatisation eliminates these fiscal problems.✓✓

- The costs of maintaining and managing state-owned enterprises are very high. ✓✓

- Some economists believe that the problems associated with public provision of goods and services are good grounds for handing state-owned enterprises to the private sector. ✓✓

(Allocate a maximum of 8 marks for mere listing of facts/examples)

(Accept any other correct relevant response)

(A maximum of FIVE problems must be discussed. The listing and explanation of the FIVE problems in a positive way, counts a maximum of 3 marks. The rest of the marks should explain the problematic nature of each aspect) (Max 26)

ADDITIONAL PART

To ensure fair income distribution consider:

- measuring income distribution on a regular basis the Gini-Coefficient is used on a regular basis as a requirement by the UN ✓✓

- delivering social services effectively in all areas especially rural areas ✓✓

- using tax monies effectively to ensure a fair redistribution and eliminate the misuse of funds / uproot corruption and nepotism ✓✓

- effectively using the fiscal policy measures will ensure an even distribution of income

- taxing incomes progressively to lower the tax burden on the lower income groups and relying more on the higher income groups ✓✓ e.g. income tax ✓

(Allocate a maximum of 2 marks for the mere listing of facts/ examples) (Max 10)

(Accept any other correct relevant response)

(A maximum of 4 marks may be allocated for redress policies, e.g. BEE, land restitution, affirmative action)

CONCLUSION

Efficient public sector provisioning in South Africa is key to a much better growth rate, higher employment rate and a better standard of living of all ✓✓

(Accept any other correct relevant higher order response) (Max 2)

[40]

QUESTION 6: ECONOMIC PURSUITS

- Discuss the following economic indicators in detail:

- Production (10 Marks)

- Foreign Trade (8 Marks)

- Money supply (8 Marks) (26 marks)

- How can productivity be used more effectively to benefit the South African economy? (10 marks)

INTRODUCTION

Economic indicators are a statistical data on the performance and trends of economic variables usually over time ✓✓

(Accept any other correct relevant response) (Max 2)

MAIN PART

Production

- An economy’s productive capacity is the maximum output that is possible with its existing resources ✓✓

- Economic growth is an increase in the productive capacity of an economy over a period of time ✓✓

- An increase in the production of goods and services is a sign enough of economic growth because it indicates an increase in a country’s capacity to produce ✓✓

GDP (Gross Domestic Product)✓

- This is the total value of all final goods and services produced within the borders of a country over a certain period of time ✓✓

- Nominal GDP (GDP at current prices) - These are market prices and they give a nominal GDP value ✓✓

- Market prices mean current prices and they imply the monetary value of goods and services ✓✓

- Current prices are the basic value indicator used in the national accounts ✓✓

Real GDP (GDP constant prices) ✓

- The growth performance of an economy is measured in terms of real GDP Figures ✓✓

- Nominal GDP cannot be used because the amounts tend to be overestimated due price increases ✓✓

- Real GDP- This is obtained when the effect of inflation is removed from the data, e.g. nominal growth is 8% and inflation is at 3% then real GDP is 5% ✓✓

Per Capita real GDP ✓

- Per capita real GDP is calculated by dividing the real GDP figures by the total population ✓✓

- It is used for the following three purposes:

- To indicate economic development ✓✓

- To indicate living standards ✓✓

- To compare living standards ✓✓

- Governments microeconomic policy aims at specific sectors and is involved in specific ways in which the business and consumers interacting all in order to bring about economic success ✓✓ e.g. promoting economic growth, development, productivity and investment in the economy ✓ (Max 10)

Foreign trade

International trade can be described as the exchange of goods and services between two or more countries ✓✓

Exchange rate✓

- This can be defined as the price at which one currency is exchanged for that of another ✓✓

- Two methods of calculating the exchange rate, the indirect and the direct method and most countries use the direct method ✓✓

- Most countries have a number of exchange rates, similar to the rand and e.g. if the rand appreciates against the US dollar it may depreciate against the euro✓✓

- Changes in the exchange rates affect the prices for imports and the prices that are earned by exports ✓✓

- E.g. the depreciation of the rand against the dollar will result in US goods becoming more expensive domestically and earnings from exports to the US increasing, although the volumes remain the same that would react in due course and the opposite will happen if the rand appreciates ✓✓

- It is therefore very important for both importers and exporters to keep an eye on the exchange rates with their trading partners ✓✓

- It is an important indicator for almost everyone in the country hence it affects both prices and availability ✓✓

Terms of trade✓

- This is the ratio between export and import prices ✓✓

- Although they only express prices, changes in them have quantity (volume) effects ✓✓

- E.g. if terms of trade deteriorate a greater volume of exports have to be produced and sold to keep export earnings constant and to maintain the volume of imports ✓✓

- The opposite happens if export prices increase and the terms of trade improve✓✓

- Changes in terms of trade serve as an indicator of changes that may spill over into the balance of payments e.g. if it deteriorate a deficit may follow and if it happens the currency may depreciate and vice versa ✓✓ (Max 8)

Money supply

- The level of money supply in the economy is very important. The SARB uses interest rates (repo rate) as the most important monetary policy instrument to influence the money supply ✓✓

- An undersupply of money in the economy will lead to a contraction in economic activities – therefore SARB will decrease the repo rate (interest rates) ✓✓

- An increase in the supply of money (over-supply) without an increase in supply of goods and services will lead to an increase in the general price level (inflation) in the long run ✓✓

The SARB considers the supply of money to include:- M1 - This includes the coins and notes in circulation plus all demand deposits in the banking sector ✓✓

- M2 - This is equal to M1 plus all other short term and medium term deposits in the banking sector ✓✓

- M3 - This is equal to M2 plus all long term deposits in the banking Sector ✓✓ (Max 8)

(Allocate a maximum of 8 marks for the mere listing of facts/ examples) (Max 26)

(Accept any other correct relevant response)

ADDITIONAL PART

Productivity can be used more effectively to benefit the South African economy by:

- Focusing on the term productivity which explain the relationship between real output and one unit of factor input ✓✓

- using productivity figures to adapt wages levels of workers / base the wage negotiations on the productivity of the workers ✓✓

- using relevant formulas to measure productivity of workers on a regular basis e.g. divide real GDP by the number of workers employed for a number of years and to construct an index number for each year ✓✓

- ensuring that an increase in labour productivity is above the increase in wage levels will decrease inflationary pressure due to higher production at lower unit costs ✓✓

- regular availability and use of the relevant indicators will benefit employers in decision making ✓✓

- increasing competition in the markets will lead to higher productivity levels of all four factors of production ✓✓

- by making students aware (work ethics) of the effects of higher productivity might filter through into the workplace ✓✓

- better utilisation of improved technology ✓ innovative usage of factory space ✓ investing creatively in scarce entrepreneurial abilities and competencies ✓✓

(Allocate a maximum of 2 marks for the mere listing of facts/examples)

(Accept any other correct relevant response)

(A maximum of 4 marks can be allocated if productivity is discussed in a general way) (Max 10)

(Max 26)

CONCLUSION

Consistent analysis of composite indicators can provide both government and business a clear sense of where the economy is going and plan for the future ✓✓ (Max 2)

(Accept any other correct relevant higher order response)

[40]

TOTAL SECTION C: 40

GRAND TOTAL: 150